REITs vs. Direct Property Ownership: Pros and Cons for Investors

Real estate has long been a cornerstone of wealth-building, offering opportunities for steady income, diversification, and long-term growth. For those approaching retirement, it’s not just about whether to include real estate in your portfolio—it’s about choosing the right approach to suit your goals and lifestyle.

Deciding what to do with yourself in the period between Christmas and the New Year can feel confusing for us all. More unsettling? The daunting decision between Real Estate Investment Trusts (REITs) and direct property ownership! While the festivities take a quick break, use your time off to research each option, as each has its own benefits and challenges, making it essential to understand how they align with your financial plans.

This blog dives into the pros and cons of both strategies, helping you make informed decisions and position your real estate investments for success in retirement.

What Are REITs?

Real Estate Investment Trusts (REITs) own, operate, or finance income-generating real estate. They pool funds from multiple investors, allowing shareholders to own a portion of large-scale properties without directly managing them. REITs are traded on public stock exchanges, making them an accessible and liquid investment vehicle.

More than 45% of American households own REITs, nearly double the estimate from two decades ago. They can be a good fit if you want the diversification benefits of real estate without the commitment and responsibilities of directly owning property. To better understand how REITs work, let’s explore the three main types available to investors, each with unique features and benefits:

- Equity REITs: These REITs focus on owning and managing properties. Some examples include apartment complexes, office buildings, and shopping malls. Investors have the potential to earn income through rental revenue.

- Mortgage REITs: Investing in mortgages and mortgage-backed securities has the potential to generate income from interest payments.

- Hybrid REITs: These combine the strategies of equity and mortgage REITs, offering potential income from rent and interest.

Now that we know more about what REITs entail let’s look at the pros and cons.

Pros of REITs

- Liquidity

One of the most significant benefits of REITs is their high liquidity. Since REIT shares are traded on stock exchanges, investors can quickly buy or sell them, unlike physical real estate transactions, which can take weeks or months. This liquidity is particularly advantageous for investors needing immediate access to funds without being locked into long-term real estate ownership.

- Diversification

REITs allow investors to spread their exposure across various properties, sectors, and geographies. For example, a single REIT may include assets like shopping malls, apartment complexes, healthcare facilities, and industrial warehouses. This built-in diversification can help reduce the risk of potential loss that could occur if an individual property or sector underperforms. It’s an efficient way to participate in the real estate market without the concentration risk of owning one or two properties.

- Accessibility

REITs offer a low barrier to entry compared to direct property ownership. Instead of needing tens or hundreds of thousands of dollars for a down payment on a property, investors can gain exposure to real estate markets with the cost of a single REIT share. This accessibility can make REITs a practical choice for small-scale investors or those just starting to diversify their portfolios into real estate.

Cons of REITs

Cons of REITs

- Market Volatility

Since REITs are traded on stock exchanges, they are subject to the same market volatility as other publicly traded securities. Their values can fluctuate based on economic conditions, interest rates, or changes in investor sentiment, regardless of the underlying real estate performance. This volatility can be challenging for investors seeking stability or those uncomfortable with the stock market’s swings.

- Limited Control

Investing in REITs means relinquishing decision-making power to the REIT’s management team. Investors cannot control which properties the REIT buys, sells, or develops. This lack of control can be a drawback for those who prefer a hands-on approach to managing their investments or want to focus on specific property types or locations.

- Tax Implications

While REITs often pay attractive dividends, these payouts are typically taxed as ordinary income rather than benefiting from the lower tax rates associated with qualified dividends or long-term capital gains. This can result in a higher tax burden for investors, particularly those in higher tax brackets. For tax efficiency, REITs may be better suited for tax-advantaged accounts like IRAs or 401(k)s.

What Is Direct Property Ownership?

Direct property ownership involves purchasing and owning physical real estate, such as residential properties, commercial spaces, or undeveloped land. Investors earn income by leasing the property or profiting from its appreciation over time. This approach requires hands-on involvement or the hiring of property management services.

Unlike REITs, direct ownership gives investors full control over property management and decision-making. However, it comes with responsibilities like tenant management, property upkeep, and navigating real estate market fluctuations.

Let’s look deeper at the pros and cons of direct property ownership.

Pros of Direct Property Ownership

- Building Equity

One of the primary benefits of direct property ownership is the ability to build equity over time. As you pay down the mortgage, your ownership stake in the property increases. This creates a valuable asset that can be leveraged for future investments or financial needs. Unlike other investments, real estate allows you to combine equity growth with income generation, such as rental payments, making it a powerful wealth-building tool.

