What You Need to Know About RMDS in 2025

As we approach the end of 2024, reviewing your retirement goals is a prime opportunity. One essential aspect to consider? Required Minimum Distributions (RMDs).

RMDs are a cornerstone of many retirement strategies, yet their complex rules and tax implications can make them challenging to navigate. Planning ahead can help you stay on track and optimize your retirement withdrawals.

With new RMD regulations set for 2025, understanding these changes can help you optimize your financial plans. In this blog, we’ll break down the fundamentals of RMDs, highlight the upcoming updates, and share practical tips to help you manage your distributions effectively.

Understanding Required Minimum Distributions (RMDs)

RMDs are mandatory withdrawals from certain retirement accounts once you reach a specific age. These withdrawals, which have grown tax-deferred over time, help retirement funds become taxable income. RMDs apply to the following accounts:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k), 403(b), and 457(b) plans (excluding Roth 401(k)s).

The annual amount you must withdraw is calculated based on your age, life expectancy, and account balance at the end of the previous year. Failing to take the required amount can result in significant tax penalties. Let’s take a look at key changes to look for in 2025.

Key Changes to RMDs for 2025

Key Changes to RMDs for 2025

As retirement planning continues to evolve, the latest updates to RMDs reflect efforts to provide more flexibility and tax advantages for retirees. The SECURE 2.0 Act introduced several new rules that impact how and when retirees must take distributions from certain accounts and adjust penalties. Below are the main changes for 2025 and beyond, designed to give retirees more control over their withdrawals and tax planning:

1. Increased RMD Starting Age: The age at which individuals must begin taking RMDs has been raised. In 2023, the age increased from 72 to 73, and it will further rise to 75 beginning in 2033.

2. Reduced Penalties for Missed RMDs: The penalty for failing to take an RMD has been reduced from 50% to 25% of the missed amount. If the missed RMD is corrected promptly, the penalty can decrease to 10%. Remember that the IRS has waived penalties for failing to take RMDs for certain inherited IRAs. For more information, see here.

3. Elimination of RMDs for Roth 401(k)s: Previously, Roth 401(k) accounts were subject to RMDs. Under the new rules, RMDs are no longer required for Roth 401(k)s, aligning them with Roth IRAs. It’s important to note that post-death minimum distribution rules, which also apply to Roth IRAs, still apply.

4. Annuities and RMDs: The SECURE 2.0 Act introduces provisions to make certain annuities more attractive within retirement plans. It allows certain types of annuity payments and clarifies qualifying longevity annuity contracts (QLACs) rules, including increasing the dollar limit to $200,000 and removing the 25% account balance cap.

5. RMDs for Surviving Spouses: Surviving spouses can now elect to be treated as the deceased account owner for RMD purposes, potentially delaying the start of RMDs if the surviving spouse is younger than the deceased. This election is irrevocable and requires notifying the account administrator.

6. Qualified Charitable Distributions (QCDs): The annual limit for QCDs, which count toward RMDs, is now indexed for inflation, starting at $105,000 in 2024. A one-time QCD of up to $50,000 is also allowed through certain charitable remainder trusts or gift annuities.

Why These Changes Matter

The recent adjustments to RMD rules are more than just technical updates—they bring valuable flexibility that can significantly benefit retirees. Here are some of the primary advantages of these changes:

1. Enhanced Growth Potential for Retirement Savings: Delaying RMDs means retirement accounts can stay invested and grow tax-deferred for longer. This change can be particularly beneficial for retirees who do not immediately need income from their retirement accounts, as it gives their investments more time to compound, potentially increasing their overall retirement nest egg.

2. More Control Over Roth 401(k) Withdrawals: With the removal of RMD requirements for Roth 401(k) accounts, retirees now have the same control as they do with Roth IRAs. This means they can choose when or if they want to withdraw from these accounts, providing a tax-free income source that can be preserved and used strategically within their broader retirement plan.

