Caregiving is a selfless act of love and devotion, yet it can also present significant financial challenges. From out-of-pocket expenses to lost wages and retirement savings, caregiving can profoundly impact long-term financial security. Nearly half (43%) of individuals are afraid that caregiving expenses will keep them from ever retiring.

More individuals find themselves in the role of caregiver—whether for aging parents, a spouse, or other loved ones. While caregiving is rewarding, it is crucial to plan ahead to minimize financial strain and help ensure your future remains secure. In this blog, we’ll explore the financial implications of caregiving, strategies to help manage costs, and steps to protect your financial well-being.

The Financial Burden of Caregiving

Caregiving is not just a time and emotional commitment—it also carries significant financial implications. The costs can quickly increase whether you provide part-time assistance or full-time care. From medical expenses to lost income, caregivers often face unexpected financial challenges that can disrupt their financial stability. The financial impact of caregiving can vary based on the level of care required, but it often includes:

- Out-of-Pocket Costs

Caregivers often take on a significant financial burden, covering expenses such as medical supplies, home modifications, transportation, and groceries. According to a recent study, caregivers spend an average of over $7,200 per year on out-of-pocket caregiving costs—amounting to 26% of their annual income. These ongoing expenses can quickly add up, making it essential for caregivers to plan ahead and explore financial resources that can help alleviate the strain.

- Lost Income and Career Disruptions

Caregiving responsibilities often require individuals to adjust their work schedules, reduce hours, or leave the workforce entirely, leading to significant financial consequences. These career interruptions can negatively affect income, retirement savings, and financial security.

- Increased Healthcare Costs

Many caregivers neglect their health due to time constraints and stress. According to the Family Caregiver Alliance, caregivers report higher levels of depression and anxiety than non-caregivers, with some experiencing caregiver burnout, a state of physical, emotional, and mental exhaustion. This not only affects their well-being but also leads to greater reliance on healthcare services, prescription medications, and mental health treatment—adding to their financial burden.

Without proper planning, these rising medical expenses can strain caregivers’ budgets, making it essential to incorporate self-care, stress management, and financial preparation into their caregiving strategy. Prioritizing your own health enables you to provide better care for your loved one while helping protect your long-term financial and physical well-being.

- Impact on Retirement Savings

Dipping into savings or reducing retirement contributions can have long-term financial consequences. Without careful planning, caregivers may face significant gaps in their retirement funds. Here are some ways you can help protect your retirement while caregiving:

- Prioritize Retirement Contributions – Even if you must reduce your contributions, try contributing at least enough to take advantage of employer-matching contributions in a 401(k) or similar plan.

- Consider Spousal IRA Contributions – If caregiving leads to job loss or reduced income, a spousal IRA can allow a working spouse to continue making contributions on behalf of the caregiver, helping ensure continued retirement savings.

- Explore Catch-Up Contributions – If you’re 50 or older, catch-up contributions allow you to contribute extra funds to retirement accounts, helping bridge the gap caused by reduced savings during caregiving years.

How to Prepare Financially for Caregiving

How to Prepare Financially for Caregiving

Taking proactive steps can help ensure you provide quality care without compromising your financial well-being. Below are key strategies to help you manage the financial responsibilities of caregiving while protecting your financial future.

- Create a Caregiving Plan

Establish a clear plan that outlines caregiving expenses, potential income changes, and available resources. Consider:

- Medical and prescription costs.

- Home modifications and assistive devices.

- Transportation and caregiving services.

- Legal and financial planning fees.

- Explore Employer Benefits

Some employers offer caregiving benefits, such as flexible work arrangements, paid family leave, or Employee Assistance Programs (EAPs). Check with your HR department to understand what support is available.

- Consider Long-Term Care Insurance

Long-term care insurance can help offset the costs of in-home care, assisted living, or nursing home care. Purchasing a policy earlier in life can lower premiums and help provide financial security if caregiving responsibilities arise.

- Plan for Your Own Future Care Needs

Preparing for your own future is essential, just as you plan for a loved one’s care. Consider setting up a Health Savings Account (HSA) or dedicated retirement funds for potential long-term care needs.

Protecting Your Financial Future

Caregiving is a profound responsibility that requires emotional, physical, and financial preparation. While the financial burden can be significant, planning ahead can help protect your financial future while providing quality care for your loved ones. A well-structured financial plan can alleviate stress and help offer long-term security for caregivers and their families.

