Happy September and National Preparedness Month – a great reminder of the importance of preparing for unexpected events. Whether you face financial challenges from a global pandemic or a volatile economy, it’s essential to have a plan in place. Here’s what you need to know.

This year, millions of households are coping with serious financial challenges related to the economic impact of the pandemic, while the threat of natural disasters is ever-present.

While the Covid-19 pandemic has increased Americans’ awareness of the need to have a will, living trust or other similar end-of-life document prepared, only about 33% of Americans have put these plans in place. That means that 67% are leaving what happens to them and their assets in case of disability or death up to others, including the state.

Even more worrying, over half (53%) of Americans report not having emergency savings should a disaster strike.

The Importance of an Emergency Fund

An Emergency Fund acts as a safety net, helping to provide the financial resources you need to navigate unforeseen circumstances – without jeopardizing your long-term financial goals or your hard-earned nest egg.

Whether it’s an unexpected evacuation due to a natural disaster or unexpected medical expenses, having funds set aside can alleviate stress and protect your assets, allowing you to focus on what truly matters—your safety and well-being.

How to Invest Your Emergency Fund for Liquidity

Having money saved for emergencies is a great first step. But if you want this emergency money to grow by investing it, it’s important to know you can still get to it quickly when you need it.

A liquid asset is something you own that can be quickly and easily turned into cash without losing much value. This means you can get your money fast when you need it. Examples include money in a regular savings account, money market accounts, and stocks that can be sold quickly.

Due to its volatility, avoiding investing your emergency fund in stocks is wise. This is because if you need to sell your stocks to use the money for an emergency expense, you may be forced to sell at a loss. Bonds are generally less volatile than stocks but may take time to sell.

If you want to try to earn returns, which can help prevent losses due to inflation, you can consider other investment choices like a money market account, high-yield savings account, or CD. For more guidance on investing your funds according to your personal situation and goals, speaking with an experienced financial advisor can help take the guesswork out of your investment journey.

Create Your Financial First Aid Kit

The Emergency Financial First Aid Kit is a crucial tool to help you make financial preparations. It offers guidance on minimizing the financial repercussions of disasters for you and your family.

Besides growing your cash through liquid assets, there are day-to-day steps you can make to help strengthen your feeling of being financially prepared:

- Prepare for the risks where you live. Personal financial planning helps families prepare for disasters, both big and small.

- Check your insurance coverage. Having insurance for your apartment, home, or business property is the best way to be sure you will have the necessary financial resources to help you repair, rebuild, or replace whatever is damaged. Furthermore, other insurance plans like Long-term Care is designed to bridge the gap and cover costs that health insurance won’t.

- Review your current retirement plan. Life can throw unexpected surprises; when they do, your retirement plan could need adjusting to adapt to these changes. Consult with your trusted financial advisor if and when life events change to see if your current strategy needs tweaking.

Establish a Clear Estate Plan

Financial preparedness extends beyond emergencies. Estate planning can help safeguard your wishes and assets.

Having a robust plan takes center stage when it comes to preparedness. An estate plan can be a lifesaver in a time of crisis. It outlines your wishes regarding the distribution of your assets and leaves instructions for situations when you become incapacitated. Your estate plan should contain a power of attorney, granting a trusted individual the authority to decide on your behalf if you cannot.

This document also empowers you to manage your finances, pay bills, and ensure the seamless continuation of essential affairs. Additionally, a healthcare proxy or medical power of attorney is equally important. This person is authorized to make medical decisions if you’re incapacitated. By appointing this person, you allow yourself to safeguard your well-being according to your wishes.

When harmoniously integrated into your broader financial strategy, these components of your estate plan can provide an extra layer of financial preparedness. By outlining your preferences and empowering trusted individuals to act on your behalf, you can help ensure that your affairs align with your wishes, even in challenging circumstances.

Regularly Review Your Plan

Creating a comprehensive preparedness plan is not a one-time task but an ongoing responsibility requiring regular attention and adjustments. As circumstances in life evolve, so should your strategy.

Life often throws you unexpected curveballs; as such, it’s essential to adjust when these changes happen. Shifts in family dynamics, such as a divorce or a death, can impact your financial standing. When these events occur, adjustments should be made to your estate and retirement plans.

Annual reviews provide an opportunity to evaluate your progress, reassess your financial situation, and make any necessary adjustments to your plan. Partnering with an experienced and trusted financial advisor can help enhance the efficacy of your emergency preparedness efforts.

Work With Agemy Financial Strategies

At Agemy Financial Strategies, our trusted advisors can help you prepare for all stages of life, even in unexpected emergencies. Our team of Fiduciaries is here to assist you every step of the way, helping to make your retirement years filled with joy and fulfillment.

We hope you feel financially inspired this National Preparedness Month. As always, contact us with any questions regarding your retirement outlook and financial future. We look forward to helping you prepare for whatever life may bring.

The Importance of Healthcare in Retirement

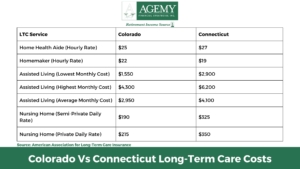

The Importance of Healthcare in Retirement Below is a comparison of long-term care costs between

Below is a comparison of long-term care costs between

3. Plan for Healthcare Costs

3. Plan for Healthcare Costs

Strategies for Tax-Smart Investing

Strategies for Tax-Smart Investing