Latest News

Everything thats going on at Enfold is collected here

Hey there! We are Enfold and we make really beautiful and amazing stuff.

This can be used to describe what you do, how you do it, & who you do it for.

Knowledge is Power this Financial Literacy Month

NewsUnderstanding how to manage money effectively is fundamental on your road to retirement.

Retirement should be a time of joy spent with loved ones and enjoying the fruits of one’s labor. However, retirees and soon-to-be retirees often feel vulnerable amidst rising inflation and unpredictable markets. Yet, with careful planning, you can protect your retirement from market turbulence and financial worries.

To empower you to retire with peace of mind, we’ve gathered retirement planning strategies for new retirees and those looking to fine-tune their plans. These insights will help you approach retirement with optimism. Here’s what you need to know.

When it comes to retirement planning, defining your goals is a crucial first step. Retirement can mean different things to different people, so it’s necessary to think about what you want your retirement to look like.

For some, retirement may involve traveling to new destinations, exploring hobbies and interests, or spending quality time with loved ones. Others may opt to continue working in some capacity during their retirement, while others may have different plans altogether. Whatever your aspirations, clearly understanding your retirement goals is essential.

Once you’ve identified your retirement objectives, you can start crafting a plan to achieve them. This plan should take into consideration various factors, including:

Planning for retirement is an essential component of financial literacy. When you define your retirement objectives and chart a course of action, you make significant strides toward accomplishing a successful retirement.

Enhance Your Investment Approach

The primary objective of investing is to achieve high returns, but with higher returns comes a higher level of risk. In order to help optimize your returns and minimize potential risks, it’s crucial to diversify your investment portfolio. Your investment strategy should be determined by several factors, such as:

The goal of investing is when the value of your investments goes up, you can earn money on them. For example, a stock’s price won’t stay the same forever—ideally, the company grows and makes money, and it becomes more valuable overall. Historically, investments in assets like stocks, bonds, and real estate offer higher average returns than traditional savings accounts. While financial markets offer no certainties, investing opens doors to accelerated wealth accumulation, outpacing the growth achievable through saving alone.

By carefully considering these variables, you can determine the best investment strategy for your retirement savings. It’s important to remember that investments are not one-size-fits-all, and what may work for one person may not work for another. Take the time to research different investment options, and if needed, seek advice from a fiduciary advisor to help ensure your investment decisions align with your retirement goals.

Have an Emergency Savings Fund

Life emergencies happen—and for some, they happen a lot. Large or small, these unplanned expenses often feel like they hit at the worst times. An Emergency Fund acts as a safety net, helping to provide the financial resources you need to navigate unforeseen circumstances – without jeopardizing your long-term financial goals or your hard-earned nest egg.

Adequate cash reserves allow you to make decisions without solely relying on fixed-income sources. You can maintain flexibility in your financial choices, whether pursuing a new opportunity, supporting a loved one, or embarking on a passion project. Cash savings help ensure you won’t have to dip into or liquidate your investments, allowing your retirement portfolio to weather economic uncertainty.

By setting up a dedicated emergency fund, you can help protect yourself from chipping into your savings so you can recover quicker and get back on track towards reaching your larger savings goals.

Most professionals believe you should have enough money in your emergency fund to cover at least 3 to 6 months’ worth of living expenses. But it’s not unwise to save more during times of uncertainty. Building up your emergency fund can help prepare you and set your mind at ease if the unexpected should occur.

Plan for Long-Term Care

If you’ve not planned correctly, perhaps one of the biggest financial setbacks to retirees is long-term care. In 2024, without insurance, monthly long-term care costs might include:

Medicare does not pay for most long-term care expenses because it is primarily designed to cover acute care services for short-term illnesses and injuries. Many individuals opt for private long-term care insurance, Medicaid, or a combination of both to cover the cost of long-term care.

With the likelihood of needing long-term care increasing with age, it’s crucial to consider this aspect in your overall retirement plan. By taking a comprehensive approach to planning for healthcare costs, you can help ensure you have the necessary resources to pay for the level of care you may require.