3. Reduced Penalties for Missed RMDs: The lower penalties for missed RMDs, combined with an opportunity for further reduction if corrected promptly, provide relief for retirees who may inadvertently miss their RMD deadline. This change reduces the financial impact of an honest mistake, making the RMD system more forgiving and manageable.

4. Options for Legacy and Charitable Planning: The increased flexibility around QCDs and the inflation-indexed annual limits make charitable giving a viable strategy for retirees looking to meet their RMD requirements while supporting causes they care about.

How to Calculate Your RMD in 2025

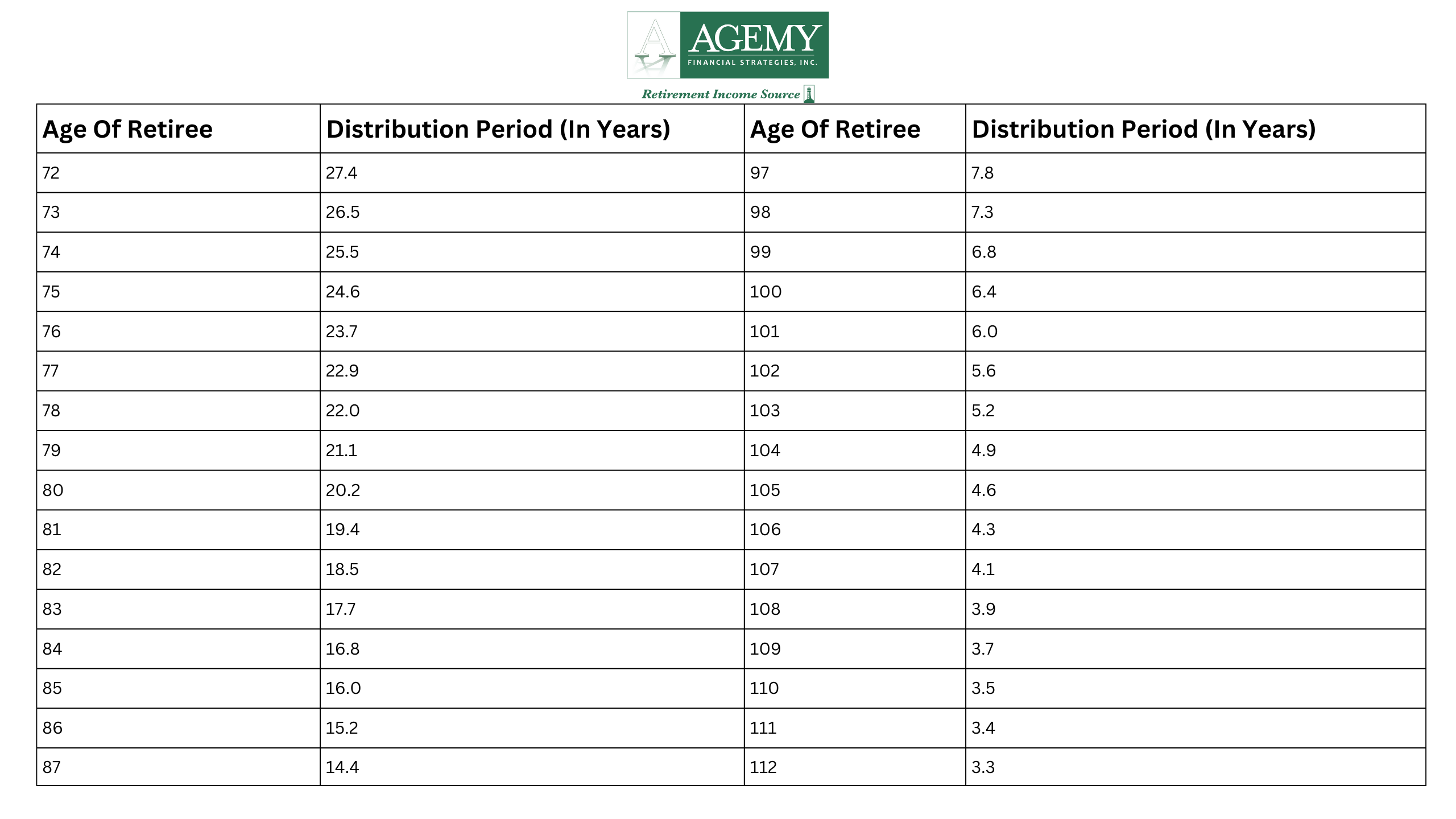

Calculating your Required Minimum Distribution (RMD) in 2025 is straightforward, with a few key steps. The IRS provides tables that determine your life expectancy factor based on your age, which you’ll use to calculate your RMD. Here’s a step-by-step guide:

- Determine Your Account Balance: Start with your retirement account balance as of December 31st of the previous year. This amount will serve as the basis for your RMD calculation.

- Find Your Life Expectancy Factor: Using the IRS Uniform Lifetime Table, locate the life expectancy factor corresponding to your age. This factor is updated periodically, so make sure you use the latest table for accuracy.

- Calculate the RMD: Divide your account balance by the life expectancy factor. The result is the minimum amount you must withdraw from your account for the year.

Below is a portion of the IRS Uniform Lifetime Table to illustrate life expectancy factors by age:

Source: Internal Revenue Service (IRS)

Common Mistakes to Avoid

Navigating RMDs can be challenging; even small missteps can have significant financial consequences. Being mindful of some of the most frequent pitfalls can help you protect your retirement savings and maximize the benefits of these withdrawals. Here are three key mistakes to watch out for when planning your RMDs:

- Missing the Deadline: Missing your RMD deadline can lead to hefty penalties. Know your required distribution date and withdraw the correct amount.

- Not Planning for Taxes: RMDs can push you into a higher tax bracket. Working with a fiduciary advisor can help you create a strategy to manage these distributions in a tax-efficient manner.

- Overlooking Beneficiary Designations: Your beneficiaries will have their own RMD requirements based on the inherited RMD rules. Regularly review your designations to align with your estate and financial goals.

