Navigating The Challenges of Long-Term Care

February 16th is National Caregivers Day, a day that honors individuals who selflessly provide care and support to those who need it most. If you are approaching retirement or even a care provider yourself, it’s also a great time to think about your own needs in your later years and how to navigate the challenges that come with it.

The inevitability of needing care in our later years is a reality that many approaching retirement grapple with. With each passing day until 2030, a staggering 10,000 Baby Boomers will turn 65, and statistics tell us that seven out of ten will, at some point, require long-term care services. This underlines the pressing need to address the complexities associated with long-term care, a critical component in the roadmap to aging gracefully.

Planning for long-term care costs is an essential aspect of planning for one’s post-working years that cannot be ignored. As we recognize the caregivers on this special day, let’s also acknowledge the importance of self-care in preparing for the journey ahead.

What Is Long-Term Care?

What Is Long-Term Care?

Long-term care refers to the ongoing support and assistance required by people who cannot perform daily activities due to chronic illness, disability, or old age. It includes a range of services like bathing, dressing, eating, and more. As the population ages and life expectancy increases, the need for long-term care becomes more prevalent, making it a crucial concern for retirees.

Currently, over 818,800 Americans reside in assisted living communities, representing about 2% of seniors over the age of 65. While it may not seem like it, assisted living is still a relatively new concept. It emerged in the 1980s as a more person-centered care model, diversifying options beyond traditional nursing homes.

Currently, The United States has over 30,600 assisted living facilities, offering nearly 1.2 million licensed beds. The rapid growth of the senior population necessitates additional assisted living communities, driven not only by the aging baby boomer generation but also by middle-aged adults planning for future senior housing. Now, more than ever, it is crucial to proactively take control of your long-term care planning and gain a comprehensive understanding of the various types of available care.

Understanding the Types of Long-Term Care

It’s important to understand the differences between types of long-term care facilities. When people hear the term “long-term care,” it’s often misinterpreted to mean a senior is very ill and can’t take care of themselves. However, long-term care can refer to anything from helping with daily activities to those in a nursing home that require around-the-clock care. There are three main types of long-term care facilities in America:

- Nursing Homes: These care facilities provide skilled nursing, rehabilitation, and 24-hour health services.

- Assisted Living Residences: This combines home, health, and supportive services while promoting self-direction and resident independence.

- Residential Care Homes: These facilities provide room, board, personal care, medication management, and some nursing “overview” but are restricted in the level of care they can provide and generally do not provide full-time nursing care.

Each type of care provides varying levels of support and assistance. Independent living facilities, for example, offer a more self-sufficient lifestyle. At the same time, assisted living communities and continuing care retirement communities fall somewhere in between. It is important to note that providing varying levels of care is based on an individual’s needs.

Long-Term Care is Costly

The cost of long-term care can be substantial, and it’s not covered by traditional health insurance or Medicare. On average, a year in a nursing home can cost around $108,408 per year for a private room. In 2024, without insurance, monthly long-term care costs might include:

- $5,148 for a home health aide

- $1,690 for adult day care

- $4,500 for assisted living

- $7,908 for a semi-private room in a nursing home

- $9,034 for a private room in a nursing home

It’s crucial to remember that nursing home costs vary significantly by location, emphasizing the importance of checking specific rates in your area. The financial commitment associated with long-term care necessitates careful consideration and planning to help ensure both the well-being of your loved ones and your financial stability.

Long-Term Care Insurance Options

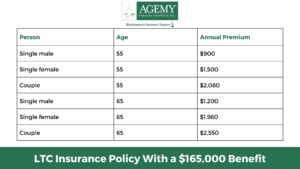

Long-term care insurance can help retirees pay for the cost of care without dipping into their savings. Before deciding, research and understanding the different types of policies available and their coverage is important. According to the American Association for Long-Term Care Insurance, you should expect to pay the following for a long-term care insurance policy with a $165,000 benefit:

Long-term care insurance can be significantly more costly than other types of insurance, but as we saw earlier, long-term care will likely cost thousands of dollars per month without insurance. Therefore, these premiums can be expensive, but they’re worth it for people anticipating a need for LTC.

Medicare Does Not Cover Most Long-Term Care Expenses

Medicare Does Not Cover Most Long-Term Care Expenses

Medicare does not pay for most long-term care expenses because it is primarily designed to cover acute care services for short-term illnesses and injuries. Long-term care is more focused on providing support for individuals with chronic conditions or disabilities that require ongoing assistance with activities of daily living, such as bathing, dressing, and eating. This type of care is considered custodial and is not covered by traditional Medicare.

Medicare only covers a limited amount of skilled nursing facility (SNF) care following a hospital stay, and even then, the covered care must be considered medically necessary. In-home care assisted living facilities and Medicare does not cover adult day care.

Many individuals opt for private long-term care insurance, Medicaid, or a combination of both to cover the cost of long-term care. Medicaid is a joint federal-state program that provides health coverage for individuals, but eligibility requirements and covered services vary by state. Long-term care insurance, on the other hand, is a private insurance product that individuals can purchase to help cover the cost of long-term care services.

Retirees should understand what their Medicare coverage includes and plan accordingly. Working with a fiduciary advisor can help you differentiate between the available types of care.

Strategic Planning For Long-Term Care

Planning for long-term care needs is essential to ensure that retirees have the necessary resources to receive the care they require. This can involve creating a financial plan, researching care options, and discussing wishes with loved ones.

At Agemy Financial Strategies, our team of fiduciary advisors helps individuals navigate the complexities of long-term care planning. We’ll evaluate your current financial and healthcare situation, identify potential risks, and develop a personalized plan to meet your long-term care needs.

By recognizing that healthcare costs can pose a significant threat to your retirement nest egg, we will identify potential gaps in your current retirement plan and make adjustments where needed. This includes factors like inflation, insurance coverage, potential health changes, and the impact of long-term care expenses on your savings.

Let’s Get Started

Agemy Financial Strategies can help individuals navigate the complexities of long-term care planning. Our team of fiduciaries can assist you in evaluating your current financial situation and developing a customized plan to meet your long-term care needs.

By working with the Agemy team, you can have peace of mind knowing that you have a solid plan to address the potential challenges of needing – and paying – for care throughout your golden years.

If you have any questions or want to set up a complimentary strategy session, contact the retirement income experts at Agemy Financial here today.

Leave a Reply

Want to join the discussion?Feel free to contribute!