Track Your Progress & Stay Informed

Monitoring your progress offers valuable learning opportunities. Regularly checking your retirement savings helps you spot potential issues early, like unexpected expenses or market changes. This allows you to take proactive steps, like adjusting your savings rate or rebalancing your investments. Monitoring your progress also helps ensure you’re moving closer to your retirement goals. Aim to review your retirement savings at least once a year and more frequently if your financial situation or investment strategy changes significantly.

Here are some tips to stay accountable during Financial Literacy Month:

Consider Working With a Fiduciary Advisor

Financial literacy is key to making smart financial choices, and a fiduciary advisor can be a valuable ally in helping you confidently navigate a complex financial landscape. If you’re unsure about your path to retirement, teaming up with a fiduciary advisor could provide much-needed support.

A fiduciary advisor is a professional who prioritizes their clients’ interests above all else. They can assist you in crafting a tailored retirement plan and staying focused on achieving your financial goals.

At Agemy Financial Strategies, our fiduciaries are dedicated to empowering our clients with knowledge across various financial domains. Our purpose is to educate retirees – whether that be planning for retirement, legacy planning, wealth management, or just holding your hand when it’s time to leap into retirement. We are celebrating 30 years in business, and we remain steadfast in our dedication to serving and educating retirees.

If you’re interested in learning more about our offerings, see here.

Final Thoughts

Whether you’re nearing the start of your retirement journey or newly retired, this process demands thorough preparation. While it can be stressful to see headlines about threats to the value of your nest egg, a volatile market does not necessarily mean danger for your retirement plans.

At Agemy Financial Strategies, we firmly believe in fostering financial stability and empowerment, particularly in the golden years of retirement. Our retirement income planning services are just one of our many resources designed to help you take control of your financial journey. This Financial Literacy Month, take charge of your retirement journey, overcome challenges, and pave the way for a secure and prosperous future with our team by your side.

Contact us today to schedule your complimentary retirement strategy session.

Connecticut vs. Colorado: Finding Your Ideal Retirement Destination

NewsMany Americans approaching retirement seek out a new location to spend their golden years, searching for a place that offers comfort and necessary resources. Whether you’re contemplating a move out of, into, or within Connecticut or Colorado, Agemy Financial Strategies is here to assist you.

As a financial firm based in Connecticut with offices in Colorado, we can offer you first-hand experience and knowledgeable advice on managing your retirement in these beautiful states. To start, let’s revisit some of the key pros and cons to consider.

Pro 1: Close Proximity to Major Cities

Nestled in the heart of New England, Connecticut exudes a classic charm that attracts retirees seeking a tranquil yet culturally rich environment. Connecticut’s location in the northeastern United States provides easy access to major cities like New York City and Boston.

Retirees can enjoy cultural attractions, world-class dining, and excellent healthcare facilities without traveling far. Connecticut boasts a rich historical heritage, with charming colonial towns, historic landmarks, and renowned museums. Retirees interested in history and culture will find plenty to explore in this picturesque state.

Pro 2: Connecticut Has a Longevity Advantage

For health enthusiasts, the concept of blue zones—areas where individuals consistently live past 100 years—holds significant intrigue. While these zones often exist in distant corners of the world, their longevity secrets offer valuable insights for everyone aiming to extend their lifespans.

According to Forbes Health, a recent study has positioned Connecticut as the fourth-ranking potential Blue Zone in the United States. Blue Zones are characterized by populations that live longer and lead healthier lives overall, with a notable number of residents reaching the centenarian mark. Connecticut stands out as one of the frontrunners among U.S. states primed to evolve into future Blue Zones.

Pro 3: Crime Rates are Falling

There’s a sense of safety, which is comforting to anyone. Connecticut is well known for its great, small community atmosphere. Many residents boast their small town feels more like a family. Connecticut witnessed a significant improvement in its crime rates between 2021 and 2022, as reported in the state’s annual crime report.

The report reveals a 13% decrease in violent crime, dropping from 6,272 offenses to 5,464. This decline marks the lowest violent crime rate per 100,000 residents the state has seen in the past decade. Additionally, property crime offenses also saw a decrease of 3% compared to the previous report.

