Connecticut vs. Colorado: Finding Your Ideal Retirement Destination

Many Americans approaching retirement seek out a new location to spend their golden years, searching for a place that offers comfort and necessary resources. Whether you’re contemplating a move out of, into, or within Connecticut or Colorado, Agemy Financial Strategies is here to assist you.

As a financial firm based in Connecticut with offices in Colorado, we can offer you first-hand experience and knowledgeable advice on managing your retirement in these beautiful states. To start, let’s revisit some of the key pros and cons to consider.

Pros of Living in Connecticut

Pros of Living in Connecticut

Pro 1: Close Proximity to Major Cities

Nestled in the heart of New England, Connecticut exudes a classic charm that attracts retirees seeking a tranquil yet culturally rich environment. Connecticut’s location in the northeastern United States provides easy access to major cities like New York City and Boston.

Retirees can enjoy cultural attractions, world-class dining, and excellent healthcare facilities without traveling far. Connecticut boasts a rich historical heritage, with charming colonial towns, historic landmarks, and renowned museums. Retirees interested in history and culture will find plenty to explore in this picturesque state.

Pro 2: Connecticut Has a Longevity Advantage

For health enthusiasts, the concept of blue zones—areas where individuals consistently live past 100 years—holds significant intrigue. While these zones often exist in distant corners of the world, their longevity secrets offer valuable insights for everyone aiming to extend their lifespans.

According to Forbes Health, a recent study has positioned Connecticut as the fourth-ranking potential Blue Zone in the United States. Blue Zones are characterized by populations that live longer and lead healthier lives overall, with a notable number of residents reaching the centenarian mark. Connecticut stands out as one of the frontrunners among U.S. states primed to evolve into future Blue Zones.

Pro 3: Crime Rates are Falling

There’s a sense of safety, which is comforting to anyone. Connecticut is well known for its great, small community atmosphere. Many residents boast their small town feels more like a family. Connecticut witnessed a significant improvement in its crime rates between 2021 and 2022, as reported in the state’s annual crime report.

The report reveals a 13% decrease in violent crime, dropping from 6,272 offenses to 5,464. This decline marks the lowest violent crime rate per 100,000 residents the state has seen in the past decade. Additionally, property crime offenses also saw a decrease of 3% compared to the previous report.

Cons of Living in Connecticut

Con 1: High Cost of Living

Connecticut ranks among the states with the highest living expenses in the United States, especially regarding housing and taxes. Its cost of living consistently exceeds the national average, with studies indicating it could be anywhere from 17% to 25% higher than the rest of the country.

For retirees, this means their retirement savings may not go as far in Connecticut’s costly environment. Housing costs in Connecticut are generally higher than the national median. According to Zillow, the average home value in Connecticut is estimated to be around $384,244 as of February 2024, a 1-year Value Change of +11.1%

Con 2: High Taxes

Connecticut imposes a range of taxes that can significantly impact residents’ finances. The state’s income tax rates vary from 3% to 6.99%, with a corresponding 7.50% corporate income tax rate. In addition, the state sales tax rate stands at 6.35%, aligning closely with the national average.

Moreover, Connecticut’s property taxes further add to the financial burden, fluctuating based on the property’s assessed value and local tax rates. Compared to other states, Connecticut’s tax system ranks unfavorably, placing 47th overall on the 2024 State Business Tax Climate Index.

Con 3: Limited Outdoor Recreation

Connecticut experiences long, harsh winters characterized by cold temperatures and substantial snowfall, which may be challenging for those who prefer milder climates. While the state has beautiful natural scenery, it may offer fewer outdoor recreational opportunities than states like Colorado. Retirees who relish hiking, skiing, and fishing might yearn for a wider array of options.

Pros of Living Colorado

Pros of Living Colorado

Pro 1: Spectacular Scenery

Colorado presents an enticing option for retirees seeking an active lifestyle amidst breathtaking natural landscapes. It is known for its breathtaking natural beauty, sparkling lakes, and picturesque forests.

