Get a Head Start on Tax Season: Build a Tax-Smart Portfolio

For high-net-worth individuals (HNWIs) nearing retirement, preparing for tax season now can make a significant difference in preserving your wealth.

Wealthy Americans contribute a significant share of the nation’s tax burden. According to a recent study, the top 1% of earners will contribute 23.9% of all taxes despite earning only 20.1% of total income. This disparity highlights the need for strategies that minimize tax liabilities and protect your hard-earned wealth.

Focusing on tax efficiency in your portfolio can help optimize your wealth preservation strategy and avoid surprises when tax laws shift. From smart asset location strategies to planning for long-term capital gains, now is the time to take proactive steps to keep more of what you’ve earned. Here’s what you need to know.

Why Tax Efficiency Matters in Retirement Planning

Without proper planning, taxes can erode a significant portion of your retirement income. According to the Tax Foundation, high-income individuals in the U.S. can face marginal tax rates as high as 37% at the federal level. Factors in state taxes, capital gains taxes, possible future law changes, and the need for a tax-efficient portfolio become clear. For retirees, particularly HNWIs, managing tax liability is more than compliance; it’s about creating sustainable wealth for years. A tax-efficient approach can help you:

- Minimize taxes on investment returns.

- Protect long-term gains.

- Align your portfolio with changing tax policies.

Understanding how and where your assets are invested can be key to achieving this. Let’s look at some strategies to help you prioritize tax efficiency.

1. Smart Asset Location: Putting Investments in the Right Accounts

1. Smart Asset Location: Putting Investments in the Right Accounts

One of the most powerful tax efficiency strategies is asset location, which involves strategically placing different types of assets in specific accounts to help minimize tax liability. Asset location is separate from asset allocation, which involves diversifying investments. Instead, asset location focuses on which accounts hold which investments.

Tax-Deferred Accounts (e.g., 401(k), Traditional IRA)

Tax-deferred accounts are ideal for investments that generate income or frequent dividends, as these will be taxed later when withdrawn, typically in retirement. Examples include bonds (interest payments), actively managed funds, and real estate investment trusts (REITs).

Taxable Accounts

Taxable brokerage accounts can be better suited for investments that are tax-efficient by nature, such as:

- Certain individual stocks (held for long-term gains).

- Certain index funds (low turnover and fewer taxable events).

- Certain municipal bonds (potentially tax-free interest income).

Tax-Free Accounts (e.g., Roth IRA, Roth 401(k))

Tax-free accounts, where withdrawals in retirement are generally not taxed, are potentially valuable for assets with the potential for high growth, such as:

- Certain stocks are expected to appreciate significantly over time.

- Certain mutual funds or ETFs.

Placing your investments in the right accounts can help reduce the taxes you owe over your lifetime. As always, it’s important to consult your advisor to see if these investments are a good fit for you and your specific situation.

2. Leveraging Long-Term Capital Gains for Greater Tax Efficiency

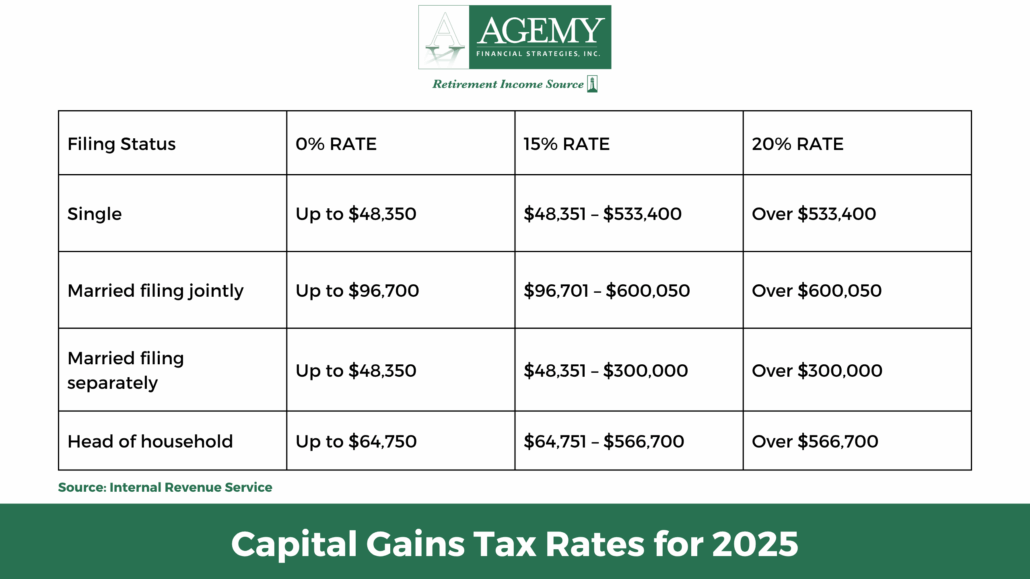

Understanding the distinction between short-term and long-term capital gains is essential when creating a tax-efficient portfolio. Short-term capital gains (on assets held less than one year) are taxed as ordinary income, while long-term capital gains (on assets held for more than a year) enjoy significantly lower rates. The table below shows the capital gains tax rates for 2025:

For HNWIs, long-term strategies are particularly important. Here are some ways to help you optimize:

- Hold Investments Longer: You can benefit from lower long-term rates by holding onto assets for over a year.

