When you’ve spent years building wealth, the last thing you want is to watch it quietly drain away at the finish line. Yet that’s exactly what happens to many high-net-worth individuals (HNWIs): not through one catastrophic mistake, but through dozens of small, fixable gaps, what professionals call estate leakage.

Estate leakage is the unintended loss of net worth across your lifetime and at death due to taxes, fees, legal friction, poor titling, outdated documents, family conflict, and inefficient structures. Think of it like a slow leak in a luxury yacht: you might not notice right away, but left unaddressed, it can compromise the whole voyage.

This guide breaks down the biggest sources of leakage, shows how they show up in real life, and outlines concrete moves to plug the leaks before they cost you and your heirs.

What Exactly Is “Estate Leakage”?

Estate leakage is any unnecessary reduction in the assets ultimately available to you, your heirs, or your philanthropic causes. It can occur:

- During life (e.g., avoidable taxes, lawsuits, creditor claims, poor diversification, inefficient charitable giving).

- At death (e.g., probate costs, state estate taxes, federal estate or generation-skipping transfer taxes, liquidity shortfalls, and forced sales).

- After death (e.g., litigation among heirs, trustee mistakes, beneficiary missteps, tax law mismatches).

The hallmark of leakage is that it’s preventable with proactive planning. But planning doesn’t mean a stack of documents collecting dust. It means coordination across advisors (financial, legal, tax, insurance), ongoing updates, and a design that reflects your asset mix and family dynamics.

The Most Common Leaks and How They Drain Wealth

1) Outdated or Incomplete Estate Documents

What leaks: Assets pass in ways you didn’t intend; probate delays; guardianship uncertainty; family disputes.

Red flags:

- Wills and trusts older than 3–5 years (or never reviewed after major life events).

- No revocable living trust or pour-over will.

- No powers of attorney or healthcare directives.

Plug it:

- Create or update a revocable living trust, pour-over will, durable powers of attorney, and healthcare documents.

- Add a “living balance sheet” to inventory accounts, entities, insurance, key documents, and passwords.

- Establish a review cadence (at least every 2–3 years or after big life changes).

2) Beneficiary & Titling Mistakes

What leaks: Accounts bypass your will and trust unintentionally; assets land with the wrong person; ex-spouse inherits; avoidable taxes.

Red flags:

- “Set it and forget it” beneficiaries on IRAs, 401(k)s, life insurance, and annuities.

- Joint ownership that defeats trust planning.

- Transfer-on-death (TOD/POD) designations that conflict with your tax or family plan.

Plug it:

- Audit beneficiaries annually and after births, deaths, divorces, and remarriages.

- Align account titling with your trust strategy (e.g., fund the revocable trust; use TOD/POD selectively).

- For complex families, consider trusts as beneficiaries to help control timing, taxes, and protections.

3) Probate & Court Friction

What leaks: Public proceedings, delays, statutory fees, and legal costs. In some states, probate can be lengthy and expensive.

Red flags:

- Sole ownership with no trust or TOD/POD.

- Real estate across multiple states.

Plug it:

- Use a revocable trust to help avoid probate and keep affairs private.

- Use ancillary trusts or LLCs for out-of-state real estate to avoid multiple probates.

- Keep your asset schedule updated so the trust is actually funded.

4) Federal & State Transfer Taxes (and the “Step-Up” Problem)

What leaks: Unnecessary estate, gift, or generation-skipping transfer (GST) taxes; lost basis step-ups; inefficient lifetime gifts.

Red flags:

- Large individual estates that could face federal estate tax if thresholds change.

- Residence or property in states with separate estate or inheritance taxes.

- Gifting low-basis assets outright without a strategy.

Plug it:

- Coordinate lifetime gifting (annual exclusion gifts, 529 “superfunding,” charitable gifts).

- Use spousal lifetime access trusts (SLATs), grantor retained annuity trusts (GRATs), intentionally defective grantor trusts (IDGTs), or family LLC/LPs with valuation discounts where appropriate.

- Manage basis: keep high-basis/step-up-eligible assets in the estate; consider swap powers in certain trusts.

- Consider domicile planning if you split time among states with more favorable regimes.

5) Retirement Account Pitfalls (post-SECURE Act)

What leaks: Compressed distribution schedules; “income in respect of a decedent” (IRD) taxed at high rates; missed planning for special situations.

