Trusts for Owners of High-Net-Worth Estates

For high-net-worth individuals looking to safeguard their assets and ensure their legacy lives on, estate planning is paramount. One effective tool that can aid in achieving these goals is a trust. In this blog, we’ll delve into the essentials of trusts and why they may be advantageous for your overall estate planning needs.

Trusts can help high-net-worth (HNW) individuals protect assets, minimize taxes for beneficiaries and help ensure their money goes where they want it to. One of the most effective ways to protect HNW estates is through using different types of trusts, which are legal entities that hold assets for the benefit of designated beneficiaries.

What is A Trust?

A trust is a legal arrangement where a trustee manages assets on behalf of the trust’s beneficiaries. Trusts can offer several benefits for high-net-worth individuals, including:

- Asset Protection: Trusts can protect your assets from creditors and lawsuits. This is especially important if you are involved in a high-risk profession.

- Estate Planning: Trusts can help you pass your wealth down to your loved ones in a tax-efficient manner. You can avoid probate, reduce estate taxes, and help ensure your assets are distributed according to your wishes.

- Privacy: Trusts are private documents, meaning that your financial affairs will be kept confidential.

Now that we’ve covered the basics of trusts, let’s take a closer look at some of the different types of trusts that may be beneficial for high-net-worth individuals.

Types of Trusts

One of the most effective ways to protect your estate is by using different types of trusts. They’re essentially legal entities that hold assets for designated beneficiaries. Let’s take a look at the types of trusts that may be beneficial for high-net-worth retirees.

1. Intentionally Defective Grantor Trusts (IDGTs)

Intentionally Defective Grantor Trusts (IDTs) are irrevocable trust that can be particularly advantageous for high-net-worth individuals. Especially if they want to reduce the impact of estate taxes while transferring wealth to beneficiaries. The unique structure of IDTs allows them to be intentionally disregarded for income tax purposes, meaning that the grantor is still responsible for paying income taxes on the trust’s income.

However, this also means that the assets in the trust can be removed from the grantor’s gross estate at death, reducing the overall value of the estate subject to estate taxes. In essence, IDTs can help individuals achieve their wealth transfer goals while minimizing tax liabilities.

2. Revocable Trusts & Irrevocable Trusts

Revocable trusts, also called living trusts, are flexible estate planning tools that allow individuals to maintain control over their assets during their lifetime. As the name suggests, revocable trusts can be amended or revoked at any time by the grantor. When the grantor passes away, the assets in the trust are distributed to the beneficiaries without the need for probate, which can save time and costs.

On the other hand, irrevocable trusts are a type of trust that cannot be amended or revoked once established. Although the grantor gives up control over the assets placed in the trust, this type of trust offers greater protection against creditors and can help reduce estate taxes. By removing assets from the grantor’s estate, the value of the estate subject to taxes is reduced. This can potentially save beneficiaries a significant amount of money. Irrevocable trusts can also be structured to benefit charities or provide for long-term wealth management for multiple generations.

3. Charitable Trusts

Charitable trusts are designed to allow individuals to donate assets to a charitable organization while still retaining some benefits from those assets. One example of a charitable trust is a charitable remainder trust, which can provide income for the grantor during their lifetime. With this type of trust, the grantor transfers assets to the trust, which then makes payments to the grantor based on an agreed-upon formula. After the grantor passes away, the remaining assets in the trust are distributed to the designated charity.

Charitable trusts offer several benefits:

- Potential tax deductions for the grantor.

- The ability to support a charitable cause or organization

- The option to receive income during the grantor’s lifetime.

These types of trusts can be tailored to meet individual goals and can be structured in various ways to suit different situations. It’s important to work with an experienced attorney and Fiduciary Advisor to determine if a charitable trust is appropriate for your estate planning needs.

4. Dynasty Trusts

A dynasty trust is a type of trust that is specifically designed to provide long-term wealth management for multiple generations. This means that the trust can help ensure that your wealth is passed down to your grandchildren and great-grandchildren – and potentially even further down the line.

One of the main benefits of a dynasty trust is that it allows you to transfer assets to future generations while minimizing tax liabilities. By keeping assets within the trust, the trust can continue to grow and provide for future generations without being subject to estate taxes at each generation’s passing.

Why Trusts Are Important

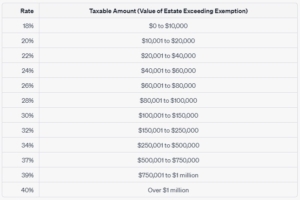

Establishing trust is essential for individuals who want to protect their assets and ensure their wealth is transferred to their beneficiaries in a tax-efficient way. Trusts offer many benefits, including the ability to minimize estate taxes. While the estate tax rates are currently progressive, it’s important to know the tax rates you’re up against. Take a look at the table below:

Any amount over $1 million is taxed at the top rate of 40%. By creating a trust, individuals can reduce the overall value of their estate subject to taxes, ensuring that more assets can be passed down to their beneficiaries. Working with an experienced Fiduciary Advisor can help individuals determine the most suitable type of trust for their unique needs and goals.

Working With a Fiduciary Advisor

Estate planning can be challenging — especially for those with a high net worth. You want to protect your family, assets, and business, and gain the peace of mind of knowing you’re prepared and in control.

Working with professionals when establishing a trust is essential to ensure that your wishes are met, and your assets are protected. An experienced fiduciary advisor can provide valuable advice and guidance, help navigate complex legal and financial issues, and determine the best type of trust for your specific needs and goals. They can also ensure that your trust is structured in a way that provides the maximum benefit to your beneficiaries.

At Agemy Financial Strategies, we have a team of skilled Fiduciary Advisors who excel in helping clients create robust and meaningful trusts. We are committed to providing our clients with the highest level of service and expertise, and we will work with you every step of the way to ensure that your trust meets your unique needs and goals.

Final Thoughts

For high-net-worth retirees, trusts can be a valuable tool in safeguarding assets and ensuring that their wealth is distributed to beneficiaries in a tax-efficient manner. But the process tends to be complicated and time-consuming because there are so many things for high-net-worth estates to consider.

If you’re in this position, you want to protect the inheritance to your heirs, reduce the amount of estate taxes you have to pay, and avoid going into probate. Partnering with a trusted financial professional to establish a trust can provide peace of mind.

At Agemy Financial Strategies, you can rest assured knowing that your financial affairs are in capable hands. If you’re interested in learning more about how trusts can benefit your estate planning needs, schedule a complimentary strategy session with us today.

Leave a Reply

Want to join the discussion?Feel free to contribute!