2025 Adjustments for Estate, Gift, and GST Tax Exemptions

Tax laws are shifting, and for individuals committed to preserving their wealth, staying ahead of these changes is more important than ever.

With new adjustments to estate, gift, and generation-skipping transfer (GST) tax exemptions on the horizon, your decisions could have a lasting impact on your financial legacy. For high-net-worth individuals (HNWIs), understanding these updates isn’t just beneficial—it provides a decisive strategic advantage.

In this blog, we’ll break down the key changes and explore how Agemy Financial Strategies can assist you in navigating the complexities of these taxes, turning challenges into opportunities to help secure your future.

What Are Estate, Gift, and Generation-Skipping Transfer Taxes?

What Are Estate, Gift, and Generation-Skipping Transfer Taxes?

The federal government employs estate, gift, and generation-skipping transfer (GST) taxes to help ensure wealth transfers are subject to taxation. In turn, this limits the accumulation of untaxed wealth across individuals and generations. Understanding how these taxes operate and interact is essential for crafting a comprehensive wealth preservation strategy. Let’s explore each tax in detail:

1. Estate Tax

The estate tax is a levy imposed on the total value of an individual’s estate that exceeds the federal exemption threshold at the time of their death. This tax applies to assets such as real estate, investments, cash, and other valuables included in the estate. The federal estate tax doesn’t apply unless you hit a certain exemption amount.

- The exemption amount for people who pass away in 2025 is $13.99 million (up from $13.6 million last year).

- Married couples can expect their exemption to be $27.98 million (up from $27.22 million last year).

Proper estate planning can help mitigate this tax burden, allowing more wealth to be passed on to your heirs.

2. Gift Tax

The gift tax applies to transferring money or assets during your lifetime that exceeds the annual or lifetime exemption limits. The annual gift tax exclusion sets the amount you can give each recipient without impacting your lifetime exemption. The IRS has announced an increase in the annual gift tax exclusion for 2025:

- Individuals: You can gift up to $19,000 per recipient, a $1,000 increase from the 2024 limit.

- Married Couples: Couples can gift up to $38,000 per recipient without triggering gift tax reporting requirements.

Maximizing annual gift exclusions helps reduce your taxable estate while providing financial support to loved ones. However, exceeding these limits without careful planning can lead to unnecessary tax liabilities. Working alongside a fiduciary can help you integrate gifting strategies into your broader estate plan.

3. Generation-Skipping Transfer (GST) Tax

The Generation-Skipping Transfer (GST) tax is designed to prevent individuals from avoiding taxation by skipping over a generation and transferring wealth directly to beneficiaries who are at least two generations younger. It is an additional tax on top of the federal gift or estate tax. For the tax year 2025, the GST tax exemption amount is set at $13.99 million per individual.

Transfers to these younger-generation beneficiaries are only tax-free up to the GST tax exemption limit. Any amount exceeding this exemption is subject to the GST tax, which, like the estate tax, has a top rate of 40%. This tax most commonly affects:

- Direct Transfers: Gifts or inheritances given directly to grandchildren or other younger-generation individuals.

- Trusts: Trusts established for the benefit of grandchildren or great-grandchildren, especially when structured to avoid intermediate taxation on the parent generation.

A fiduciary can help you by providing tailored advice for your estate plan accounts. With proactive planning and guidance, you can better protect your financial legacy and help ensure it benefits your family for years.

Why Understanding These Taxes Matters

Proper planning for estate, gift, and GST taxes is essential to help protect your financial legacy. Failing to account for these taxes can result in significant financial losses for your heirs and complicate wealth transfer strategies. For example:

- Overlooking Gift Tax Exclusions: Missing annual or lifetime gift tax exclusions can unintentionally trigger higher tax liabilities.

- Missing the Current Exemptions: Failing to take advantage of the higher exemptions before they are reduced in 2026 could expose your estate to substantial federal taxes.

- Mismanaging GST Tax Liabilities: Poor planning could undermine the long-term benefits of trusts and other wealth transfer strategies to skip generations.

Working with a fiduciary can help you have the guidance needed to navigate the nuances of these taxes. A trusted fiduciary can help you maximize available exemptions and create a plan to help preserve your wealth for future generations.

Key Changes to Tax Exemptions for 2025

The Tax Cuts and Jobs Act (TCJA) of 2017 significantly increased the exemptions for estate, gift, and GST tax. However, these enhancements are set to sunset at the end of 2025, potentially altering how wealth can be transferred tax-efficiently. Here’s what to expect:

Post-2025 Adjustments

- The lifetime estate and gift tax exemptions are scheduled to be cut in half after 2025 to approximately $7 million per individual (adjusted for inflation).

- Without action, gifts or estate transfers exceeding these reduced limits could face federal taxes at rates as high as 40%.

If you have a large estate, taking advantage of the higher exemptions in 2025 can help reduce your tax liabilities and preserve wealth for future generations. Early planning is essential to avoid the financial burden of potential reductions.