At Agemy Financial Strategies, we understand the unique financial challenges caregivers face. Our award-winning team is here to help you navigate these complexities and develop a plan that helps protect your financial well-being while supporting your caregiving journey. Here’s how we can help:

- Establish Legal and Financial Safeguards

Caregiving often involves managing financial and legal decisions on behalf of a loved one. Our fiduciary advisors can help caregivers put important legal documents in place, such as:

- Durable Power of Attorney for financial and healthcare decisions.

- Living Will and Advance Directives.

- Trusts to manage assets and protect financial interests.

- Seek Financial Planning Assistance

Many caregivers find themselves financially stretched due to unexpected costs, career disruptions, and the need to support both their loved ones and their own future. Here’s how our team can help:

- Personalized Financial Plan: We help structure a financial plan that accounts for caregiving costs, income adjustments, and savings goals.

- Investment Strategies: Our team guides you in balancing liquidity with growth, helping you access funds when needed while continuing to build wealth.

- Retirement Planning: We work with caregivers to develop strategies that help keep their retirement goals on track, even if they need to reduce contributions or change their income structure temporarily.

- Have Open Conversations About Caregiving Expectations

Many caregivers focus so much on their loved one’s well-being that they neglect to plan for their own future care needs. Failing to prepare for potential long-term care expenses can lead to financial strain. Here’s how we can help:

- Creating a future care plan for potential healthcare costs, long-term care options, and financial safety nets.

- Facilitating family discussions around caregiving expectations, helping to create a structured plan that distributes responsibilities fairly among family members.

- Building emergency savings and contingency plans to cover unexpected expenses, helping ensure that caregivers maintain financial independence.

Planning for the Future with Agemy Financial Strategies

At Agemy Financial Strategies, we understand the financial challenges caregivers face. Our team is committed to providing personalized, fiduciary-based financial planning that empowers you to navigate caregiving responsibilities while helping secure your financial future. If you’re balancing caregiving with financial concerns, let’s create a strategy that supports both your present needs and long-term goals.

Contact us today to schedule a consultation and take the first step toward financial peace of mind.

Frequently Asked Questions (FAQ)

How can I financially prepare to become a caregiver?

Start by creating a detailed caregiving budget, exploring employer benefits, and considering long-term care insurance. Utilizing potential tax breaks can also help offset caregiving costs. Working alongside a trusted advisor can help you explore your available options.

Are there tax benefits available for caregivers?

Caregivers may qualify for potential deductions through the IRS. Deductions may include the Dependent Care Credit, Medical Expense Deduction, and the Child and Dependent Care Tax Credit. It’s important to consult with a trusted advisor to determine your eligibility.

Should I quit my job to provide full-time care?

Before making this decision, consider the long-term impact on your income, benefits, and retirement savings. Explore flexible work options and financial assistance programs to help balance caregiving and employment.

How can a fiduciary advisor help caregivers?

A fiduciary advisor can help create a comprehensive financial plan that accounts for caregiving costs while maintaining long-term financial security. They can also provide investment strategies and tax-efficient solutions tailored to individual needs.

Disclaimer: This content is for informational purposes only and should not be considered financial or investment advice. The strategies discussed may not be suitable for all individuals. Consult the qualified fiduciary advisors at Agemy Financial Strategies for personalized guidance tailored to your situation.

A Fiduciary’s Perspective on Long-Term Wealth Growth

A Fiduciary’s Perspective on Long-Term Wealth Growth

Benefits of an HSA

Benefits of an HSA

Make the Most of Your HSA With Agemy

Make the Most of Your HSA With Agemy

Economic Predictions for 2025: Key Trends Impacting Crypto

Economic Predictions for 2025: Key Trends Impacting Crypto

Working With the Right Advisor

Working With the Right Advisor  Navigate the Crypto Landscape with Confidence

Navigate the Crypto Landscape with Confidence What Are Estate, Gift, and Generation-Skipping Transfer Taxes?