Working with a fiduciary can help ensure that your RMDs are managed to align with your financial goals and help you make the most of your retirement savings.

Working With an Advisor

New tax laws, potential shifts in Medicare premiums, income bracket adjustments, and evolving rules around charitable giving mean that your retirement income strategy may need some fine-tuning. Staying informed is essential for making the most of these adjustments and preparing your RMDs effectively.

At Agemy Financial Strategies, we provide personalized insights into your RMD responsibilities and tax-efficient strategies to help you manage these distributions. Our fiduciary advisors are dedicated to helping you meet your RMD obligations while optimizing your financial situation within IRS guidelines. We’ll work closely with you to assess your income needs in retirement and develop a plan that aligns with your financial goals and adapts to new regulations.

As part of our commitment to supporting your financial well-being, we offer tools like our free online RMD Calculator to help you estimate your required withdrawals. For more details on our services, please see our service offerings page here.

Final Thoughts

Navigating RMDs effectively requires staying informed about changing rules and understanding how these mandatory withdrawals impact your retirement income. Planning, keeping abreast of IRS updates, and consulting with financial advisors can help ensure that RMDs work in your favor while minimizing tax liabilities.

At Agemy Financial Strategies, our team is here to provide personalized guidance and support tailored to your financial needs and goals. Let us help ensure your tax obligations are appropriately managed throughout your retirement.

Preparing for 2025 doesn’t have to be overwhelming—let us help guide you toward a well-planned and prosperous new year. Contact us today to schedule your complimentary consultation.

Disclaimer: The information provided in this blog is for educational purposes only and is not intended as specific financial or investment advice. Each individual’s financial situation is unique, and any changes to your retirement income strategy or RMD planning should be discussed with a qualified financial advisor. We recommend consulting with our team at Agemy Financial Strategies to ensure your decisions align with your financial goals, risk tolerance, and the latest IRS regulations.

Leave a Reply

Want to join the discussion?Feel free to contribute!