Cons of Living in Connecticut

Con 1: High Cost of Living

Connecticut ranks among the states with the highest living expenses in the United States, especially regarding housing and taxes. Its cost of living consistently exceeds the national average, with studies indicating it could be anywhere from 17% to 25% higher than the rest of the country.

For retirees, this means their retirement savings may not go as far in Connecticut’s costly environment. Housing costs in Connecticut are generally higher than the national median. According to Zillow, the average home value in Connecticut is estimated to be around $384,244 as of February 2024, a 1-year Value Change of +11.1%

Con 2: High Taxes

Connecticut imposes a range of taxes that can significantly impact residents’ finances. The state’s income tax rates vary from 3% to 6.99%, with a corresponding 7.50% corporate income tax rate. In addition, the state sales tax rate stands at 6.35%, aligning closely with the national average.

Moreover, Connecticut’s property taxes further add to the financial burden, fluctuating based on the property’s assessed value and local tax rates. Compared to other states, Connecticut’s tax system ranks unfavorably, placing 47th overall on the 2024 State Business Tax Climate Index.

Con 3: Limited Outdoor Recreation

Connecticut experiences long, harsh winters characterized by cold temperatures and substantial snowfall, which may be challenging for those who prefer milder climates. While the state has beautiful natural scenery, it may offer fewer outdoor recreational opportunities than states like Colorado. Retirees who relish hiking, skiing, and fishing might yearn for a wider array of options.

Pro 1: Spectacular Scenery

Colorado presents an enticing option for retirees seeking an active lifestyle amidst breathtaking natural landscapes. It is known for its breathtaking natural beauty, sparkling lakes, and picturesque forests.

Colorful Colorado offers retirees abundant outdoor recreational activities, from skiing and snowboarding in the Rocky Mountains to hiking, biking, and fishing in the numerous state parks. Here are just some of the many places you can easily visit when retiring in Colorado:

Pro 2: Low Taxes

Colorado has relatively low taxes compared to many other states, making it an attractive option for retirees looking to stretch their retirement savings. The state income tax range is a low, flat rate of 4.4%, and you get a fair deduction on retirement income. Sales tax may run higher in the state, but it doesn’t apply to groceries or medication. Another great reason to retire in Colorado is that there’s no estate tax. You can leave money to your family without paying those hefty fees, which can be a huge perk.

Pro 3: Retirement Communities are an Abundance

Retirement communities offer an excellent opportunity to connect with like-minded individuals, fostering social interactions and shared interests. Colorado boasts over 240 retirement communities spread across the state, providing ample options for retirees seeking vibrant social environments. Allowing you to have the best of everything with neighbors your age and loads of activities to keep you as social and busy as you want to be.

Cons of Living in Colorado

Con 1: High Cost of Living

Living expenses in Colorado tend to surpass the national average. This holds true for assisted living costs as well. On average, monthly care expenses for assisted living in Colorado range from $3,800 to $6,200, exceeding the national average. In Denver, specifically, the average monthly cost stands around $5,000.

Even in rural and suburban areas, living expenses can be slightly higher than average. In mountain towns like Aspen, however, costs can soar much higher than the national average. Therefore, if you’re working with a tight budget, it’s crucial to thoroughly assess the cost of living in different Colorado cities before making any decisions.

Con 2: Cost of Healthcare

If you’re considering retiring in Colorado, factoring in the cost of care is crucial. Colorado experienced the second-highest increase in private health insurance premiums this year, trailing only Georgia, according to a recent report. The average monthly cost for a 40-year-old with a mid-range silver plan surged by 19.6% in Colorado, rising from $409 to $489 between 2022 and 2023. Nationally, the average premium increase stands at approximately 4%, with an average monthly cost of $560. However, when considering all age groups and coverage types, Colorado’s average rate hike is closer to 10.4%.

Con 3: Traffic Jams

Due to the popularity of Colorado, some residents have been irked by the overcrowding, and in very populated areas, traffic congestion is also a problem. These are somehow inevitable consequences of a popular place. As more and more people move to live there, the population increases and overcrowding continues. For retirees wishing to live in Colorado, the overcrowding can be a problem if you were hoping to move into a quiet and calm environment.

