Latest News

Everything thats going on at Enfold is collected here

Hey there! We are Enfold and we make really beautiful and amazing stuff.

This can be used to describe what you do, how you do it, & who you do it for.

2025 Adjustments for Estate, Gift, and GST Tax Exemptions

Estate Planning, News, Tax PlanningTax laws are shifting, and for individuals committed to preserving their wealth, staying ahead of these changes is more important than ever.

With new adjustments to estate, gift, and generation-skipping transfer (GST) tax exemptions on the horizon, your decisions could have a lasting impact on your financial legacy. For high-net-worth individuals (HNWIs), understanding these updates isn’t just beneficial—it provides a decisive strategic advantage.

In this blog, we’ll break down the key changes and explore how Agemy Financial Strategies can assist you in navigating the complexities of these taxes, turning challenges into opportunities to help secure your future.

The federal government employs estate, gift, and generation-skipping transfer (GST) taxes to help ensure wealth transfers are subject to taxation. In turn, this limits the accumulation of untaxed wealth across individuals and generations. Understanding how these taxes operate and interact is essential for crafting a comprehensive wealth preservation strategy. Let’s explore each tax in detail:

1. Estate Tax

The estate tax is a levy imposed on the total value of an individual’s estate that exceeds the federal exemption threshold at the time of their death. This tax applies to assets such as real estate, investments, cash, and other valuables included in the estate. The federal estate tax doesn’t apply unless you hit a certain exemption amount.

Proper estate planning can help mitigate this tax burden, allowing more wealth to be passed on to your heirs.

2. Gift Tax

The gift tax applies to transferring money or assets during your lifetime that exceeds the annual or lifetime exemption limits. The annual gift tax exclusion sets the amount you can give each recipient without impacting your lifetime exemption. The IRS has announced an increase in the annual gift tax exclusion for 2025:

Maximizing annual gift exclusions helps reduce your taxable estate while providing financial support to loved ones. However, exceeding these limits without careful planning can lead to unnecessary tax liabilities. Working alongside a fiduciary can help you integrate gifting strategies into your broader estate plan.

3. Generation-Skipping Transfer (GST) Tax

The Generation-Skipping Transfer (GST) tax is designed to prevent individuals from avoiding taxation by skipping over a generation and transferring wealth directly to beneficiaries who are at least two generations younger. It is an additional tax on top of the federal gift or estate tax. For the tax year 2025, the GST tax exemption amount is set at $13.99 million per individual.

Transfers to these younger-generation beneficiaries are only tax-free up to the GST tax exemption limit. Any amount exceeding this exemption is subject to the GST tax, which, like the estate tax, has a top rate of 40%. This tax most commonly affects:

A fiduciary can help you by providing tailored advice for your estate plan accounts. With proactive planning and guidance, you can better protect your financial legacy and help ensure it benefits your family for years.

Why Understanding These Taxes Matters

Proper planning for estate, gift, and GST taxes is essential to help protect your financial legacy. Failing to account for these taxes can result in significant financial losses for your heirs and complicate wealth transfer strategies. For example:

Working with a fiduciary can help you have the guidance needed to navigate the nuances of these taxes. A trusted fiduciary can help you maximize available exemptions and create a plan to help preserve your wealth for future generations.

Key Changes to Tax Exemptions for 2025

The Tax Cuts and Jobs Act (TCJA) of 2017 significantly increased the exemptions for estate, gift, and GST tax. However, these enhancements are set to sunset at the end of 2025, potentially altering how wealth can be transferred tax-efficiently. Here’s what to expect:

Post-2025 Adjustments

If you have a large estate, taking advantage of the higher exemptions in 2025 can help reduce your tax liabilities and preserve wealth for future generations. Early planning is essential to avoid the financial burden of potential reductions.

In addition to federal estate taxes, many states impose their own estate or inheritance taxes, often with lower exemption thresholds. For residents of states like Connecticut, where state-level estate taxes can be significant, careful planning is crucial to help avoid unexpected tax liabilities.

The current Connecticut estate tax exemption is $13.61, and the flat tax rate is 12%. Any taxable gifts or estates exceeding this exemption amount will be subject to a 12% tax. Thus, it is vital for Connecticut residents to integrate state tax considerations into their overall estate planning strategy.

The absence of a state estate tax offers a significant advantage for Colorado residents. Without an additional layer of taxation, residents can pass on their wealth to loved ones without incurring state-level estate taxes. This benefit particularly appeals to retirees seeking to preserve their legacy and help maximize the financial resources available to their families.

With dedicated offices in Connecticut and Colorado, Agemy Financial Strategies has extensive experience helping residents navigate these state-specific tax laws. Whether navigating Connecticut’s estate tax thresholds or taking advantage of Colorado’s tax benefits, our team helps protect your financial legacy for future generations.

How Agemy Financial Strategies Can Help

The upcoming changes to estate, gift, and GST tax exemptions present a valuable opportunity to help optimize your financial legacy and minimize future tax burdens for your heirs. However, navigating these complex tax structures requires skilled guidance and thoughtful planning. At Agemy Financial Strategies, we help simplify financial complexities, equipping you with the tools and knowledge to make confident, informed decisions about your wealth. Here’s how we can help:

Preparing for the Future: Start Today

The adjustments to estate, gift, and generation-skipping tax exemptions represent a pivotal moment for estate planning. With potential tax savings at stake, proactive planning in 2025 and beyond is more important than ever.

