April 11, 2024

Taxpayers across the United States anticipate a looming deadline: Tax Day. Falling on Monday, April 15th, this date evokes a sense of urgency and, for many, a hint of stress as they rush to gather essential documents, receipts, and forms.

An estimated 28% of Americans are unaware of this year’s tax filing deadline. Agemy Financial Strategies is here to provide the necessary guidance and assistance, offering careful planning to help you seize the opportunity to optimize your financial situation. Here’s what you need to know.

Gather All the Essentials

Gather All the Essentials

The key to a smooth Tax Day experience lies in careful preparation. Here’s a checklist of essential items you’ll need to gather before the April 15th deadline:

- Income Documents: This includes W-2 forms from your employer(s), 1099 forms for freelance or contract work, and any income generated from investments or rental properties.

- Expense Records: Keep track of deductible expenses such as mortgage interest, property taxes, medical expenses, charitable contributions, and unreimbursed business expenses.

- Moving Expenses: Document any expenses incurred due to relocation for employment or retirement purposes, including transportation, lodging, and storage costs, as they may be eligible for deduction under certain circumstances.

- Tax Forms: Confirm you have the necessary forms, including Form 1040 for individual income tax returns and any additional schedules or forms relevant to your financial situation.

- Previous Year’s Return: Having last year’s tax return on hand can provide valuable insight into your tax history and help ensure accuracy when filing this year.

- Identification Information: You’ll need Social Security or tax identification numbers for yourself, your spouse, and any dependents you claim.

Compiling these documents and information ahead of time can help you streamline the tax filing process and minimize the risk of errors or oversights.

Understand Changes to Tax Brackets

Understanding tax bracket changes for the 2023 tax year is crucial for taxpayers to navigate their financial planning effectively. Tax brackets are revised periodically to adjust for inflation and changes in the tax code. While the tax rates have remained unchanged, there has been a notable 5.4% increase in the federal income tax brackets.

Staying informed about these changes can help empower individuals and businesses to make informed decisions regarding their income, investments, and overall financial strategy. Taking advantage of available tax deductions and credits can also help minimize your tax liability.

Maximize Available Deductions and Credits

Maximizing deductions and credits is a savvy strategy for taxpayers looking to lower their taxable income and reduce their tax liability. Deductions such as contributions to retirement accounts, including traditional IRAs or 401(k)s, help individuals save for the future and offer immediate tax benefits by lowering taxable income.

Charitable giving can also be a tax-smart strategy, particularly for retirees with substantial assets. It can help lower withdrawal taxes from your tax-deferred retirement accounts, including Required Minimum Distributions (RMDs). Additionally, it can help reduce your taxable estate and minimize the tax liability for your account beneficiaries. However, it’s important to note that generally, you should be over the age of 59½ to avoid early withdrawal penalties.

To help maximize these tax benefits, consider seeking advice from a financial advisor. They can provide insights into optimizing your tax advantages. Strategies such as grouping charitable donations into a single year or establishing charitable trusts are effective ways to enhance the tax benefits of charitable giving. By strategically maximizing deductions and credits, taxpayers can help optimize their tax situation and maximize their financial resources.

Manage Your Tax Deadline Effectively

The IRS allows retirees who cannot file their tax returns by the April 15th deadline to request a six-month extension. This extension can be helpful in situations where a taxpayer needs a tax form or additional time to prepare their return. Taxpayers can request an extension for free via IRS Free File, regardless of their income.

It’s essential to note that while an extension will give retirees additional time to file their returns, it doesn’t extend the deadline to pay their federal taxes. Your tax bill has to be paid by the April 15th deadline. In cases where a taxpayer is missing a tax form, they can estimate their tax bill by using tax software and inputting estimates for any missing forms.

It’s also worth noting that requesting a federal extension doesn’t automatically extend the deadline for state tax returns. Those who need additional time to file their state tax returns must request a separate extension.

There is no penalty for filing an extension. However, not paying on time or enough, or failing to file altogether, may cost you.

- If you don’t pay the full amount you owe, the IRS will charge you interest on the unpaid balance until you do.

- You may be subject to a late payment penalty if you don’t pay at least 90% of your debt. The penalty is usually half of 1% of the amount owed each month, up to a maximum of 25%.

- If you don’t file your return or Form 4868 by the tax filing deadline, you’ll be subject to a late filing penalty. The penalty is 5% of the amount you owe each month and can increase to 25%.

After you file the extension, you’ll have until October 15th to gather your documents and finish your filing. When you complete your return, you should include the amount you’ve already paid in the payments section of your Form 1040.

Minimize Your Tax Burden With a Financial Advisor

While gathering the necessary paperwork is essential, it’s only one piece of the puzzle. Partnering with a skilled financial advisor can take your tax planning to the next level by helping you strategically manage your finances throughout the year to minimize your tax burden.

At Agemy Financial Strategies, we can help you explore options to help ensure you take advantage of tax strategies that can minimize your tax liability while boosting your savings. Here’s how our advisors can assist you in creating a tax plan strategy:

- Strategic Planning: A financial advisor can help you develop a comprehensive tax plan tailored to your unique financial situation and long-term goals. By analyzing your income, investments, and expenses, they can identify opportunities to help optimize your tax strategy and maximize tax-saving opportunities.

- Investment Guidance: Certain investment vehicles, such as retirement and tax-deferred accounts, offer significant tax advantages. A financial advisor can advise you on the most tax-efficient investment strategies to help grow your wealth while minimizing tax liability.

- Income Management: Timing is key to managing income for tax purposes. A financial advisor can help you strategically time withdrawals from retirement accounts, capital gains realizations, and other income sources to minimize your overall tax liability.

- Estate Planning: Tax planning isn’t just about the present—it’s also about planning for the future. A financial advisor can assist you in developing an estate plan that helps minimize estate taxes and provides a smooth transfer of wealth to your heirs.

Get an Extension

Not ready to file on Monday? Taxpayers who can’t file by the deadline of April 15, 2024, should request an extension before that deadline. Remember, however, that an extension to file is not an extension to pay taxes. If they owe taxes, they should pay them before the due date to avoid potential penalties and interest on the amount owed. Apply for your extension here.

Last Thoughts

Tax Day doesn’t have to be a dreaded deadline. By gathering the necessary documents and partnering with a financial advisor to develop a tax plan strategy, you can confidently navigate the tax filing process and even potentially minimize your tax burden.

Agemy Financial Strategies is dedicated to providing knowledgeable guidance on tax planning strategies to help you minimize future tax burdens. Our team is here to help you every step of the way, helping ensure that your retirement years are filled with immense fulfillment.

With our guidance, you can embrace the opportunity to optimize your financial situation and secure a brighter financial future. Contact us today to get started and schedule your complimentary strategy session here.

Map Out Your Retirement Dreams

Map Out Your Retirement Dreams

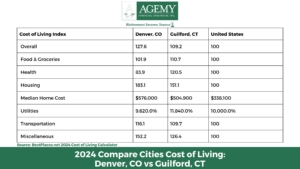

Pros of Living in Connecticut

Pros of Living in Connecticut

Pros of Living Colorado

Pros of Living Colorado

1. File Taxes on Time

1. File Taxes on Time

Financial Advisors Can Help With Taxes

Financial Advisors Can Help With Taxes Setting Up A Trust

Setting Up A Trust

The Role of a Fiduciary in Estate Planning

The Role of a Fiduciary in Estate Planning What is ‘Peak 65’?

What is ‘Peak 65’?

Getting The Help You Need

Getting The Help You Need