Comparing the Two States

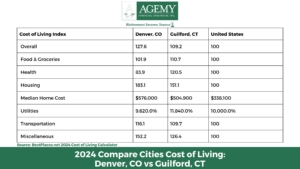

When weighing the options between Guilford, CT and Denver, CO, it’s important to consider several key factors. While Guilford generally offers a lower overall cost of living and provides more affordable housing options compared to Denver, the healthcare expenses in Guilford are notably higher. Therefore, the decision between these two cities may hinge on individual priorities and budgetary considerations. Here’s what we know about comparing Guilford, CT and Denver, CO:

Making Your Decision

Ultimately, the decision between Connecticut and Colorado comes down to your personal preferences, priorities, and lifestyle goals. Working alongside a trusted fiduciary advisor can help your transition to retirement. At Agemy Financial Strategies, our Connecticut and Colorado-based fiduciaries can provide valuable assistance in developing a retirement income plan that encompasses crucial financial factors, such as:

Our fiduciary advisors are committed to working closely with you to maximize your retirement years. We understand that retirement planning looks different for each individual, and with that in mind, we carefully craft your plan to meet your specific needs. For a complete list of our service offerings, see here.

Contact us today for more information on our retirement and financial planning services.

Tax Day: What You Need for Tuesday’s Deadline

NewsTax Day is Tuesday, April 18th, and filing last-minute (in the correct manner) is critical. Are you ready?

Having a solid tax plan can help retirees maximize their retirement income and avoid unexpected tax liabilities. But many Americans push this important-yet-unpopular task to the wayside, only to bring panic as tax day on April 18th creeps up. According to the Internal Revenue Service, 20-25% of all Americans wait until the last two weeks before the deadline to prepare their tax returns. At that late date, there are only two things you can do: File your taxes pronto, or request a tax extension.

Regardless of whether you’re a recent retiree or are approaching retirement, our goal is to equip you with the tools necessary to make informed decisions about your taxes. Here are some key considerations to keep in mind as you prepare to file your taxes for 2022.

Organization is key

Having everything in one place—even if it’s just a shoebox—will help make preparation of your income tax return easier. Some of the documents that might be required to complete the process include:

Avoid Common Mistakes

Retirees should be particularly careful when filing their tax returns as common mistakes can delay the processing of the return or the refund they are owed. One of the most significant errors is missing tax forms. This includes forms such as 1099’s, which may occur if you receive investment income.

Although it’s easy to overlook such forms, the IRS receives copies of them and will expect that information to be included on your return. Other common mistakes include the following:

It’s crucial to double-check all information before submitting your tax return. Double-check all information before submitting your tax return, and consider filing electronically to streamline the process. Taking these steps can help ensure a smooth and stress-free tax filing experience.

You Can Get an Extension to File— But Not to Pay

For retirees who are unable to file their tax returns by the April 18 deadline, the IRS allows them to request a six-month extension. This extension can be helpful in situations where a taxpayer is missing a tax form or needs additional time to prepare their return. Taxpayers can request an extension for free via IRS Free File, regardless of their income.

It’s essential to note that while an extension will give retirees additional time to file their returns, it doesn’t extend the deadline to pay their federal taxes. The tax bill has to be paid by the April 18 deadline. In cases where a taxpayer is missing a tax form, they can estimate their tax bill by using tax software and inputting estimates for any missing forms.

It’s also worth noting that requesting a federal extension doesn’t automatically extend the deadline for state tax returns. Those who need additional time to file their state tax returns must request a separate extension.

There is no penalty for filing an extension. However, not paying on time or enough, or failing to file altogether, may cost you.

After you file the extension, you’ll have until October 15 to gather your documents and finish your filing. When you complete your return, you should include the amount you’ve already paid in the payments section of your Form 1040.