Whether you’re seeking to preserve wealth for future generations or minimize tax liabilities, the key is working with a knowledgeable advisor who understands your needs. Agemy Financial Strategies is here to assist you in navigating these changes and helping secure your financial legacy.

Contact us today to learn how we can help you make the most of this critical tax planning period.

Frequently Asked Questions (FAQs)

How will these exemptions change in 2026?

Unless new legislation is passed, the exemptions will revert to $5 million per individual (indexed for inflation) on January 1, 2026, which is expected to be approximately $7 million per individual.

What Happens If You Exceed the Annual Limit?

Gifts exceeding the annual exclusion are deducted from your lifetime gift and estate tax exemption. If your total lifetime gifts surpass the federal exemption threshold, the remaining amount may be subject to federal gift taxes, which are taxed at a maximum rate of 40%.

How can I take advantage of the current exemptions?

The higher exemptions in 2025 can be used to make large lifetime gifts, establish trusts, or utilize other tax-efficient wealth transfer strategies. Consulting a fiduciary advisor can help ensure your plan is effective and compliant.

What is a Spousal Lifetime Access Trust (SLAT)?

A SLAT is an irrevocable trust that allows one spouse to gift assets to the other while retaining indirect access to the assets. It is a popular tool for utilizing the higher gift exemptions before they are reduced.

How do state-level estate taxes affect my plan?

Some states impose their own estate or inheritance taxes, with exemption thresholds often lower than federal limits. A comprehensive estate plan should account for both federal and state tax implications.

How does Agemy Financial Strategies help with these taxes?

Agemy Financial Strategies provides personalized estate planning services, including wealth analysis, trust creation, and tax-efficient gifting strategies. We help clients navigate complex tax laws and align their plans with long-term goals.

How do I get started with estate planning?

Start by scheduling a consultation with Agemy Financial Strategies. We’ll help you by reviewing your financial situation, discussing your goals, and designing a tailored estate plan to meet your needs. Visit us today to get started.

Disclaimer: The information provided in this blog is for educational purposes only and should not be considered specific investment, tax, legal, or financial advice. Agemy Financial Strategies does not guarantee results, and past performance does not indicate future results. Tax laws are subject to change, and any strategies discussed should be reviewed in the context of current legislation and individual circumstances.

Is Crypto Right for Your Retirement Portfolio?

Cryptocurrency Investing, NewsAs Bitcoin and other cryptocurrencies continue to gain mainstream attention, more Americans are considering the role of digital assets in their retirement portfolios.

The volatile nature of cryptocurrencies, combined with their potential for substantial gains, has piqued the interest of investors seeking alternative ways to secure their financial future. In this blog, we’ll explore the intersection of Bitcoin and retirement and discuss how a financial advisor can be a valuable resource in helping you make informed decisions. Here’s what you should know.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that relies on cryptography for security. During the first half of 2023, Bitcoin (BTC) and various other cryptocurrencies have rebounded following significant losses experienced in 2022. Nevertheless, the prolonged “crypto winter” (which some experts say is now over) has revealed vulnerabilities within the digital currency landscape, such as excessive risk-taking, the promotion of illegal securities, and even fraudulent activities.

Unlike traditional currencies issued and regulated by governments*, cryptocurrencies operate on blockchain decentralized technology. This technology helps provide transparency and immutability of transactions. (*The sale of cryptocurrency is generally only regulated if the sale (i) constitutes the sale of a security under state or federal law, or (ii) is considered money transmission under state law or conduct otherwise making the person a money services business (“MSB”) under federal law.)

One of the most well-known cryptocurrencies is Bitcoin, but thousands of others have unique features and use cases. Investors can use cryptocurrencies for various purposes, including online purchases and investment, and to transfer value across borders quickly and with lower transaction fees than traditional financial systems.

Close to 44% of U.S. adults who’ve started saving for retirement say they have invested part of their retirement savings in cryptocurrency. Nearly half of these people indicated they had invested a “big” part of their retirement funds in crypto. It’s essential to recognize that cryptocurrencies also come with volatility and regulatory considerations that users must be aware of.

Why is Crypto an Appealing Investment for Retirees

Since its inception in 2009, the pioneering cryptocurrency, Bitcoin, has exhibited extraordinary growth. Starting from virtually nothing, it surged to reach peaks exceeding $60,000 per Bitcoin in 2023, attracting the attention of both individual and institutional investors. The idea of using Bitcoin as a potential retirement asset has gained traction for several reasons:

Some investors hope to capitalize on this growth potential to boost their retirement savings. However, it’s important to use caution as digital assets can be risky investments. Consult with a financial advisor experienced in Crypto to help you align cryptocurrency investments with your unique retirement goals and risk tolerance.

Cryptocurrency has generated a lot of buzz in recent years, with some investors reaping substantial profits. However, it’s crucial to understand that investing in crypto is not without its risks, and it may not be the right choice for everyone.

One of the most significant concerns with cryptocurrency is its extreme price volatility. Prices can skyrocket one day and plummet the next. Its volatility is often driven by factors like market sentiment, regulatory developments, or technological advancements. This can lead to significant gains but also substantial losses.

Since the cryptocurrency market is relatively new, it lacks the comprehensive regulation seen in traditional financial markets. This means that investors have fewer protections. In fact, hackers stole $400 million of crypto in the first three months of 2023. Security professionals celebrated that number because it’s 70% less than what was stolen in the first three months of 2022.