What Are Estate, Gift, and Generation-Skipping Transfer Taxes?  State Estate Taxes: Another Layer to Consider

State Estate Taxes: Another Layer to Consider

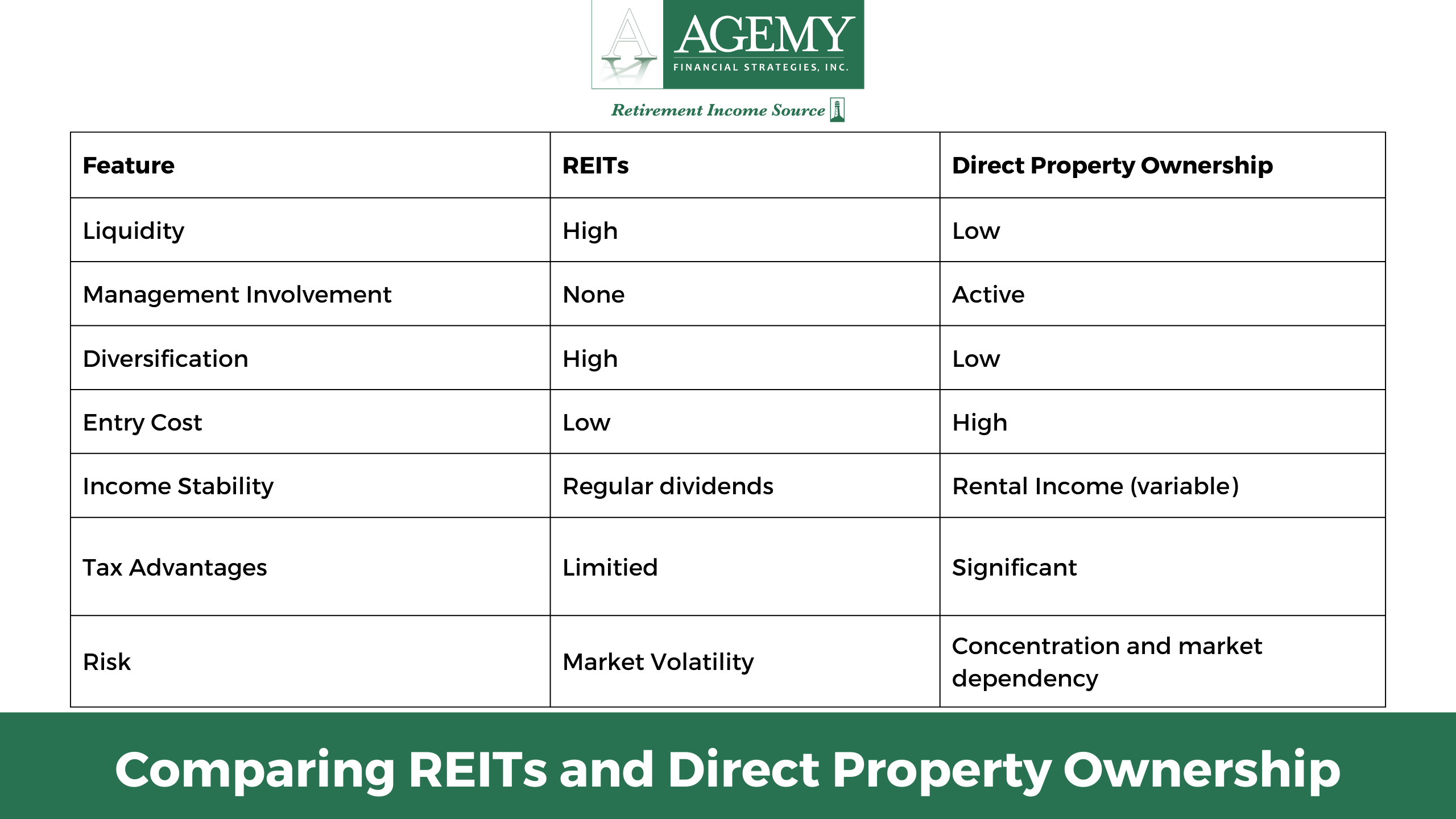

Risk vs. Reward

Risk vs. Reward

Cons of REITs

Cons of REITs

Cons of Direct Property Ownership

Cons of Direct Property Ownership

The Importance of Early Estate Planning

The Importance of Early Estate Planning Selecting Trustees and Beneficiaries

Selecting Trustees and Beneficiaries Regularly Review and Update Your Plan

Regularly Review and Update Your Plan

3. Being Part of the Sandwich Generation

3. Being Part of the Sandwich Generation

Planning for a Secure Retirement with Agemy Financial Strategies

Planning for a Secure Retirement with Agemy Financial Strategies