Know Which Health Coverage Form You Need

Three versions of Form 1095 exist: A, B and C. Form 1095-A will be sent to you if you get your health insurance through the Health Insurance Marketplace. You will need information from this form to file your tax return, but don’t include the form with your return. You will receive Form 1095-B if you are covered by minimum essential coverage, and if you are covered by a plan sponsored by an applicable large employer (ALE), you will get 1095-C. You don’t need to wait for 1095-B or 1095-C to file your return.

About filing your tax return

If you have income below the standard deduction threshold for 2022, which is $12,950 for single filers and $25,900 for married couples filing jointly, you may not be required to file a return. However, you may want to file anyway. You may be able to take advantage of several features and benefits in the tax system which could reduce the amount you owe. Or in many cases, especially for people with low incomes, these features can increase the amount you could receive in a refund. There are some key factors to make sure you look out for.

Changes for 2023

For tax year 2022 some tax credits that were expanded in 2021 will return to 2019 levels. This means that affected taxpayers will likely receive a smaller refund compared with the previous tax year. The 2023 changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Credit.

Tax Planning With Agemy Financial Services

Tax planning is an important aspect of retirement planning that cannot be overlooked. Retirees who take the time to understand their tax obligations now can enjoy a more secure financial future.

While certain taxes may be deferred, others can be minimized through tax-efficient investment planning. This is why a Fiduciary Advisor can be a valuable resource for those seeking to navigate the complexities of tax planning.

At Agemy Financial Strategies, we can help you explore your options to make sure you’re not missing out on tax strategies that could help boost your retirement savings. From reassessing your investments to postponing RMDs, Agemy Financial Strategies has over 32 years of experience in tax-strategizing to maximize retirement income in your golden years.

Let’s put together your personalized plan with a complimentary strategy session. Set yours up here today.

Estate Planning: Creating a Legacy and Protecting Your Assets

NewsEstate planning may not typically rank high on your priority list, but it is crucial to create a plan for the benefit of your family’s future and your peace of mind. Continue reading below to discover how to safeguard your assets while leaving a lasting legacy.

Understanding The Importance of Estate Planning

Estate planning is a crucial aspect of retirement planning as it allows retirees to set a blueprint for the distribution of their assets after their passing. Without an estate plan in place, retirees risk leaving their loved ones without clear instructions on how to handle their estate. This can lead to confusion, disputes, and potentially costly legal battles.

By creating an estate plan, you can help ensure that your assets are distributed according to your wishes, minimizing the likelihood of family conflict. Before consulting with an Attorney or Fiduciary advisor to start your estate plan, take some time to reflect on your posthumous wishes, as well as some critical questions and scenarios, including:

Although it may be challenging to initiate, discussing your intentions with your loved ones in advance allows you to convey your wishes clearly and provides an opportunity for everyone to ask questions or express their concerns.

Creating Your Estate Plan

In addition to a will, an estate plan may involve various documents that reflect a person’s unique circumstances, such as Living Trusts or Power of Attorney. These complexities can be addressed by your Fiduciary advisor, who can assist in helping to ensure that all necessary documents are properly completed, witnessed, signed, filed, and stored in accordance with state laws.

The following items are some of the most common documents that can be included in an estate plan:

Trusts

A trust outlines precisely how and when your assets will be distributed after your demise, and it can also serve to reduce taxes, bypass probate, and identify the person responsible for caring for your minor children in the event of your passing. Often, individuals use trust in conjunction with a will. The primary distinction between a trust and a will is that a trust circumvents the probate process of transferring property from you to your beneficiaries. The following are two of the most common types of trusts:

Both types of trusts offer unique advantages and disadvantages, depending on your circumstances and estate planning goals.

Powers of Attorney

In addition to planning for the distribution of your assets, it is also essential to plan for situations where you cannot make decisions for yourself. There are several different Power of Attorney (POA) appointed tasks that you should consider, including:

Your health care power of attorney and living will are often referred to as “advance directives,” “health care directives,” or “medical directives.” These documents can be incredibly beneficial in end-of-life situations and serious medical conditions, which can understandably be emotionally challenging for your loved ones.

By including these documents in your estate plan, you can help minimize the stress and anxiety your family members will experience.