Assessing your risk tolerance is a pivotal step when considering cryptocurrency investments, especially during retirement. Making ill-informed decisions in the crypto market could potentially jeopardize your hard-earned nest egg. However, working with the right financial advisor can help you understand your risk tolerance and explore the best investments based on your unique needs and financial goals.

How a Financial Advisor Can Help

While Bitcoin may have its appeal, it’s important to remember that it is a highly speculative and risky asset. But with great risk comes the potential for great returns.

“If you invest 2% of your savings and lose it, those savings can eventually be replaced. But if you invest 2% with a 10X return, it’s a game changer for your golden years…” said Daniel J. Agemy, CPM®, RFC®, Chief Investment Officer at Agemy Financial Strategies. With over a decade of portfolio management under his belt, Daniel is well-versed in the alternative ways of helping retirees and pre-retirees generate income streams that last throughout their retirement years.

Daniel continues, “As a fiduciary, I believe that seeking guidance for investment advice is essential because it means we are not just committed to your financial success; we are legally bound to always put your interests first, providing you with personalized and trustworthy support on your financial journey.”

For more valuable insights from the investing world, including cryptocurrency investing, Daniel and his father, Andrew A. Agemy, MRFC®, Founder and CEO

Investment Advisor at Agemy co-hosts the wildly popular radio show and YouTube podcast Financial Strategies, which airs every weekend in Connecticut and Colorado and is available wherever you listen to your favorite podcasts.

Advice You Can Trust

At Agemy Financial Strategies, we want you to know that we are committed to helping you achieve your retirement goals.

Here’s a breakdown of how our experienced advisors can play a crucial role in helping you integrate Bitcoin into your retirement plan:

The path to wealth accumulation is marked by a commitment to slow and steady progress, and the realm of cryptocurrency remains shrouded in uncertainty. Could cryptocurrency emerge as a more mainstream investment option in the future? That possibility exists. However, having a skilled financial advisor by your side can help ensure that you navigate this dynamic landscape with levelheadedness.

Final Thoughts

Bitcoin’s potential as a retirement asset is a growing interest, but it’s important to approach it with caution and careful planning. At Agemy Financial Strategies, we are dedicated to helping clients navigate the intricacies of planning for retirement to help ensure you never outlive your savings. Our fiduciary advisors can be a valuable resource in helping you navigate the cryptocurrency landscape, assess the risks, and integrate Bitcoin into your retirement strategy to align with your financial goals and risk tolerance.

If you’re ready to explore the world of cryptocurrency investing, contact us today to set up your complimentary consultation here.

Disclaimer: This content is for educational purposes only and should not be considered financial or investment advice. Please consult with the fiduciary advisors at Agemy Financial Strategies before making any investment decisions.

REITs vs. Direct Property Ownership: Pros and Cons for Investors

News, Real EstateReal estate has long been a cornerstone of wealth-building, offering opportunities for steady income, diversification, and long-term growth. For those approaching retirement, it’s not just about whether to include real estate in your portfolio—it’s about choosing the right approach to suit your goals and lifestyle.

Deciding what to do with yourself in the period between Christmas and the New Year can feel confusing for us all. More unsettling? The daunting decision between Real Estate Investment Trusts (REITs) and direct property ownership! While the festivities take a quick break, use your time off to research each option, as each has its own benefits and challenges, making it essential to understand how they align with your financial plans.

This blog dives into the pros and cons of both strategies, helping you make informed decisions and position your real estate investments for success in retirement.

What Are REITs?

Real Estate Investment Trusts (REITs) own, operate, or finance income-generating real estate. They pool funds from multiple investors, allowing shareholders to own a portion of large-scale properties without directly managing them. REITs are traded on public stock exchanges, making them an accessible and liquid investment vehicle.

More than 45% of American households own REITs, nearly double the estimate from two decades ago. They can be a good fit if you want the diversification benefits of real estate without the commitment and responsibilities of directly owning property. To better understand how REITs work, let’s explore the three main types available to investors, each with unique features and benefits:

Now that we know more about what REITs entail let’s look at the pros and cons.

Pros of REITs

One of the most significant benefits of REITs is their high liquidity. Since REIT shares are traded on stock exchanges, investors can quickly buy or sell them, unlike physical real estate transactions, which can take weeks or months. This liquidity is particularly advantageous for investors needing immediate access to funds without being locked into long-term real estate ownership.

REITs allow investors to spread their exposure across various properties, sectors, and geographies. For example, a single REIT may include assets like shopping malls, apartment complexes, healthcare facilities, and industrial warehouses. This built-in diversification can help reduce the risk of potential loss that could occur if an individual property or sector underperforms. It’s an efficient way to participate in the real estate market without the concentration risk of owning one or two properties.

REITs offer a low barrier to entry compared to direct property ownership. Instead of needing tens or hundreds of thousands of dollars for a down payment on a property, investors can gain exposure to real estate markets with the cost of a single REIT share. This accessibility can make REITs a practical choice for small-scale investors or those just starting to diversify their portfolios into real estate.

Since REITs are traded on stock exchanges, they are subject to the same market volatility as other publicly traded securities. Their values can fluctuate based on economic conditions, interest rates, or changes in investor sentiment, regardless of the underlying real estate performance. This volatility can be challenging for investors seeking stability or those uncomfortable with the stock market’s swings.

Investing in REITs means relinquishing decision-making power to the REIT’s management team. Investors cannot control which properties the REIT buys, sells, or develops. This lack of control can be a drawback for those who prefer a hands-on approach to managing their investments or want to focus on specific property types or locations.

