With today’s economic volatility—rising interest rates, inflation pressures, tariff rollercoasters, and shifting housing demands—it’s more important than ever for retirees to not only generate income from real estate but also protect those investments against downside risk.

Here’s how to approach real estate strategically in turbulent times.

Understanding the Real Estate Landscape in Connecticut and Colorado

Connecticut

Despite broader market uncertainty, Connecticut has remained relatively stable. In 2025, regions like Greater Hartford and New Haven performed well, with Hartford ranked among the top 50 U.S. metros for growth potential by Zillow.

With an average home sale price of $414,183 (a 5.1% YOY increase), retirees may find solid investment opportunities, especially in suburban communities where remote work and space are still in demand. However, protecting those assets through diversified approaches and risk management is key.

Colorado

Colorado continues to outperform national trends. Cities like Colorado Springs are projected to see a 27.1% increase in home sales in 2025. With a strong job market, expanding tech sector, and high quality of life, the state remains a magnet for population growth.

Yet, rapid appreciation also brings risk—market corrections, regulatory shifts, and rising property taxes can affect your bottom line. Diversifying income sources and proactively managing assets becomes critical in times of market instability.

Connecticut

Connecticut’s real estate market has demonstrated remarkable resilience, even amid broader economic fluctuations. In 2025, the Greater Hartford metropolitan area, including New Haven, became one of the state’s top-performing regions, with Zillow naming Hartford among the top 50 U.S. metros for growth potential.

The average sale price in Connecticut stood at approximately $407,391, reflecting a 5.8% year-over-year increase in 2025. However, affordability remains a concern, especially with the state’s average household income of $130,601. As a result, retirees need to consider strategic investment approaches, particularly in suburban areas where the demand for larger homes is increasing.

Colorado

Colorado’s real estate market has grown substantially, particularly in cities like Colorado Springs and Denver. In 2025, Colorado Springs experienced a 27.1% year-over-year increase in home sales. The combination of economic stability, robust job markets, and a growing population has made the state’s real estate market an attractive prospect for retirees. Whether it’s residential or commercial properties, Colorado’s diverse economy and strong demand for housing make it an ideal location for income-generating real estate investments.

How Tariffs Affect Real Estate Investments

Tariffs may seem like a distant issue for real estate investors, but their ripple effects can have real consequences. When new tariffs are imposed—especially on imported construction materials like steel, lumber, aluminum, and appliances—the cost of development and property maintenance can rise significantly. This affects not only builders and developers but also income property owners who may face higher renovation and repair costs, ultimately squeezing profit margins.

In times of economic uncertainty, tariff-driven inflation can also impact consumer confidence and interest rates, leading to slower growth in property values or a cooling rental market. For real estate investors, this makes it even more important to focus on efficient property management, secure stable tenant leases, and explore tax-advantaged strategies like 1031 exchanges or cost segregation.

Proactive financial planning and a diversified investment approach can help protect your portfolio and preserve income—even when the broader economy faces headwinds.

How to Help Protect & Optimize Your Real Estate Income

1. Create a Defensive Rental Strategy

Rental income remains one of the most reliable ways to earn from real estate, but retirees must defend against vacancies and declining rents during downturns.

Protective Actions:

- Target stable markets like suburbs with consistent rental demand.

- Screen tenants rigorously to help reduce turnover.

- Include inflation-adjusted rent clauses in new leases.

- Maintain liquidity for emergency repairs or vacancies.

2. Embrace Short-Term Rentals with Built-In Flexibility

Vacation rentals can generate higher income, but also face more volatility. During economic downturns, tourism may drop or regulations may tighten.

Protective Actions:

- Use dynamic pricing tools to help optimize occupancy.

- Invest in markets with dual appeal (business + leisure travelers).

- Maintain necessary permits and insurance coverage.

- Be prepared to pivot properties into long-term rentals if needed.