Regularly Reviewing Your Estate Plan

As life changes, so will your estate plan. It’s paramount to periodically review your estate plan to ensure that everything is current and meets your requirements. Here are some factors to consider when it’s time to update your estate plan:

Apart from reviewing your trusts and power of attorney, it’s also important to verify that the designated beneficiaries for your life insurance policies, retirement plans, and bank accounts are appropriate.

Minimize Income, Gift and Estate Taxes

Estate planning and tax planning go hand-in-hand. Estate tax planning attempts to reduce potential estate tax liability by utilizing planning techniques to reduce either the amount of property in the taxable estate, or to minimize the valuation of the property in the taxable estate. Some strategies to include:

tax liability. (Up to $17,000 per beneficiary in 2023).

How a Fiduciary Advisor Can Help

A Fiduciary advisor can be a valuable resource when it comes to planning your estate, especially for those who may have complex financial and personal circumstances to consider. A Fiduciary advisor is held to the highest ethical standard and is legally required to act in the best interest of their clients.

At Agemy Financial Strategies, our Fiduciary Advisors can help you navigate the intricacies of estate planning. This includes crafting a comprehensive plan for the distribution of assets, minimizing tax liability, and identifying the right type of trust to suit your needs. If you have more questions about our estate planning services, see here.

Working With Agemy Financial Strategies

Without an estate plan in place, your heirs could face big tax burdens and the courts could designate how your assets are divided.

When it comes to creating your estate plan, having a retirement income advisor that you trust is crucial to your planning success. At Agemy Financial Strategies, we have over 30 years of estate planning experience to guide you through the entire process.

While a proper estate plan will not enable you to avoid death, it can help eliminate, or at the very least, minimize estate taxes. Our experienced estate planning advisors will assess your assets, listen to your concerns and recommend an approach that is most likely to safeguard your estate for future generations.

If you’re ready to get started on your estate planning, set up a complimentary consultation here today.

Retire Confidently with Agemy Financial Strategies

NewsThe unpredictability of financial markets can disrupt even the best-laid retirement plans. This Financial Literacy month, let’s take some time to reflect on the importance of retirement planning with confidence amid financial turmoil.

Retirement should be about spending time with those you love, enjoying the perks of free time, and having the money you need to achieve all of your retirement goals and dreams. However, the last few years may have felt like that dream is being ripped away from you as we go through yet another rollercoaster in the financial world.

Unfortunately, retirees and those planning to retire soon are the people most threatened by high inflation and extremely rocky financial markets. Fortunately, planning ahead can go a long way toward helping you protect your retirement when market volatility and worry hits.

At Agemy Financial Strategies, we understand that retirement planning can be intimidating in 2023. To help you retire with confidence, we have compiled a series of retirement planning strategies for both newly retired individuals and those who wish to refine their current plans. This will help allow you to approach the retirement process with a brighter outlook.

Here’s what you need to know.

Define Your Retirement Goals

When it comes to retirement planning, defining your goals is a crucial first step. Retirement can mean different things to different people, so it’s necessary to think about what you want your retirement to look like.

For some, it may involve traveling to new places, pursuing hobbies and new interests, or spending time with family and friends. Some people may choose to work during their retirement years, while others may have different plans. Whatever your plans are, it’s crucial to have a clear comprehension of your goals for retirement.

Once you have a clear idea of your retirement goals, you can begin creating a plan to help you achieve them. This plan should take into account a variety of factors such as:

Planning for retirement is an essential component of financial literacy. When you define your retirement objectives and chart a course of action, you make significant strides toward accomplishing a successful retirement.

Invest Wisely

As the financial world evolves, we understand investing can be overwhelming. But it is an excellent source to help grow your money – and let it work for you in your golden years.

The primary objective of investing is to achieve high returns, but with higher returns come higher risks. In order to optimize your returns and minimize potential risks, it’s crucial to diversify your investment portfolio. Your investment strategy should be determined by several factors, such as:

By carefully considering these variables, you can determine the best investment strategy for your retirement savings. It’s important to remember that investments are not one-size-fits-all, and what may work for one person may not work for another.