While REITs often pay attractive dividends, these payouts are typically taxed as ordinary income rather than benefiting from the lower tax rates associated with qualified dividends or long-term capital gains. This can result in a higher tax burden for investors, particularly those in higher tax brackets. For tax efficiency, REITs may be better suited for tax-advantaged accounts like IRAs or 401(k)s.

What Is Direct Property Ownership?

Direct property ownership involves purchasing and owning physical real estate, such as residential properties, commercial spaces, or undeveloped land. Investors earn income by leasing the property or profiting from its appreciation over time. This approach requires hands-on involvement or the hiring of property management services.

Unlike REITs, direct ownership gives investors full control over property management and decision-making. However, it comes with responsibilities like tenant management, property upkeep, and navigating real estate market fluctuations.

Let’s look deeper at the pros and cons of direct property ownership.

Pros of Direct Property Ownership

One of the primary benefits of direct property ownership is the ability to build equity over time. As you pay down the mortgage, your ownership stake in the property increases. This creates a valuable asset that can be leveraged for future investments or financial needs. Unlike other investments, real estate allows you to combine equity growth with income generation, such as rental payments, making it a powerful wealth-building tool.

Real estate has a historical tendency to appreciate over time, offering investors the potential for substantial capital gains. Investors can benefit from increasing property values by holding long-term property long-term, particularly in growing markets or areas with rising demand. This potential for growth makes real estate a valuable component of a long-term investment strategy.

Real estate is often considered a natural hedge against inflation because property values and rental income typically rise over time, outpacing it. This ability to preserve and potentially increase purchasing power during inflationary periods makes real estate a reliable store of value. This characteristic makes direct property ownership particularly attractive for investors seeking long-term stability.

One of the most significant drawbacks of owning physical property is its lack of liquidity. Unlike REITs or stocks, selling a property can take several months and involves high transaction costs, including real estate agent commissions, closing fees, and potential repairs or upgrades to prepare the property for sale. This lack of liquidity can be a drawback for retirees who need quick access to funds.

Direct property ownership requires active involvement, making it far from a passive investment. Owners are responsible for property maintenance, tenant relations, and compliance with local laws and regulations. Even when hiring a property manager, the owner is ultimately accountable for decisions and outcomes, which can still demand time and effort.

The value and income real estate generates are heavily influenced by local market conditions, economic trends, and interest rate fluctuations. For instance, an economic downturn or oversupply of rental properties in a specific area can lead to declining property values and rental income. Similarly, rising interest rates can make mortgages more expensive, reducing affordability and demand. These factors can create unpredictable fluctuations in income and value, requiring property owners to carefully research and monitor market conditions to mitigate risks.

Key Considerations for Investors

Choosing between REITs and direct property ownership depends on your financial goals, time horizon, risk tolerance, and tax strategy. Each option has unique strengths and potential drawbacks; understanding these factors can help you make an informed decision.