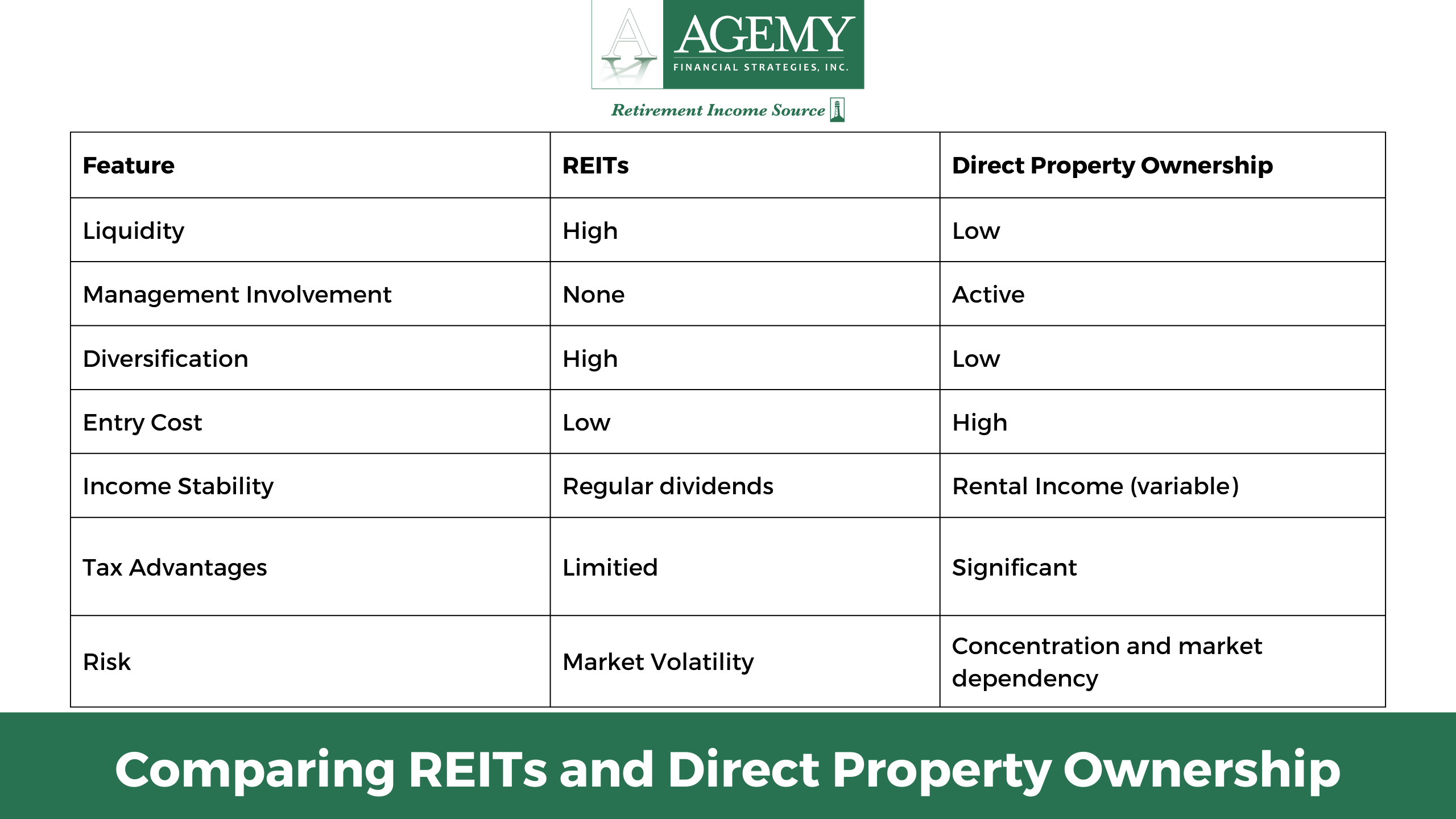

3. Diversify with Real Estate Investment Trusts (REITs)

REITs offer exposure to real estate with built-in diversification, which can help buffer retirees against market turbulence without direct property ownership.

Protective Actions:

- Focus on REITs in resilient sectors (e.g., healthcare, logistics).

- Regularly reassess holdings to reflect changing risk tolerance.