Red flags:

- Large traditional IRAs with non-spouse or trust beneficiaries.

- No Roth conversion strategy.

- Trusts not drafted to handle 10-year payout rules.

Plug it:

- Coordinate Roth conversions in lower-tax years.

- Consider charitable remainder trusts (CRTs) to spread taxable income for certain beneficiaries.

- Update trust language to align with current distribution rules.

- Align beneficiary choices with tax profiles (e.g., leave pre-tax assets to charity; after-tax to heirs).

6) Illiquidity & Forced Sales

What leaks: Fire-sale of concentrated positions, closely held businesses, or trophy real estate to raise cash for taxes or equalization.

Red flags:

- An estate dominated by private business or illiquid real assets.

- No buy-sell agreement or poor funding.

- Estate tax due with no liquidity plan.

Plug it:

- Maintain adequate liquidity and credit lines.

- Use irrevocable life insurance trusts (ILITs) to provide tax-efficient liquidity.

- Draft and fund buy-sell agreements; consider key person coverage.

- Rehearse the “Day Two plan”: what gets sold, when, and at what minimums.

7) Concentration & Single-Asset Risk

What leaks: A sudden drop in a single stock, business, or sector wipes out decades of gains.

Red flags:

- Employer stock, pre-IPO shares, or private company value >30–40% of net worth.

- Emotional attachment to a legacy holding.

Plug it:

- Engineer a systematic diversification plan (10b5-1 for insiders, exchange funds, collars, charitable strategies to manage taxes).

- Think in tranches and time windows; hedge where appropriate.

8) Business Succession Gaps

What leaks: Leadership vacuums, valuation disputes, tax inefficiency, family conflict, and failed continuity.

Red flags:

- No written succession plan or governance structure.

- Unfunded or outdated buy-sell agreements.

- Key leaders are uninsured; no incentive or retention plans.

Plug it:

- Formalize a succession roadmap with roles, timelines, and decision rights.

- Keep valuations current; fund buy-sell with life and disability insurance.

- Use trusts and voting/nonvoting shares to separate control from economics.

- Build a family employment policy and advisory board for accountability.

9) Creditor, Lawsuit, and Divorce Exposure

What leaks: Personal guarantees, professional liability, and marital property claims.

Red flags:

- Personal assets commingled with business risks.

- No umbrella liability coverage.

- Gifting outright to children in volatile marriages or professions.

Plug it:

- Use LLCs/LPs, proper titling, and tenancy by the entirety where available.

- Maintain umbrella liability and a liability-aware investment strategy.

- Favor discretionary, spendthrift trusts over outright gifts to heirs.

10) Cross-Border & Non-Citizen Spouse Issues

What leaks: Treaty misalignment, double taxation, blocked transfers to a non-citizen spouse, overlooked reporting.

Red flags:

- Assets or heirs in multiple countries.

- Non-citizen spouse or green card status in flux.

Plug it:

- Use Qualified Domestic Trusts (QDOTs) for non-citizen spouse planning where needed.

- Coordinate advisors across jurisdictions; review treaties, reporting, and situs rules.

- Consider where trusts are established (situs) for creditor protection and tax efficiency.

11) Philanthropy Done the Hard Way

What leaks: High compliance costs, timing mismatches, and suboptimal asset selection for gifts.

Red flags:

- Writing checks instead of gifting appreciated assets.

- A private foundation, when a donor-advised fund (DAF) or charitable trust, would be simpler.

- No policy on family participation or grantmaking.

Plug it:

- Donate appreciated securities; avoid triggering gains.

- Use a DAF for simplicity or CLTs/CRTs for tax and income engineering.

- Draft a philanthropy charter so giving reflects your values and reduces conflict.

12) Digital Assets, Passwords, and the “Unknown Unknowns”

What leaks: Lost crypto, inaccessible accounts, domain names, or valuable IP; subscription creep.

Red flags:

- No digital asset inventory or password vault.

- No executor authority for digital assets.

Plug it:

- Maintain a secure password manager with emergency access.

- Add digital asset powers in estate documents.

- Keep an updated list of domains, IP addresses, social handles, and subscription commitments.

Real-World Snapshots

- The Concentrated Founder: A founder died with most wealth in pre-IPO stock. No liquidity plan; estate forced to sell during a lock-up trough. A prearranged hedging/diversification plan and ILIT-funded liquidity could have preserved millions.