- Tax-Loss Harvesting: Offsetting capital gains with losses from other investments can help reduce your taxable income.

- Gifting Appreciated Assets: Gifting long-term appreciated assets to family members in lower tax brackets can help minimize overall tax exposure while supporting your loved ones.

3. Proactively Planning for Future Tax Law Changes

Tax laws can change, and for HNWIs, staying informed and flexible is key to tax efficiency. For instance, the Tax Cuts and Jobs Act (TCJA) lowered tax rates but will sunset at the end of 2025, which could mean higher taxes for many individuals. Being proactive now can help mitigate the impact of these changes later. Here are some key strategies to consider:

- Roth Conversions: Converting assets from a traditional IRA to a Roth IRA can help you pay taxes at today’s lower rates, locking in tax-free growth for the future.

- Diversifying Tax Buckets: Balancing your investments across taxable, tax-deferred, and tax-free accounts can help you remain flexible as tax laws change.

- Monitor Income Thresholds: Keeping taxable income below certain thresholds can help you avoid the Medicare surtax and other income-related taxes.

Working closely with a fiduciary advisor who monitors the tax landscape can help ensure you remain one step ahead.

4. Maximizing Retirement Account Contributions

4. Maximizing Retirement Account Contributions

Retirement accounts provide valuable tax advantages, and maximizing your contributions now can lead to significant long-term benefits. For 2025, contribution limits are as follows:

- 401(k): Up to $23,500, with an additional $7,500 catch-up contribution for those aged 50 and older.

- IRA: Up to $7,000, with an additional $1,000 catch-up contribution for individuals aged 50 and older.

Maximizing contributions to tax-advantaged accounts can defer income taxes and allow your investments to grow tax-deferred or tax-free, depending on the account type. To make the most of these opportunities, consider consulting a fiduciary advisor who can help you develop a strategy tailored to your financial goals.

5. Prioritizing Tax-Efficient Investments

Certain types of investments are inherently more tax-efficient than others, making them more ideal for taxable accounts.

- Index Funds and ETFs: These investments are known for low turnover and fewer capital gains distributions, helping reduce your tax burden.

- Municipal Bonds: For investors in high tax brackets, municipal bonds offer interest income often exempt from federal taxes (and sometimes state taxes).

- Tax-Managed Funds: These funds are actively managed to help minimize capital gains distributions, making them suitable for taxable accounts.

Prioritizing tax-efficient investments can help you enhance after-tax returns and preserve more of your wealth.

The Importance of Proactive Tax Planning

The Importance of Proactive Tax Planning

Tax efficiency is not a once-a-year activity; it requires a year-round, proactive approach. At Agemy Financial Strategies, we pride ourselves on providing personalized, fiduciary-based advice that prioritizes your best interests. Here are some areas where we can help:

- Continuously monitor the tax implications of your investments to identify opportunities to save.

- Adjust your strategies as tax laws evolve, allowing your portfolio to remain optimized under current regulations.

- Implement charitable giving, Roth conversions, and tax-loss harvesting techniques at the right time to help minimize your tax burden.

- Provide personalized guidance to help you balance short-term needs with long-term tax planning strategies tailored to your financial goals.

Our team is dedicated to helping you incorporate tax efficiency into your retirement planning strategy, which can help you prepare for tax season and a tax-optimized future.

Plan Now for a Tax-Efficient Retirement

Getting ahead of tax season means more than filing your return early. It means building a retirement portfolio to minimize taxes and maximize long-term wealth. Focusing on strategies like asset location, long-term capital gains, and proactive planning can help you take control of your tax liability and create a more stable financial future.

At Agemy Financial Strategies, we help individuals optimize their portfolios for tax efficiency. Our fiduciaries understand the importance of wealth preservation and proactive planning for HNWIs approaching retirement.

Contact us today to learn more about how we can help you navigate tax-efficient strategies tailored to your financial goals.

Disclaimer: This blog is for informational purposes only and does not constitute financial, tax, or investment advice. The content is not intended to be a solicitation or recommendation for any specific financial product or service. Tax laws and regulations are subject to change, and the information presented may not apply to your individual circumstances. Please consult the fiduciary advisors at Agemy Financial Strategies for personalized advice regarding your financial situation.

Leave a Reply

Want to join the discussion?Feel free to contribute!