Is a Self-Directed IRA Right For You?

IRAs are a great way to invest for your retirement years. But if you want to invest in assets like precious metals, real estate and crypto, certain assets are off-limits. That’s where opening a self-directed IRA comes into play.

If you’re approaching retirement, you’re likely exploring avenues to fine-tune your financial strategy. One option worth considering is the Self-Directed Individual Retirement Account (SDIRA). While traditional IRAs and 401(k)s certainly have their benefits, SDIRAs present distinct advantages for retirees with substantial wealth.

In this blog post, we will delve into the world of SDIRAs, examining their benefits, potential drawbacks, and whether they align with your needs in retirement. Here’s what you need to know.

What is a Self-Directed IRA?

A Self-Directed Individual Retirement Account (SDIRA) is a retirement savings account that gives you greater control over your investments than traditional IRAs. The main difference between an SDIRA and other IRAs is the types of investments allowed. Regular IRAs limit you to common investments like stocks, bonds, CDs, and mutual funds.

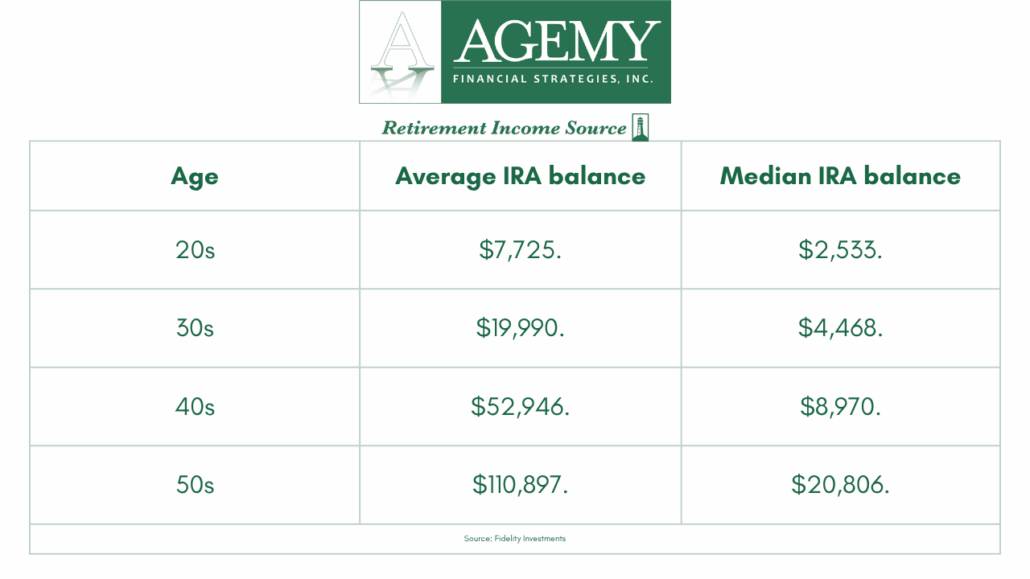

As of 2023, there has been an 11.1% uptick in the number of Americans choosing to open IRA accounts. This surge is reflected in the table below, which shows a total of 13.1 million IRA accounts currently active.

However, SDIRAs open the door to a wider range of assets. With an SDIRA, you can invest in precious metals, commodities, private placements, real estate, and other unique options. This means that managing an SDIRA requires more effort and careful research from the account owner.

Understanding Taxes, Withdrawals and Contributions

Contributions to a self-directed IRA are limited to yearly amounts. In 2023, this amount is $6,500 for individuals under 50, and if you’re over 50, you can add an extra $1,000 as a catch-up contribution.

When you decide to start taking money out, you’ll have to pay regular income taxes unless you’re 59½ or older. If you withdraw any funds before hitting this age, there’s a 10% penalty, and you’ll still owe income tax on what you take out.

Once you reach 73, the IRS says you must begin withdrawing money. The amount you need to withdraw depends on your account balance and life expectancy, following their minimum requirements.

Benefits of Self-Directed IRAs for High Net Worth Retirees

It is common for most high-net-worth retirees to invest a notable portion of their wealth in traditional avenues. Self-Directed IRAs (SDIRAs) present a valuable opportunity to grow your investment portfolio. Here’s a look at some of the benefits SDIRAs can offer:

- Diversification Opportunity: SDIRAs allow high-net-worth retirees to diversify their investment portfolios beyond traditional stocks and bonds, reducing overall risk exposure.

- Tax Advantages: Contributions to a traditional SDIRA are usually tax-deductible, and investments grow tax-deferred until retirement withdrawals, benefiting high-net-worth individuals in higher tax brackets.

- Personalized Investment Options: SDIRAs empower investors to make decisions based on their expertise and preferences, potentially leading to higher returns.

Now that we know about the benefits let’s look at some drawbacks.

Potential Drawbacks of Self-Directed IRAs

Managing SDIRAs can be more intricate than traditional retirement accounts, requiring a deeper understanding of investment options and compliance with IRS regulations. While SDIRAs offer many advantages, it’s important to be aware of their potential drawbacks:

- Complexity: Managing a self-directed retirement account can be more complex than a traditional IRA. You must adhere to IRS rules and regulations, and certain investments may require additional paperwork and compliance measures.

- Risk: With greater investment control comes greater responsibility. High net-worth retirees must carefully research and select investments, which can be riskier if not done wisely.

- Fees: SDIRAs may have higher administrative fees than traditional IRAs, given the need for additional services like custodians or facilitators for certain asset types.

Working with a financial advisor can help you understand the advantages and drawbacks of SDIRAs. They can assist you in making informed decisions about your retirement savings strategy.

Is a Self-Directed IRA Right for You?

Determining whether a Self-Directed Individual Retirement Account (SDIRA) is the right choice for you involves considering various crucial factors. Firstly, your level of investment experience plays a pivotal role; if you possess knowledge in alternative investments like real estate or private equity, an SDIRA may align well with your expertise and interests.

Secondly, assessing your risk tolerance is vital, as self-directed investments carry potential risks that require careful management and due diligence. Lastly, consulting with a financial advisor to understand the tax implications of incorporating an SDIRA into your financial strategy is essential. They can help you learn about the potential tax benefits and associated consequences.

Working With a Financial Advisor

Navigating the complexities of retirement planning, especially with Self-Directed IRAs, can be challenging. Working with an experienced financial advisor becomes crucial to help you navigate this financial realm.

A financial advisor can help you review your investments while accounting for risk management tactics to help ensure they remain in sync with your financial situation. At Agemy Financial Strategies, our team of financial advisors is here to walk you through the process of achieving renewable wealth so that your money can work hard for you and you can reap the benefits of a comfortable retirement. Here are just some of the many ways we can help our clients:

- Assessment of Your Financial Situation

- Investment Strategy

- Tax Planning

- Portfolio Monitoring & Rebalancing

By regularly reviewing and adjusting your plan, you can make informed decisions to help maximize your retirement savings and help ensure financial security for you and your loved ones.

Last Thoughts

Self-Directed IRAs offer a unique way to plan for retirement, especially for those nearing retirement. However, they require careful thought and more active management of your investments.

To see if an SDIRA fits your retirement goals and financial situation, it’s crucial to talk to a financial advisor. Making the right choice can set you up for a successful retirement that helps your finances for years to come.

Start your journey to financial success by scheduling your complimentary strategy session today.

Leave a Reply

Want to join the discussion?Feel free to contribute!