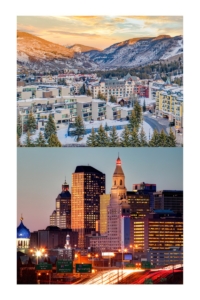

- The Two-State Homeowner: A couple held properties in several states under their personal names. Multiple probates delayed distribution for 18 months and racked up fees. Titling via revocable trusts and/or LLCs would have avoided it.

- The Outdated Trust: A trust written before major tax law changes forced accelerated retirement distributions to a young beneficiary in a high tax bracket. Redrafting could have smoothed taxes and protected assets longer.

- The Entrepreneur Without a Map: No buy-sell agreement, no valuation, and no key person insurance. After an unexpected death, creditors pressed, and a low-ball sale followed. A funded buy-sell and contingency plan might have saved the legacy.

The HNWI Playbook to Plug Leaks

Think of this as a sequence, not a one-time project. Each move supports the next. (This material is for educational purposes only and does not constitute individualized financial, legal, or tax advice.)

1) Assemble a Coordinated Team

- Lead advisor/quarterback to coordinate your attorney, CPA, insurance professional, and investment team.

- Agree on shared documents, a secure data room, and decision timelines.

2) Map Your Balance Sheet Like a Business

- Produce a living balance sheet: entities, accounts, policies, liabilities, basis, beneficiaries, titling, and jurisdiction.

- Add a family org chart: who’s involved, roles, and readiness.

3) Update the Core Documents

- Revocable trust + pour-over will.

- Financial and healthcare powers of attorney.

- Guardianship (if applicable).

- Letter of wishes and ethical will to share values and intent.

4) Engineer Tax Outcomes

- Coordinate annual exclusion gifts, 529 plans, and intra-family loans.

- Consider SLATs, GRATs, IDGTs, and family LLC/LPs to shift growth.

- Manage basis and step-ups: evaluate which assets to retain vs. gift.

- Align with state tax realities; review domicile and property situs.

5) Optimize Retirement Accounts

- Model Roth conversions across your retirement income plan.

- Update trust language for current distribution rules.

- Consider CRTs or charities for large IRD assets.

6) Diversify & De-Risk

- Build a multi-year plan for concentrated positions (trading windows, collars, exchange funds).

- Use tax-aware rebalancing, loss harvesting, and charitable strategies.

7) Lock Down Business Continuity

- Write and rehearse your succession plan.

- Keep valuations current; fund buy-sell agreements.

- Consider key person and disability buy-out policies.

8) Create Liquidity on Your Terms

- Maintain cash buffers and committed credit lines.

- Use ILIT-owned life insurance to create estate liquidity without swelling the taxable estate.

- Pre-plan sales with price floors and governance.

9) Protect from Creditors & Claims

- Separate risk with LLCs/LPs and proper titling.

- Use spendthrift trusts for heirs.

- Maintain umbrella liability and review policy alignment annually.

10) Make Philanthropy Efficient

- Contribute appreciated assets to a DAF for instant deduction and flexible timing.

- Use CLTs/CRTs to pair tax goals with income needs.

- Involve family with a written giving mission and decision cadence.

11) Secure the Intangibles

- Centralize passwords and digital assets.

- Record IP ownership, licensing, and royalty flows.

- Document family traditions, values, and stewardship expectations.

High-Impact Tools (and When They Fit)

- Revocable Living Trust: Everyone with meaningful assets in multiple accounts or states, privacy, and probate avoidance.

- ILIT (Irrevocable Life Insurance Trust): Estate tax liquidity and equalization among heirs without growing the taxable estate.

- SLAT: Shift appreciation while keeping spousal access; best with strong marital stability and careful reciprocal trust design.

- GRAT: Efficiently move appreciation of volatile or high-growth assets to heirs with minimal gift tax.

- IDGT + Installment Note: Sell appreciating assets to a grantor trust for estate freeze and income tax efficiency.

- Family LLC/LP: Centralize management, enable discounts where appropriate, and add governance.

- DAF / CRT / CLT: Streamline giving, reduce concentration, manage income taxes, and involve family across generations.

- Buy-Sell Agreement: Set clear exit mechanics and fund it; life and disability coverage aren’t optional.