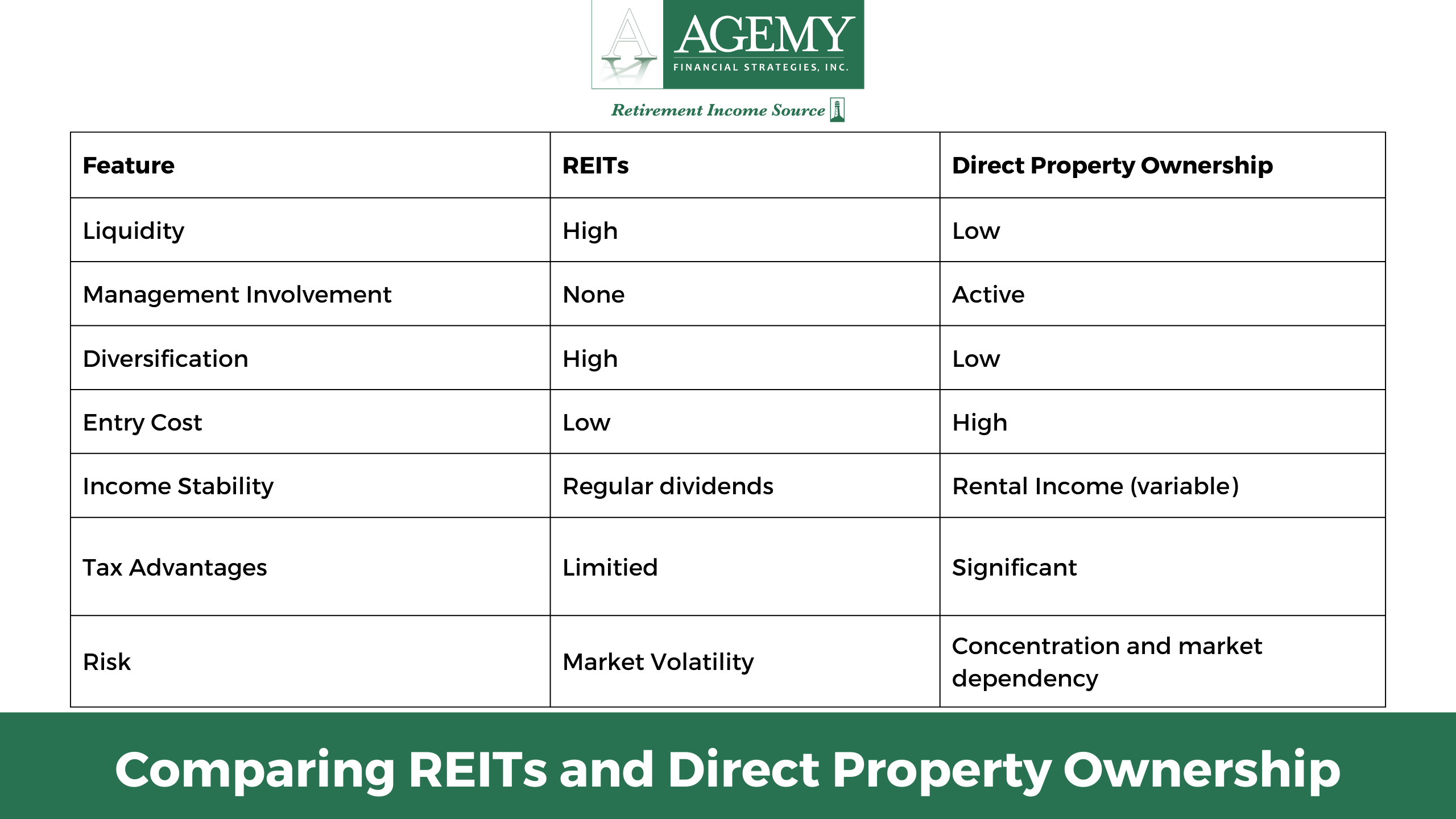

To make this decision easier, we’ve outlined the key differences between REITs and direct property ownership in the table below. Use it as a quick reference to compare their features side by side:

Partner With a Fiduciary Advisor

Investing in real estate during retirement can pose complexities, especially for those managing significant portfolios. If you’re looking for a fiduciary advisor with extensive experience in real estate investments, Agemy Financial Strategies is here to help.

Fiduciary advisors are legally obligated to prioritize your best interests, delivering impartial advice and recommendations aligned with your financial goals. Our seasoned professionals can help you identify opportunities and make well-informed decisions tailored to your unique needs and objectives.

Our advisors are adept at seamlessly integrating your real estate investments into your investment portfolio, helping to ensure they remain balanced and diversified. To explore our full-service offerings, see here.

Final Thoughts

REITs and direct property ownership offer unique advantages, making the right choice dependent on your financial goals, risk tolerance, and time horizon. At Agemy Financial Strategies, we help investors navigate the complexities of real estate investments for their financial portfolios. For over 30 years, our team of fiduciaries has guided clients in exploring opportunities in REITs and other investment vehicles to build resilient, diversified portfolios.

Contact us today to learn how we can help you achieve your financial aspirations and make informed decisions about real estate investments.

Disclaimer: This blog is intended for educational purposes only and should not be considered financial, tax, or legal advice. The information provided is general and may not apply to your financial situation. Investment decisions should always be based on your unique circumstances, goals, and risk tolerance. We recommend consulting a qualified financial advisor, such as our team at Agemy Financial Strategies, for personalized guidance tailored to your needs. Past performance does not indicate future results, and all investments carry inherent risks, including potential loss.

I’m High-Net-Worth. When Should I Start Estate Planning?

Estate Planning, NewsIf you have substantial wealth, the need for estate planning becomes even more significant due to the complexity of your financial situation. But when should you start estate planning if you fall into the HNWI category?

Estate planning is crucial for managing your wealth and protecting your assets so that they are distributed according to your wishes after your passing. In this blog, we will explore the importance of early estate planning for high-net-worth individuals and the key considerations to remember. Here’s what you need to know…

Estate planning is a solid guide on how you wish your assets to be distributed after passing. Whether your goal is to establish a lasting legacy or secure the financial well-being of your loved ones, starting estate planning early helps to ensure that your intentions are documented and legally binding.

A recent survey showed 73% of respondents had no estate plan. What’s even more surprising is that among respondents aged 75 and older, 72% were found to be without an estate plan. While it can be an uncomfortable topic to think about and discuss, postponing estate planning for too long can lead to potential complications and difficulties.

Let’s look deeper at some of the benefits of estate planning for high-net-worth individuals.

The Benefits of Establishing A Trust

As a HNWI, establishing a trust can be a powerful tool for achieving various financial goals and protecting your assets. Trusts offer flexibility, control, and numerous benefits, making them popular among individuals with substantial wealth.

There are various types of trusts, each designed to serve different purposes. Common types include revocable living trusts, irrevocable trusts, charitable trusts, and special needs trusts. Trusts can help shield your assets from creditors, lawsuits, and other threats. High-net-worth individuals can benefit from using irrevocable trusts for asset protection and estate tax planning.

Some trusts allow you to serve as the trustee, maintaining control while enjoying the benefits of asset protection and tax planning. The federal estate tax ranges from 18% to 40% and generally only applies to assets over $12.92 million in 2023 or $13.61 million in 2024. It’s important to consult with a financial advisor who can help you navigate the complexities of trusts to preserve, protect, and distribute your wealth according to your wishes.

Estate planning transcends the mere allocation of assets; it involves pivotal decisions regarding the inheritors of your wealth. For high-net-worth individuals, the meticulous selection of trustees and beneficiaries is paramount in crafting a robust estate plan.

Beneficiaries, slated to inherit your assets upon your passing, can encompass a range of individuals or entities, from beloved family members and friends to charitable organizations close to your heart.

Trustees, on the other hand, assume the pivotal role of overseeing and executing the distribution of assets in alignment with your meticulously outlined estate plan. Their role is instrumental in ensuring the proper management of your wealth.

