Getting A Head Start On The 2023 Tax Season

It’s no secret we all dislike paying taxes, which is why many Americans tend to put off filing theirs until the last minute. If you want to avoid the April panic, planning ahead for the upcoming tax season is a smart move that can save you stress later on.

A solid tax plan is especially beneficial for retirees, and those near to retirement, as it can help you make the most of your retirement income while avoiding unexpected tax surprises. 20-25% of Americans wait until the final two weeks before the tax deadline to start preparing their tax returns. At that point, you only have two choices: rush to file your taxes or request a tax extension.

At Agemy Financial Strategies, our goal is to provide you with the necessary tools to make informed and on-time tax decisions. As we look ahead to preparing you for the upcoming tax season, here are some important tips to keep in mind.

Stay Organized

Having everything in one safe and designated place can help make the preparation of your income tax return easier. Some of the documents that might be required to complete the process include:

- Form W-2 (your employer must mail the form, which shows your earnings and taxes withheld, by Jan. 31)

- Form 1099-INT, for interest earned, such as from a savings account

- Form 1098, Mortgage Interest Statement, shows mortgage interest paid on a loan for your home and receipts for all purchases and payments, including those for business, healthcare, and education.

- Older adults have special tax situations and benefits, like Form 1040-SR.

Understanding how these forms can affect you and your taxes is paramount if you don’t want to unnecessarily overpay Uncle Sam. Get general information about how to file and pay taxes, including many free services, by visiting the IRS Individuals page.

Avoid Common Mistakes

Retirees should be particularly careful when filing their tax returns, as common mistakes can delay the processing of the return or the refund they are owed. One of the most significant errors is missing tax forms. This includes forms mentioned above, such as 1099’s, which may occur if you receive investment income.

Although it’s easy to overlook tax filing forms, the IRS receives copies and will expect that information to be included on your return. Other common mistakes include the following:

- Incorrect spelling or digits for your name.

- Incorrect birth date.

- Incorrect Social Security number.

- Incorrect bank account and routing number information.

It’s crucial to double-check all information before submitting your tax return. Review all information in detail before submitting your tax return, and consider filing electronically to streamline the process. Taking these steps can help ensure a smooth and stress-free tax filing experience.

Understand New Tax Bracket Adjustments

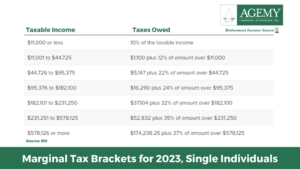

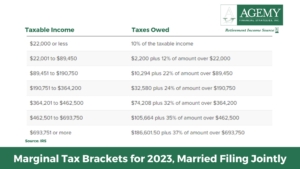

When preparing to file your tax return for the 2023 tax year, it’s important to take note of significant changes compared to 2022. While the tax rates have remained unchanged, there has been a notable 5.4% increase in the federal income tax brackets.

This increase effectively expands the taxable income thresholds within each bracket. You can calculate your taxable income within a bracket by subtracting the standard or itemized deductions from your adjusted gross income. Due to the increase, the standard deduction has also seen adjustments. Married couples filing together can now claim a standard deduction of $27,700, up from $25,900 in 2022. Single filers are eligible for a standard deduction of $13,850 in 2023, a marked increase from the previous year’s $12,950. See the following tables for a detailed view of how tax brackets will change based on your reported income.

Important Tax Considerations for Tax Season

In addition to understanding the tax bracket adjustments and standard deduction changes for the 2023 tax year, there are a few other essential factors that require your attention:

- Tax Breaks for Vehicle Purchases and Home Energy Improvements: If you acquired a vehicle during 2023 or made energy-efficient enhancements to your home, you may qualify for valuable tax breaks. The Clean Vehicle Tax Credit carries a maximum cap of $7,500.

- IRS Reporting Change Delay: It’s worth mentioning that the IRS postponed a reporting change scheduled for 2023 concerning business payments made through apps like PayPal or Venmo. Before this change, even a payment of $600 or more would have triggered the issuance of Form 1099-K, which reports such business payments to the IRS.

Stay informed and take advantage of these changes to help ensure your tax return for 2023 is as accurate and beneficial as possible.

You Can Get an Extension to File— But Not to Pay

You Can Get an Extension to File— But Not to Pay

For retirees who cannot file their tax returns by the April 18 deadline, the IRS allows them to request a six-month extension. This extension can be helpful in situations where a taxpayer is missing a tax form or needs additional time to prepare their return. Taxpayers can request an extension for free via IRS Free File, regardless of their income.

It’s essential to note that while an extension will give retirees additional time to file their returns, it doesn’t extend the deadline to pay their federal taxes. The tax bill has to be paid by the April 18 deadline. In cases where a taxpayer is missing a tax form, they can estimate their tax bill by using tax software and inputting estimates for any missing forms.

It’s also worth noting that requesting a federal extension doesn’t automatically extend the deadline for state tax returns. Those who need additional time to file their state tax returns must request a separate extension. There is no penalty for filing an extension. However, not paying on time or enough, or failing to file altogether, may cost you.

- If you don’t pay the full amount you owe, the IRS will charge you interest on the unpaid balance until you pay the full amount.

- You may be subject to a late payment penalty if you don’t pay at least 90% of what is owed. The penalty is usually half of 1% of the amount owed each month, up to a maximum of 25%.

- You may be subject to a late filing penalty if you don’t file your return or Form 4868 by the tax filing deadline. The penalty is usually 5% of the amount you owe each month, up to a maximum of 25%.

After you file the extension, you’ll have until October 16 to gather your documents and finish your filing. When you complete your return, you should include the amount you’ve already paid in the payments section of your Form 1040.

Tax Planning With Agemy Financial Strategies

Tax planning is an important aspect of an overall retirement strategy that should not be overlooked. Understanding your tax obligations now can help you enjoy a more secure financial future.

While certain taxes may be deferred, others can be minimized through tax-efficient investment planning. That is why a fiduciary advisor can be a valuable resource for those seeking to navigate the complexities of tax planning.

At Agemy Financial Strategies, we can help you explore your options to help ensure you’re not missing out on tax strategies that could boost your retirement savings. From reassessing your investments to postponing RMDs, Agemy Financial Strategies has over 32 years of experience in tax-strategizing to maximize retirement income in your golden years.

Let us help you create a personalized tax plan with a complimentary strategy session. Set yours up here today.

Leave a Reply

Want to join the discussion?Feel free to contribute!