Around 60% of households in the U.S. own securities in investments on accounts such as IRAs, and employer-sponsored retirement plans. However, this percentage drops to a little over 30% when considering only taxable investments.

It’s essential to take the time to research different investment options and consult with a Fiduciary Advisor if necessary to make informed investment decisions that align with your retirement goals.

Monitor Your Progress

Monitoring your retirement savings progress enables you to make necessary adjustments to your investment strategy, ensuring that you’re on track to achieve your retirement goals. You should check your retirement savings at least once a year, and more frequently if you have made significant changes to your financial situation or investment strategy.

Regularly monitoring your retirement savings also helps you identify potential issues early on, such as unexpected expenses or market volatility. If you are aware of these issues, you can take proactive measures to tackle them, such as modifying your savings rate or rebalancing your portfolio.

Additionally, keeping tabs on your retirement savings progress can motivate you to stay on track and increase your savings rate if needed.

Factor in Emergencies

Life emergencies happen. And they happen a lot. We’re not just talking about your car breaking down. A fender bender, an unexpected medical bill, a broken appliance, a loss of income, or even a damaged cell phone. Large or small, these unplanned expenses often feel like they hit at the worst times. By setting up a dedicated emergency fund, you can help protect yourself from chipping into your savings so you’re able to recover quicker and get back on track towards reaching your larger savings goals.

Most experts believe you should have enough money in your emergency fund to cover at least 3 to 6 months’ worth of living expenses. But it’s not unwise to save more during times of uncertainty. Building up your emergency fund can help prepare you and set your mind at ease if the unexpected should occur.

Plan for Long-Term Care

If you’ve not planned correctly, perhaps one of the biggest financial setbacks to retirees is long-term care. 70% of us will need long-term care, and it’s not cheap. An average room in an assisted living facility in 2023 will set you back around $5000 per month.

In 2023 without insurance, monthly long-term care costs could see you paying:

Medicare does not pay for most long-term care expenses because it is primarily designed to cover acute care services for short-term illnesses and injuries. To cover the cost of long-term care, many individuals opt for private long-term care insurance, Medicaid, or a combination of both.

With the likelihood of needing long-term care increasing with age, it’s crucial to consider this aspect in your overall retirement plan. By taking a comprehensive approach to planning for healthcare costs, you can help ensure you have the resources necessary to pay for the level of care you may require in the future.

Consider Working with a Fiduciary Advisor

If you are worried about your road to retirement, working with a Fiduciary Advisor can provide invaluable guidance and expertise in retirement planning. A Fiduciary Advisor can help you develop a personalized retirement plan, optimize your investment strategy, and stay on track to achieve your goals.

At Agemy Financial Strategies we are committed to educating our clients on a range of financial matters, including retirement planning, legacy planning, wealth management, and even providing support during the transition to retirement. With over 30 years of experience in helping individuals reach retirement in a stress-free manner, our unwavering dedication to educating and serving our clients remains at the core of our mission.

If you’re interested in learning more about our offerings, see here.

Final Thoughts

While it can be stressful to see headlines about threats to the value of your nest egg, a volatile market does not necessarily mean danger for your retirement plans.

At Agemy Financial Strategies, we believe that everyone deserves financial stability and freedom, especially during retirement. We’re passionate about helping our clients achieve their retirement goals, and our commitment to providing resources and guidance is a testament to that.

Our financial guide to retirement planning is just one of the many tools we offer to help you take control of your finances and plan for the future. Don’t wait any longer to start planning for your retirement.

Contact us today to learn more about how we can help you achieve financial security and peace of mind.

Tax Secrets the IRS Won’t Tell You… But We Will

NewsTaxes – they’re a fact of life. Whether you love them or loathe them, they’re essential to living in a modern society. But navigating the murky waters of tax laws and regulations can often feel like deciphering a cryptic code. Read on to discover strategies to help mitigate the effects of taxes on your nest egg this filing season.

In the fiscal year of 2023, the IRS processed more than 160 million federal individual tax returns and supplemental documents. However, despite the abundance of information the IRS provides on how to file your taxes correctly, certain lesser-known secrets could save you money or protect you from trouble. In this blog, we’ll shed light on some of these tax secrets that the IRS might not readily disclose.