By thoughtfully handpicking both beneficiaries and trustees, you lay the foundation for effectively realizing your estate plan’s objectives. Furthermore, this strategic selection significantly reduces the likelihood of conflicts and delays, assuring you that your assets will be disbursed precisely as you intended.

Minimizing Tax Liabilities

Reducing taxes on what you leave behind is a common estate-planning goal. Estate planning is about protecting your loved ones from potential IRS tax burdens. Essential to estate planning is transferring assets to heirs to create the smallest possible tax burden. Here are some key points to consider:

Life is constantly changing, and so should your estate plan. Changes in your family structure, financial situation, or legal regulations might necessitate updates to your plan to guarantee it remains aligned with your goals. A fiduciary advisor can help you with any changes that life may bring and help you adapt your plan accordingly.

Estate planning can be challenging — especially for those with a high net worth. You want to protect your family, assets, and business and gain peace of mind knowing you’re prepared and in control. Therefore, it’s essential to regularly review and update your estate plan to confirm it remains aligned with your goals and takes advantage of any new tax-saving opportunities.

An experienced fiduciary advisor can provide valuable advice and guidance regarding estate planning. At Agemy Financial Strategies, our team of skilled fiduciaries excels in assisting clients with creating robust estate plans. We are committed to providing our clients with the highest level of service, and we will work with you every step of the way to confirm that your estate plan needs are taken care of.

Last Thoughts

Estate planning is not just about wealth preservation; it’s about leaving a lasting legacy that reflects your values and priorities. Working with professionals to establish trust is essential to help guarantee your wishes are met, and your assets are protected.

At Agemy Financial Strategies, you can rest assured knowing that your financial affairs are in capable hands. If you want to learn more about how trusts can benefit your estate planning needs, schedule a complimentary strategy session with us today.

Disclaimer: This content is for educational purposes only and should not be considered financial or investment advice. Please consult with the fiduciary advisors at Agemy Financial Strategies before making any investment decisions.

Is Your Retirement at Risk? 5 Key Threats You Should Know

News, Retirement PlanningPlanning for retirement is a complex journey, with numerous factors influencing your financial security. While a single issue may not derail your plans, a combination of common yet often overlooked risks can significantly impact your retirement outlook.

A recent study found that nearly half of American households could run out of money in retirement if they cease working at 65. Understanding these hidden threats and taking proactive steps to mitigate them can mean the difference between a secure, fulfilling retirement and one filled with financial stress.

In this blog, we’ll uncover five major risks to your retirement that you won’t want to ignore. We will share how tips for strategic planning can help you navigate these challenges, allowing you to retire on your terms with more confidence and peace of mind.

1. Poor Asset Allocation: Finding the Right Balance

Improper asset allocation is one of the biggest risks to retirement savings. Many assume retirement demands a dramatic shift to conservative investments like bonds or cash equivalents. While reducing risk is wise, going too conservative can also hinder your savings growth, leaving you vulnerable to inflation.

A recent study was conducted to gain insight into investors’ alternative investments in workplace retirement savings plans. The study revealed solid interest in private assets despite a significant knowledge gap. Among those who expressed interest in private investments, most would take a measured approach with their retirement plan allocations (Schroders):

The ideal asset mix depends on individual goals, time horizon, and risk tolerance. Partnering with a fiduciary advisor can help you find the optimal balance and craft a plan that adapts to market conditions and personal changes. This approach can help keep your portfolio resilient and aligned with long-term goals.

2. Running Into Unexpected Expenses

When unexpected expenses arise, they can significantly affect your long-term financial health, particularly in retirement. These unplanned costs can quickly deplete your retirement savings, whether it’s a medical emergency, family support, or sudden home repairs. Nearly 6 in 10 (59%) U.S. adults feel unprepared for financial emergencies, indicating a widespread need for better financial planning.

This highlights the importance of a well-structured emergency fund. An emergency fund acts as a financial buffer, allowing you to manage surprise expenses without jeopardizing your retirement accounts. Building and maintaining this fund requires careful planning. With professional support, you can establish a cushion that shields your retirement savings from unplanned withdrawals, helping ensure your long-term financial security stays intact.

The “Sandwich Generation” refers to adults simultaneously supporting aging parents and children, a responsibility that can strain financial resources and delay retirement goals. Juggling these family obligations often means taking on additional healthcare, education, and living expenses, leaving less room for retirement savings.

In fact, 90% of Sandwich Generation adults report making a lifestyle change or financial decision because of caregiving responsibilities. Setting boundaries and establishing a structured financial plan is essential for those in this position. Prioritizing retirement savings while supporting family members can help safeguard long-term financial security.

A fiduciary advisor can provide valuable support by developing a balanced plan tailored to your situation. This personalized guidance can make a significant difference in helping maintain financial stability for both your loved ones and your future.

4. Long-Term Care Expenses: Protecting Against Rising Healthcare Costs

Long-term care remains a significant concern for retirees, with the U.S. Department of Health and Human Services estimating that 70% of people turning 65 will need some form of long-term care in their lifetime. Unfortunately, Medicare provides limited coverage for these services, and long-term care insurance can be costly. Planning for these potential expenses is crucial to helping safeguard your retirement savings.

The 2024 American Association for Long-Term Care Insurance (AALTCI) annual Price Index survey shows that the average annual premium for a $165,000 benefit policy without inflation protection is $950 for a single 55-year-old male and $1,500 for a single 55-year-old female. For a 55-year-old couple, the average combined annual premium reaches $2,080. These figures highlight the financial impact of securing long-term care coverage and the importance of including these costs in retirement planning.