State Estate Taxes: Another Layer to Consider

State Estate Taxes: Another Layer to Consider

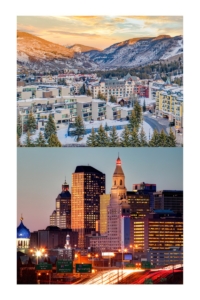

In addition to federal estate taxes, many states impose their own estate or inheritance taxes, often with lower exemption thresholds. For residents of states like Connecticut, where state-level estate taxes can be significant, careful planning is crucial to help avoid unexpected tax liabilities.

The current Connecticut estate tax exemption is $13.61, and the flat tax rate is 12%. Any taxable gifts or estates exceeding this exemption amount will be subject to a 12% tax. Thus, it is vital for Connecticut residents to integrate state tax considerations into their overall estate planning strategy.

The absence of a state estate tax offers a significant advantage for Colorado residents. Without an additional layer of taxation, residents can pass on their wealth to loved ones without incurring state-level estate taxes. This benefit particularly appeals to retirees seeking to preserve their legacy and help maximize the financial resources available to their families.

With dedicated offices in Connecticut and Colorado, Agemy Financial Strategies has extensive experience helping residents navigate these state-specific tax laws. Whether navigating Connecticut’s estate tax thresholds or taking advantage of Colorado’s tax benefits, our team helps protect your financial legacy for future generations.

How Agemy Financial Strategies Can Help

The upcoming changes to estate, gift, and GST tax exemptions present a valuable opportunity to help optimize your financial legacy and minimize future tax burdens for your heirs. However, navigating these complex tax structures requires skilled guidance and thoughtful planning. At Agemy Financial Strategies, we help simplify financial complexities, equipping you with the tools and knowledge to make confident, informed decisions about your wealth. Here’s how we can help:

- Tailored Estate Planning: We can design personalized estate plans that align with your unique goals, helping ensure your wealth transitions smoothly and tax-efficiently.

- Proactive Gifting Strategies: Our team will guide you in leveraging exemptions, avoiding common pitfalls, and making tax-savvy decisions.

- Trust Design and Management: Whether you’re setting up a trust or optimizing an existing one, we provide solutions to help maximize benefits for you and your heirs.

- Holistic Financial Advice: Estate planning works best when integrated with your broader financial goals. We offer comprehensive advice to help ensure all aspects of your financial life are aligned.

- Staying Ahead of Legislative Changes: Tax laws change frequently, and we keep you informed, adapting strategies as needed.

Preparing for the Future: Start Today

The adjustments to estate, gift, and generation-skipping tax exemptions represent a pivotal moment for estate planning. With potential tax savings at stake, proactive planning in 2025 and beyond is more important than ever.

Whether you’re seeking to preserve wealth for future generations or minimize tax liabilities, the key is working with a knowledgeable advisor who understands your needs. Agemy Financial Strategies is here to assist you in navigating these changes and helping secure your financial legacy.

Contact us today to learn how we can help you make the most of this critical tax planning period.

Frequently Asked Questions (FAQs)

How will these exemptions change in 2026?

Unless new legislation is passed, the exemptions will revert to $5 million per individual (indexed for inflation) on January 1, 2026, which is expected to be approximately $7 million per individual.

What Happens If You Exceed the Annual Limit?

Gifts exceeding the annual exclusion are deducted from your lifetime gift and estate tax exemption. If your total lifetime gifts surpass the federal exemption threshold, the remaining amount may be subject to federal gift taxes, which are taxed at a maximum rate of 40%.

How can I take advantage of the current exemptions?

The higher exemptions in 2025 can be used to make large lifetime gifts, establish trusts, or utilize other tax-efficient wealth transfer strategies. Consulting a fiduciary advisor can help ensure your plan is effective and compliant.

What is a Spousal Lifetime Access Trust (SLAT)?

A SLAT is an irrevocable trust that allows one spouse to gift assets to the other while retaining indirect access to the assets. It is a popular tool for utilizing the higher gift exemptions before they are reduced.

How do state-level estate taxes affect my plan?

Some states impose their own estate or inheritance taxes, with exemption thresholds often lower than federal limits. A comprehensive estate plan should account for both federal and state tax implications.

How does Agemy Financial Strategies help with these taxes?

Agemy Financial Strategies provides personalized estate planning services, including wealth analysis, trust creation, and tax-efficient gifting strategies. We help clients navigate complex tax laws and align their plans with long-term goals.

How do I get started with estate planning?

Start by scheduling a consultation with Agemy Financial Strategies. We’ll help you by reviewing your financial situation, discussing your goals, and designing a tailored estate plan to meet your needs. Visit us today to get started.

Disclaimer: The information provided in this blog is for educational purposes only and should not be considered specific investment, tax, legal, or financial advice. Agemy Financial Strategies does not guarantee results, and past performance does not indicate future results. Tax laws are subject to change, and any strategies discussed should be reviewed in the context of current legislation and individual circumstances.

Leave a Reply

Want to join the discussion?Feel free to contribute!