The IRS is strict about Americans paying their taxes on time. If you’re even a day late with a payment, you can expect penalties and possibly fines added to what you owe. This applies even if you disagree with the amounts on your tax return. For example, if you finish your tax return but don’t understand why some deductions were denied, you still have to pay the amount listed as owed.

If you complete your tax return but find certain deductions disallowed, you’re still obligated to remit the amount stated as owed on your return. Afterward, you can consult with the IRS to contest the disallowed deductions, and they may even issue a refund if deemed appropriate. However, if you don’t file your return by the due date, you’ll get hit with a penalty of 5% for every month it’s late, up to 25%. The bottom line? You must file your tax return on time, even if you don’t agree with the outcome.

2. You May Have To Find Deductions and Credits on Your Own

Understanding the nuances between tax credits and tax deductions is essential for maximizing your tax savings. Tax deductions lower your taxable income by subtracting eligible expenses or contributions from your total income. The IRS provides the standard deduction amount on your tax form:

Tax credits can result in substantial savings, as they directly reduce your tax liability rather than just lowering your taxable income. Various credits are available, such as the retirement saver’s credit, mortgage insurance premiums, and the earned income tax credit, which you could be eligible for.

Understanding the distinctions between tax credits and deductions can help you spot opportunities to leverage these tax benefits and retain more of your money. Consulting with a financial advisor can provide valuable guidance if you’re unsure about optimizing your credits and deductions.

3. Utilize Tax-Advantaged Retirement Accounts

Utilizing tax-advantaged accounts is a smart strategy for minimizing your tax burden while saving for future expenses. One key aspect of retirement planning is understanding the contribution limits for retirement accounts such as 401(k)s and IRAs. These limits determine how much you can contribute to these accounts each year, helping you build a robust nest egg for retirement.

Let’s take a look at the expected contribution limits for 2024:

It’s essential to consult with a financial advisor or check the latest IRS guidelines to confirm these limits for 2024 and adjust your retirement savings strategy accordingly.

5. Explore Other Savings Options

While traditional IRAs and 401(k)s are well-known options, several other tax-advantaged accounts are worth considering. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are particularly beneficial for managing medical expenses. With an HSA, you can contribute pre-tax dollars to cover qualified medical expenses, such as doctor visits, prescriptions, and over-the-counter items. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free, making it a triple tax-advantaged account.

Similarly, FSAs allow you to set aside pre-tax dollars to cover eligible medical expenses, offering immediate tax savings on qualified healthcare costs. Exploring these tax-advantaged account options can lead to significant tax savings while helping you achieve your financial goals, whether saving for retirement or managing healthcare costs. Strategically utilizing these accounts can help you maximize your tax efficiency and keep more of your hard-earned money in your pocket.

Understanding tax strategies and managing your tax bill should be part of any sound financial approach. Some taxes can be deferred, and others can be managed through tax-efficient investing. With careful and consistent preparation, a financial advisor can help you manage the impact of taxes on your financial efforts.

This is where working with a fiduciary advisor can prove immensely beneficial. Fiduciary advisors offer personalized financial strategies to help manage the impact of taxes on your financial efforts. What’s more, as a fiduciary and Registered Investment Advisor, you can be confident Agemy advisors will recommend only what is in your best interest.

From tax planning and legacy planning to wealth management and estate planning, we provide the guidance and support needed to navigate every stage of your financial journey, including the transition into retirement. With years of experience and a personalized approach, you can confidently chart a course toward a secure and prosperous future.

Final Thoughts

While the IRS provides plenty of guidance on fulfilling your tax obligations, there are still many secrets and strategies that can help you save money and avoid trouble. By understanding the ins-and-outs of the tax code and leveraging lesser-known techniques, you can help make the most of your tax filing.

At Agemy Financial Strategies, we are committed to educating our clients on various financial matters. With over 30 years of experience in helping individuals reach retirement stress-free, our unwavering dedication to serving our clients remains at the core of our mission.

Contact us today to learn how we can help you this tax season and beyond.