A fiduciary advisor can help you navigate various funding options for long-term care, such as health savings accounts (HSAs), hybrid insurance policies, and setting aside dedicated assets within your retirement plan. With a fiduciary’s guidance, you’ll have access to strategies designed in your best interest, helping ensure these costs won’t drain your retirement funds and that you’re better prepared for the future.

5. Ignoring the Impact of Inflation

One of the most common yet underestimated threats to retirement savings is inflation. Over time, inflation erodes the purchasing power of your money, meaning that the same dollar buys less and less each year. For example, if inflation averages just 3% annually, in 20 years, you’ll need nearly twice as much money to maintain the same standard of living. For retirees, this steady cost increase can severely strain savings, particularly when living on a fixed income.

Ignoring inflation’s impact on retirement planning can lead to a financial shortfall when it matters most. Understanding the long-term impact and incorporating strategies to help protect your purchasing power is essential. Working alongside a fiduciary can help you build a portfolio that includes inflation-resistant assets aimed at outpacing inflation over time. By planning and adjusting your portfolio as needed, you can retain the ability to meet rising costs without compromising your financial security in retirement.

A secure retirement doesn’t happen by chance; it requires proactive planning and a clear understanding of the risks that lie ahead. Andrew Agemy, Owner and CEO of Agemy Financial Strategies, emphasizes the importance of a client-focused approach. “Our focus is on serving our clients with an educational process and listening with our hearts, not just our ears. This empowers our clients to make and realize their own solid financial decisions and allows them to remain in control.”

Here is how our team can help you navigate these challenges with confidence:

With Agemy Financial Strategies by your side, you can build a retirement plan designed to empower you and support a financially secure future.

Final Thoughts

Understanding and addressing these five critical retirement risks can make a significant difference in securing a comfortable, worry-free future. By taking proactive steps to help protect your savings and working with a knowledgeable fiduciary advisor, you can be better prepared to navigate unexpected challenges and achieve your retirement goals.

At Agemy Financial Strategies, we’re committed to helping you build a retirement plan that aligns with your vision and financial needs. With our personalized approach, you can plan confidently, knowing you’re well-prepared for the future.

Contact us today to start planning a retirement that fulfills your dreams and provides peace of mind.

Frequently Asked Questions

Q: How can I be sure my retirement plan is on track?

A: Regularly reviewing your retirement plan is essential to staying on course. At Agemy Financial Strategies, we offer ongoing support and periodic reviews to help your plan adapt to changes in market conditions, tax laws, and your personal financial situation. These reviews help you stay aligned with your long-term goals.

Q: What if I don’t know how much I’ll need for retirement?

A: Determining your retirement income needs is a common challenge. Our team at Agemy Financial Strategies helps you estimate these needs by examining your current expenses, desired lifestyle, and potential future costs like healthcare and long-term care. This process gives you a clearer picture of the savings required to maintain your lifestyle.

Q: How do you approach healthcare and long-term care costs?

A: Healthcare and long-term care expenses can be significant in retirement. We explore various options with you, including health savings accounts (HSAs), long-term care insurance, and retirement assets earmarked for medical needs. Planning for these costs in advance helps reduce their impact on your savings.

Q: How does Agemy Financial Strategies help manage inflation risks?

A: Inflation can erode the purchasing power of your savings over time. To combat this, we build inflation-resistant elements into your portfolio, such as stocks, bonds, and other investments that aim to outpace inflation. This approach helps protect your wealth and maintain your standard of living in retirement.

Q: What is the advantage of working with a fiduciary advisor?

A: As fiduciary advisors, we are legally and ethically committed to putting your best interests first. This means that all our recommendations are based solely on what’s best for you, with no conflicts of interest. Our goal is to provide transparent, objective guidance to help you achieve a secure and fulfilling retirement.

Disclaimer: The information provided in this blog is for educational purposes only and should not be taken as specific retirement or investment advice. Retirement and investment strategies should be tailored to each individual’s financial situation, goals, and risk tolerance. Before making any changes to your retirement investments, consult our qualified advisors to ensure these decisions align with your personal retirement objectives.

What You Need to Know About RMDS in 2025

News, Tax PlanningAs we approach the end of 2024, reviewing your retirement goals is a prime opportunity. One essential aspect to consider? Required Minimum Distributions (RMDs).

RMDs are a cornerstone of many retirement strategies, yet their complex rules and tax implications can make them challenging to navigate. Planning ahead can help you stay on track and optimize your retirement withdrawals.

With new RMD regulations set for 2025, understanding these changes can help you optimize your financial plans. In this blog, we’ll break down the fundamentals of RMDs, highlight the upcoming updates, and share practical tips to help you manage your distributions effectively.

Understanding Required Minimum Distributions (RMDs)

RMDs are mandatory withdrawals from certain retirement accounts once you reach a specific age. These withdrawals, which have grown tax-deferred over time, help retirement funds become taxable income. RMDs apply to the following accounts:

The annual amount you must withdraw is calculated based on your age, life expectancy, and account balance at the end of the previous year. Failing to take the required amount can result in significant tax penalties. Let’s take a look at key changes to look for in 2025.

As retirement planning continues to evolve, the latest updates to RMDs reflect efforts to provide more flexibility and tax advantages for retirees. The SECURE 2.0 Act introduced several new rules that impact how and when retirees must take distributions from certain accounts and adjust penalties. Below are the main changes for 2025 and beyond, designed to give retirees more control over their withdrawals and tax planning:

1. Increased RMD Starting Age: The age at which individuals must begin taking RMDs has been raised. In 2023, the age increased from 72 to 73, and it will further rise to 75 beginning in 2033.

