Healthcare & LTC Planning for Seniors

August 14, 2024

August 21st is World Senior Citizens Day, a perfect time to celebrate our seniors and acknowledge their unique financial challenges in retirement.

Chances are, you’ll probably spend more in retirement than you think. Did you know that recent data shows a healthy 65-year-old couple might need over $395,000 for healthcare in retirement?

At Agemy Financial Strategies, we know how important it is to plan ahead for these expenses to help ensure a comfortable retirement. Our team is here to help seniors and their families navigate the details of healthcare and long-term care planning.

In this blog, we’ll provide essential insights into planning for healthcare and long-term care. We’ll cover key aspects of preparing for these significant costs and offer practical tips to help you create a robust plan for a financially stable retirement.

Why Seniors Need Both Healthcare and Long-Term Care

It’s important to understand the distinction between healthcare and long-term care, as they serve different purposes and have different financial implications. Seniors often require both healthcare and long-term care, as healthcare coverage alone may not address all their needs.

Healthcare focuses on treating and managing acute and chronic medical conditions. It covers medical expenses related to illnesses or injuries, such as doctor visits, hospital stays, medical procedures, surgeries, prescription medications, and preventive care. Typically, healthcare is covered by health insurance plans, including Medicare and private insurance policies.

Long-term care is about maintenance rather than treatment, aiming to provide comfort and safety. It includes assistance with daily living activities such as bathing, dressing, eating, and mobility. Services can range from nursing home care and assisted living to in-home and adult day care. Unlike healthcare, long-term care is typically not covered by standard health insurance or Medicare, requiring separate long-term care insurance or personal savings.

Understanding these differences helps you make informed decisions about the type of care you may need in the future and how to plan financially for these needs.

The Importance of Healthcare in Retirement

The Importance of Healthcare in Retirement

Healthcare is a critical component of retirement planning. As we age, the likelihood of needing more frequent medical care increases, making it essential to have a robust healthcare plan. Finding the best health insurance for retirees and seniors involves evaluating various factors, including coverage options, costs, and additional benefits like prescription drug coverage.

Medicare often serves as the foundation for healthcare coverage for seniors, but understanding its parts—Part A, Part B, Part C, and Part D—is crucial for complete coverage. Here is a closer look:

- Medicare Part A: Often referred to as hospital insurance, Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services.

- Medicare Part B: This insurance policy covers outpatient care, doctor’s visits, preventive services, and medical supplies, such as durable medical equipment.

- Medicare Part C (Medicare Advantage): These plans often provide additional benefits beyond Original Medicare, such as dental, vision, and hearing coverage. They can be an excellent option for seniors looking for more comprehensive care.

- Medicare Part D (Prescription Drug Plans): Helps ensure coverage for prescription medications, especially those for managing chronic conditions.

- Medigap Policies: Also known as Medicare Supplement Insurance, Medigap policies help cover out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

At Agemy Financial Strategies, our fiduciaries help clients navigate these options, helping ensure they choose a plan that fits their medical needs and financial situation. Let’s take a look at some crucial factors to consider.

The Growing Need for Long-Term Care

Long-term care is another critical aspect of planning for the senior years. This type of care encompasses various services designed to meet health or personal care needs over an extended period. The cost of long-term care can be substantial.

On average, a year in a nursing home can cost around $108,408 per year for a private room. However, these costs can vary widely based on location, so checking specific rates in your area is crucial. The financial commitment associated with long-term care requires careful planning to help ensure the well-being of your loved ones and your financial stability.

Medicare primarily covers acute care services for short-term illnesses and injuries, not long-term care. Long-term care supports individuals with chronic conditions or disabilities who need ongoing help with daily activities like bathing, dressing, and eating. This kind of custodial care is not included in traditional Medicare coverage.

While Medicare does provide limited coverage for skilled nursing facility (SNF) care following a hospital stay, this is only for a short period and must be considered medically necessary. To help cover long-term care expenses, many people rely on private long-term care insurance, Medicaid, or sometimes both. Retirees must understand Medicare’s limitations in covering long-term care and plan accordingly as they age.

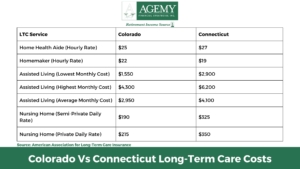

Below is a comparison of long-term care costs between

Below is a comparison of long-term care costs between

This comparison highlights the importance of planning for long-term care expenses, as costs can vary greatly depending on the location. For those approaching their senior years or planning for the future, understanding these costs and securing the right insurance or savings plans is crucial to help ensure financial stability and access to necessary care.

How Agemy Financial Strategies Can Help

Navigating healthcare and long-term care options can be daunting, especially considering the financial implications. If you’re in Connecticut or Colorado, our fiduciary advisors are here to help you plan effectively for your healthcare needs in retirement. At Agemy Financial Strategies, we recognize that healthcare costs can significantly threaten your retirement nest egg. That’s why we provide valuable assistance in developing a comprehensive retirement income plan that encompasses crucial financial factors, such as:

We understand that retirement planning looks different for each individual, so we carefully craft your plan to meet your specific needs. By taking a proactive approach, we help you manage healthcare expenses and maintain financial stability throughout your retirement.

Final Thoughts

National Senior Citizens Day reminds us to honor and support our senior community. Helping provide access to quality healthcare and planning for long-term care are essential steps in providing the security and peace of mind they deserve. At Agemy Financial Strategies, we are here to help every step of the way, providing the compassion needed to navigate these critical aspects of retirement planning.

Contact us today to learn how we can assist you in planning for a secure and comfortable future.

Leave a Reply

Want to join the discussion?Feel free to contribute!