- Potential for Appreciation

Real estate has a historical tendency to appreciate over time, offering investors the potential for substantial capital gains. Investors can benefit from increasing property values by holding long-term property long-term, particularly in growing markets or areas with rising demand. This potential for growth makes real estate a valuable component of a long-term investment strategy.

- Inflation Hedge

Real estate is often considered a natural hedge against inflation because property values and rental income typically rise over time, outpacing it. This ability to preserve and potentially increase purchasing power during inflationary periods makes real estate a reliable store of value. This characteristic makes direct property ownership particularly attractive for investors seeking long-term stability.

Cons of Direct Property Ownership

Cons of Direct Property Ownership

- Illiquidity

One of the most significant drawbacks of owning physical property is its lack of liquidity. Unlike REITs or stocks, selling a property can take several months and involves high transaction costs, including real estate agent commissions, closing fees, and potential repairs or upgrades to prepare the property for sale. This lack of liquidity can be a drawback for retirees who need quick access to funds.

- Management Burden

Direct property ownership requires active involvement, making it far from a passive investment. Owners are responsible for property maintenance, tenant relations, and compliance with local laws and regulations. Even when hiring a property manager, the owner is ultimately accountable for decisions and outcomes, which can still demand time and effort.

- Market Dependency

The value and income real estate generates are heavily influenced by local market conditions, economic trends, and interest rate fluctuations. For instance, an economic downturn or oversupply of rental properties in a specific area can lead to declining property values and rental income. Similarly, rising interest rates can make mortgages more expensive, reducing affordability and demand. These factors can create unpredictable fluctuations in income and value, requiring property owners to carefully research and monitor market conditions to mitigate risks.

Key Considerations for Investors

Choosing between REITs and direct property ownership depends on your financial goals, time horizon, risk tolerance, and tax strategy. Each option has unique strengths and potential drawbacks; understanding these factors can help you make an informed decision.

- Financial Goals: If you’re seeking consistent income with minimal effort, REITs may be the better choice as they provide potential dividends and require no active management. On the other hand, direct property ownership may be ideal for those prioritizing control over their investment and potential long-term property appreciation.

- Time Horizon: REITs’ liquidity and ease of access can benefit investors nearing retirement. In contrast, younger investors with a longer time horizon may benefit from the potential appreciation and equity growth associated with owning property directly. Because every investor’s journey is different, consulting a fiduciary advisor is crucial to help your decisions align with your financial goals.

- Risk Tolerance: REITs inherently offer diversification, spreading risk across multiple properties or sectors, helping reduce the impact of underperformance in any single asset. Direct property ownership, however, concentrates risk into fewer assets, which could be advantageous for investors willing to take on more responsibility for higher potential returns.

- Tax Strategy: Tax advantages can vary significantly between the two options. REITs may have limited tax benefits compared to direct ownership, which can offer depreciation and other deductions. Consulting an advisor or tax professional can be essential to help optimize your investment strategy based on your tax situation.