Colorful Colorado offers retirees abundant outdoor recreational activities, from skiing and snowboarding in the Rocky Mountains to hiking, biking, and fishing in the numerous state parks. Here are just some of the many places you can easily visit when retiring in Colorado:

- Explore the Garden of the Gods in Colorado Springs.

- Take a mining tour at Cripple Creek or Mollie Kathleen gold mine.

- Visit wine country in Grand Junction.

- Take a gondola ride in Telluride.

Pro 2: Low Taxes

Colorado has relatively low taxes compared to many other states, making it an attractive option for retirees looking to stretch their retirement savings. The state income tax range is a low, flat rate of 4.4%, and you get a fair deduction on retirement income. Sales tax may run higher in the state, but it doesn’t apply to groceries or medication. Another great reason to retire in Colorado is that there’s no estate tax. You can leave money to your family without paying those hefty fees, which can be a huge perk.

Pro 3: Retirement Communities are an Abundance

Retirement communities offer an excellent opportunity to connect with like-minded individuals, fostering social interactions and shared interests. Colorado boasts over 240 retirement communities spread across the state, providing ample options for retirees seeking vibrant social environments. Allowing you to have the best of everything with neighbors your age and loads of activities to keep you as social and busy as you want to be.

Cons of Living in Colorado

Con 1: High Cost of Living

Living expenses in Colorado tend to surpass the national average. This holds true for assisted living costs as well. On average, monthly care expenses for assisted living in Colorado range from $3,800 to $6,200, exceeding the national average. In Denver, specifically, the average monthly cost stands around $5,000.

Even in rural and suburban areas, living expenses can be slightly higher than average. In mountain towns like Aspen, however, costs can soar much higher than the national average. Therefore, if you’re working with a tight budget, it’s crucial to thoroughly assess the cost of living in different Colorado cities before making any decisions.

Con 2: Cost of Healthcare

If you’re considering retiring in Colorado, factoring in the cost of care is crucial. Colorado experienced the second-highest increase in private health insurance premiums this year, trailing only Georgia, according to a recent report. The average monthly cost for a 40-year-old with a mid-range silver plan surged by 19.6% in Colorado, rising from $409 to $489 between 2022 and 2023. Nationally, the average premium increase stands at approximately 4%, with an average monthly cost of $560. However, when considering all age groups and coverage types, Colorado’s average rate hike is closer to 10.4%.

Con 3: Traffic Jams

Due to the popularity of Colorado, some residents have been irked by the overcrowding, and in very populated areas, traffic congestion is also a problem. These are somehow inevitable consequences of a popular place. As more and more people move to live there, the population increases and overcrowding continues. For retirees wishing to live in Colorado, the overcrowding can be a problem if you were hoping to move into a quiet and calm environment.

Comparing the Two States

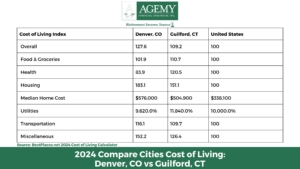

When weighing the options between Guilford, CT and Denver, CO, it’s important to consider several key factors. While Guilford generally offers a lower overall cost of living and provides more affordable housing options compared to Denver, the healthcare expenses in Guilford are notably higher. Therefore, the decision between these two cities may hinge on individual priorities and budgetary considerations. Here’s what we know about comparing Guilford, CT and Denver, CO:

Making Your Decision

Ultimately, the decision between Connecticut and Colorado comes down to your personal preferences, priorities, and lifestyle goals. Working alongside a trusted fiduciary advisor can help your transition to retirement. At Agemy Financial Strategies, our Connecticut and Colorado-based fiduciaries can provide valuable assistance in developing a retirement income plan that encompasses crucial financial factors, such as:

Our fiduciary advisors are committed to working closely with you to maximize your retirement years. We understand that retirement planning looks different for each individual, and with that in mind, we carefully craft your plan to meet your specific needs. For a complete list of our service offerings, see here.

Contact us today for more information on our retirement and financial planning services.

Leave a Reply

Want to join the discussion?Feel free to contribute!