The Human Side: Heirs, Governance, and Communication

Technical perfection doesn’t matter if your family can’t navigate the plan. Leakage often starts with silence.

- Family meetings (annual or milestone-based) to explain the “why,” not just the “what.”

- Governance documents: family charter, investment policy for trusts, philanthropy mission.

- Stewardship education: introduce heirs to advisors, simulate real decisions with small “training” trusts, and set expectations.

A well-run family behaves like an enduring enterprise: clear purpose, role clarity, decision rules, and continuity of leadership.

An HNWI Estate Leakage Checklist

Use this for a quick self-audit:

- Do I have a current revocable trust, will, POAs, and healthcare directives (reviewed within 3 years)?

- Are all accounts and real estate titles to align with my trust and beneficiary strategy?

- Have I run a Roth conversion and retirement distribution analysis for tax smoothing?

- Do my trusts reflect modern retirement account rules and distribution objectives?

- Is there a plan to diversify concentrated positions over time (including hedging or charitable strategies)?

- Do I have a liquidity plan (cash, credit, ILIT) to avoid forced sales or rushed decisions?

- Is my business succession plan written, funded, and rehearsed?

- Have I addressed state estate/inheritance tax exposure and domicile questions?

- Are umbrella liability, property/casualty, and key person coverages aligned and sufficient?

- Is my philanthropy structured for tax efficiency (DAF, CRT/CLT) and family engagement?

- Do I maintain a living balance sheet (assets, debt, basis, beneficiaries, passwords) in a secure vault?

- Have I scheduled a family meeting and provided a letter of wishes?

If you can’t check these off with confidence, you’ve likely got leaks.

Why This Is Urgent Now

Laws evolve. Markets move. Families change. The “perfect” plan from five years ago can become misaligned overnight, especially for HNWIs with dynamic asset mixes (private enterprises, real estate, alternatives, equity comp). A proactive refresh is the single most cost-effective way to add seven figures of value without taking market risk.

How Agemy Financial Strategies Helps You Plug the Leaks

At Agemy Financial Strategies, we act as your financial quarterback, coordinating with your attorney, CPA, and insurance specialists to design, implement, and maintain a plan that helps keep more of your wealth where you want it:

- Holistic Review: We map your entire financial ecosystem, entities, accounts, policies, titling, beneficiaries, basis, and highlight leak points.

- Help Tax-Smart Design: We model multi-year tax outcomes (lifetime and at death) and suggest strategies like SLATs, GRATs, IDGTs, ILITs, and charitable vehicles when they genuinely fit.

- Business & Liquidity Planning: From buy-sell funding to ILIT-based estate liquidity, we help you avoid forced sales and preserve control.

- Concentration Management: We help you engineer systematic diversification with tax awareness, hedging, and philanthropic tactics to reduce single-asset risk.

- Governance & Family Alignment: We help facilitate family meetings, create stewardship materials, and help ensure the next generation understands both the plan and the purpose behind it.

- Ongoing Maintenance: We keep documents, titling, beneficiaries, and insurance aligned as your life and the law evolve, so small issues never become expensive problems.

Final Thought

Estate leakage isn’t one big hole; it’s dozens of pinpricks. The sooner you find and fix them, the more choice, control, and confidence you preserve for your family and your legacy.

Let’s plug the leaks. If you’re a business owner, an executive with concentrated equity, or a family with multi-state or cross-border complexity, now is the moment to get coordinated. Agemy Financial Strategies can help you turn a good plan into a resilient one, built to keep more of what you’ve earned.

Ready to start? Schedule a confidential review with Agemy Financial Strategies, and we’ll show you, line by line, where leakage is likely, what it could cost, and how to fix it with clarity and precision.

Disclaimer: This material is for educational purposes only and does not constitute individualized financial, legal, or tax advice. Consult your professional advisors about your specific situation and state-specific rules.

What Are Estate, Gift, and Generation-Skipping Transfer Taxes?

What Are Estate, Gift, and Generation-Skipping Transfer Taxes?  State Estate Taxes: Another Layer to Consider

State Estate Taxes: Another Layer to Consider

The Importance of Early Estate Planning

The Importance of Early Estate Planning Selecting Trustees and Beneficiaries

Selecting Trustees and Beneficiaries Regularly Review and Update Your Plan

Regularly Review and Update Your Plan