- Consult with a fiduciary to review dividend yield vs. market risk.

4. Participate in Syndications That Prioritize Capital Preservation

Real estate syndications provide access to large-scale properties with shared risk. In turbulent times, it can be beneficial to choose conservative, income-focused projects.

Protective Actions:

- Vet sponsors’ history of navigating downturns.

- Consider opting for cash-flowing properties over speculative developments.

- Ensure there’s a clear exit strategy and downside protections.

5. Use Cost Segregation and Tax Strategies to Boost After-Tax Income

In uncertain markets, improving cash flow through tax savings can be just as powerful as increasing rent.

Protective Actions:

- Use cost segregation studies to help accelerate depreciation.

- Stay updated on IRS changes that may impact deductions.

- Align tax strategies with overall retirement income planning.

- Aligning Real Estate Strategies with Retirement Goals

To help optimize your real estate holdings in volatile times, your approach must go beyond buying and holding. It’s about aligning cash flow, capital preservation, and flexibility with your retirement lifestyle.

Key Focus Areas:

- Income Stability: Seek assets that generate consistent returns, even in down markets.

- Risk Reduction: Diversify across property types, geographies, and ownership models.

- Liquidity Management: Maintain enough cash to weather rental gaps or major expenses.

How Agemy Financial Strategies Can Help

In a changing market, working with a fiduciary partner like Agemy Financial Strategies can help provide the stability and knowledge you need.

- Real Estate Income Optimization: We help evaluate your current holdings and identify opportunities for income growth and downside protection.

- Market-Aware Investment Strategies: We help tailor strategies for turbulent markets—whether it’s shifting into REITs, diversifying rentals, or exiting high-risk assets.

- Tax & Estate Planning: We guide you through depreciation tactics, 1031 exchanges, and wealth transfer strategies to help protect your legacy.

- Holistic Retirement Planning: Real estate isn’t a siloed asset—it’s part of your bigger retirement picture. We help you build a resilient plan with real estate as a core income engine.

Final Thoughts

From Connecticut’s steady suburbs to Colorado’s booming cities, real estate remains a powerful tool for retirement income, even in turbulent times. But the key to success is adaptability and risk management.

By working with Agemy Financial Strategies, you gain a partner who understands both the potential and the pitfalls of real estate investing—and knows how to navigate them with your retirement goals in mind.

Frequently Asked Questions (FAQs)

1. How can I help protect my real estate investments during a recession?

Focus on diversification, maintain cash reserves, and prioritize properties with steady demand. Consulting a fiduciary may help with building a more resilient portfolio strategy.

2. Is now a good time to buy real estate in Connecticut or Colorado?

Both markets offer opportunities, but timing depends on interest rates, local trends, and your financial goals. A fiduciary advisor can help you evaluate current conditions.

3. How can I boost income from underperforming properties?

Consider rent increases, short-term rentals, tax strategies, or upgrading property features to attract higher-paying tenants.

4. Should I invest in REITs instead of physical property during uncertain times?

REITs offer liquidity and built-in diversification, making them attractive for retirees seeking lower-risk exposure.

5. What’s the role of estate planning in protecting real estate assets?

Estate planning can help ensure your real estate transfers smoothly to heirs, reduce tax burdens, and align with your legacy goals. Agemy Financial Strategies can help create a comprehensive estate strategy.

Disclaimer: This content is for informational and educational purposes only and should not be construed as financial, legal, or tax advice. Investment strategies, including real estate, involve risk and may not be suitable for everyone. For a full understanding of any investment strategy’s risks and potential rewards, we encourage you to schedule a complimentary consultation with one of our fiduciary advisors.

Cons of REITs

Cons of REITs

Cons of Direct Property Ownership

Cons of Direct Property Ownership

Cash Flow in Real Estate

Cash Flow in Real Estate

1. Real Estate Investments

1. Real Estate Investments

Having a Tax-Efficient Strategy

Having a Tax-Efficient Strategy

Lower Borrowing Costs

Lower Borrowing Costs

Alternative Real Estate Investment Strategies

Alternative Real Estate Investment Strategies