2. Reduced Penalties for Missed RMDs: The penalty for failing to take an RMD has been reduced from 50% to 25% of the missed amount. If the missed RMD is corrected promptly, the penalty can decrease to 10%. Remember that the IRS has waived penalties for failing to take RMDs for certain inherited IRAs. For more information, see here.

3. Elimination of RMDs for Roth 401(k)s: Previously, Roth 401(k) accounts were subject to RMDs. Under the new rules, RMDs are no longer required for Roth 401(k)s, aligning them with Roth IRAs. It’s important to note that post-death minimum distribution rules, which also apply to Roth IRAs, still apply.

4. Annuities and RMDs: The SECURE 2.0 Act introduces provisions to make certain annuities more attractive within retirement plans. It allows certain types of annuity payments and clarifies qualifying longevity annuity contracts (QLACs) rules, including increasing the dollar limit to $200,000 and removing the 25% account balance cap.

5. RMDs for Surviving Spouses: Surviving spouses can now elect to be treated as the deceased account owner for RMD purposes, potentially delaying the start of RMDs if the surviving spouse is younger than the deceased. This election is irrevocable and requires notifying the account administrator.

6. Qualified Charitable Distributions (QCDs): The annual limit for QCDs, which count toward RMDs, is now indexed for inflation, starting at $105,000 in 2024. A one-time QCD of up to $50,000 is also allowed through certain charitable remainder trusts or gift annuities.

Why These Changes Matter

The recent adjustments to RMD rules are more than just technical updates—they bring valuable flexibility that can significantly benefit retirees. Here are some of the primary advantages of these changes:

1. Enhanced Growth Potential for Retirement Savings: Delaying RMDs means retirement accounts can stay invested and grow tax-deferred for longer. This change can be particularly beneficial for retirees who do not immediately need income from their retirement accounts, as it gives their investments more time to compound, potentially increasing their overall retirement nest egg.

2. More Control Over Roth 401(k) Withdrawals: With the removal of RMD requirements for Roth 401(k) accounts, retirees now have the same control as they do with Roth IRAs. This means they can choose when or if they want to withdraw from these accounts, providing a tax-free income source that can be preserved and used strategically within their broader retirement plan.

3. Reduced Penalties for Missed RMDs: The lower penalties for missed RMDs, combined with an opportunity for further reduction if corrected promptly, provide relief for retirees who may inadvertently miss their RMD deadline. This change reduces the financial impact of an honest mistake, making the RMD system more forgiving and manageable.

4. Options for Legacy and Charitable Planning: The increased flexibility around QCDs and the inflation-indexed annual limits make charitable giving a viable strategy for retirees looking to meet their RMD requirements while supporting causes they care about.

How to Calculate Your RMD in 2025

Calculating your Required Minimum Distribution (RMD) in 2025 is straightforward, with a few key steps. The IRS provides tables that determine your life expectancy factor based on your age, which you’ll use to calculate your RMD. Here’s a step-by-step guide:

Below is a portion of the IRS Uniform Lifetime Table to illustrate life expectancy factors by age:

Source: Internal Revenue Service (IRS)

Common Mistakes to Avoid

Navigating RMDs can be challenging; even small missteps can have significant financial consequences. Being mindful of some of the most frequent pitfalls can help you protect your retirement savings and maximize the benefits of these withdrawals. Here are three key mistakes to watch out for when planning your RMDs:

Working with a fiduciary can help ensure that your RMDs are managed to align with your financial goals and help you make the most of your retirement savings.

Working With an Advisor

New tax laws, potential shifts in Medicare premiums, income bracket adjustments, and evolving rules around charitable giving mean that your retirement income strategy may need some fine-tuning. Staying informed is essential for making the most of these adjustments and preparing your RMDs effectively.

At Agemy Financial Strategies, we provide personalized insights into your RMD responsibilities and tax-efficient strategies to help you manage these distributions. Our fiduciary advisors are dedicated to helping you meet your RMD obligations while optimizing your financial situation within IRS guidelines. We’ll work closely with you to assess your income needs in retirement and develop a plan that aligns with your financial goals and adapts to new regulations.

As part of our commitment to supporting your financial well-being, we offer tools like our free online RMD Calculator to help you estimate your required withdrawals. For more details on our services, please see our service offerings page here.

Final Thoughts

Navigating RMDs effectively requires staying informed about changing rules and understanding how these mandatory withdrawals impact your retirement income. Planning, keeping abreast of IRS updates, and consulting with financial advisors can help ensure that RMDs work in your favor while minimizing tax liabilities.

At Agemy Financial Strategies, our team is here to provide personalized guidance and support tailored to your financial needs and goals. Let us help ensure your tax obligations are appropriately managed throughout your retirement.

Preparing for 2025 doesn’t have to be overwhelming—let us help guide you toward a well-planned and prosperous new year. Contact us today to schedule your complimentary consultation.

Disclaimer: The information provided in this blog is for educational purposes only and is not intended as specific financial or investment advice. Each individual’s financial situation is unique, and any changes to your retirement income strategy or RMD planning should be discussed with a qualified financial advisor. We recommend consulting with our team at Agemy Financial Strategies to ensure your decisions align with your financial goals, risk tolerance, and the latest IRS regulations.