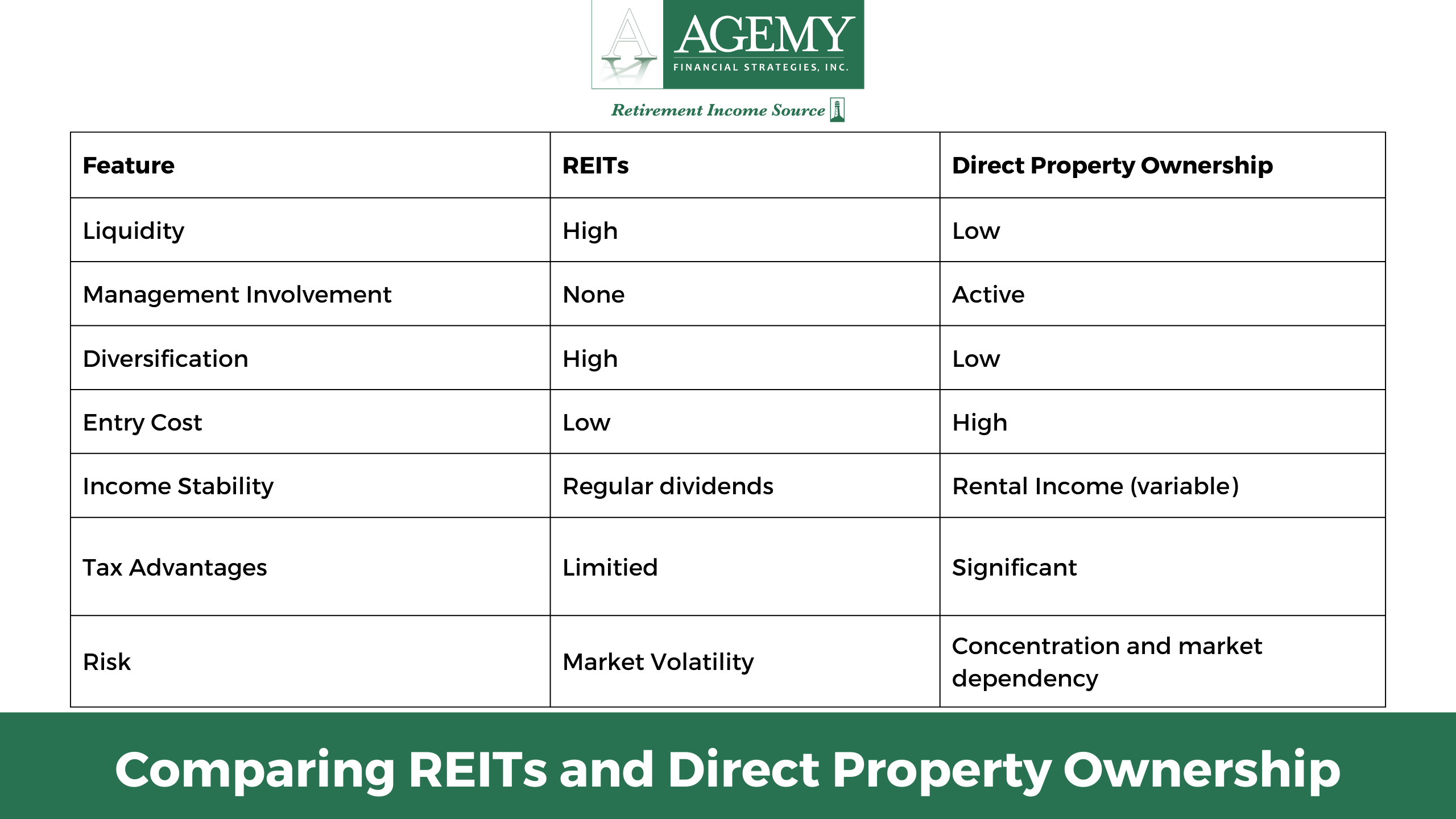

To make this decision easier, we’ve outlined the key differences between REITs and direct property ownership in the table below. Use it as a quick reference to compare their features side by side:

Partner With a Fiduciary Advisor

Investing in real estate during retirement can pose complexities, especially for those managing significant portfolios. If you’re looking for a fiduciary advisor with extensive experience in real estate investments, Agemy Financial Strategies is here to help.

Fiduciary advisors are legally obligated to prioritize your best interests, delivering impartial advice and recommendations aligned with your financial goals. Our seasoned professionals can help you identify opportunities and make well-informed decisions tailored to your unique needs and objectives.

Our advisors are adept at seamlessly integrating your real estate investments into your investment portfolio, helping to ensure they remain balanced and diversified. To explore our full-service offerings, see here.

Final Thoughts

REITs and direct property ownership offer unique advantages, making the right choice dependent on your financial goals, risk tolerance, and time horizon. At Agemy Financial Strategies, we help investors navigate the complexities of real estate investments for their financial portfolios. For over 30 years, our team of fiduciaries has guided clients in exploring opportunities in REITs and other investment vehicles to build resilient, diversified portfolios.

Contact us today to learn how we can help you achieve your financial aspirations and make informed decisions about real estate investments.

Disclaimer: This blog is intended for educational purposes only and should not be considered financial, tax, or legal advice. The information provided is general and may not apply to your financial situation. Investment decisions should always be based on your unique circumstances, goals, and risk tolerance. We recommend consulting a qualified financial advisor, such as our team at Agemy Financial Strategies, for personalized guidance tailored to your needs. Past performance does not indicate future results, and all investments carry inherent risks, including potential loss.

Leave a Reply

Want to join the discussion?Feel free to contribute!